The cryptocurrency market has experienced a sharp decline recently. Bitcoin has fallen by about 17% in the past four days, and even fell below the $50,000 mark at one point. Panic is spreading to the entire market. The U.S. Bitcoin spot exchange-traded fund (ETF) recorded a net outflow of US$168 million yesterday (5th). However, the Ethereum spot ETF showed a net inflow.

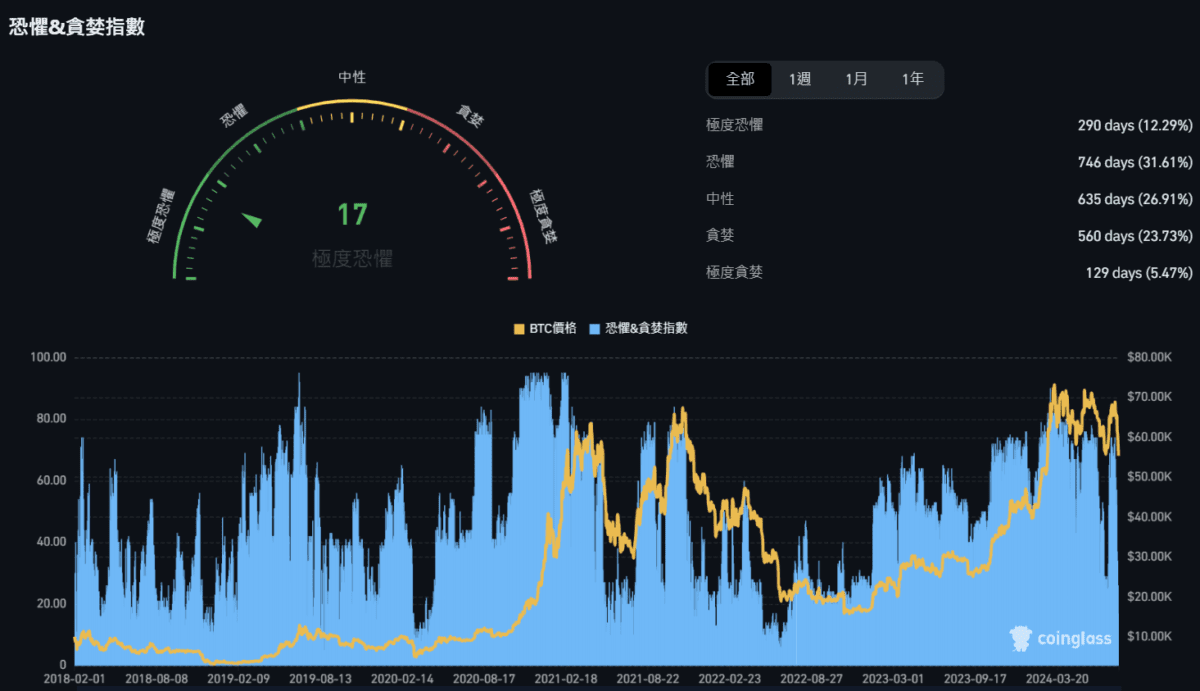

According to data from coinglass, the current fear and greed index in the Bitcoin market has fallen into the "extreme fear" zone, with a reading of 17 points being the lowest since July 2022. The Fear and Greed Index measures current sentiment in the Bitcoin market.

Panic in the cryptocurrency market appears to be reflected in fund products. Preliminary statistics from SoSo Value show that the U.S. Bitcoin spot ETF recorded a net outflow of US$168 million yesterday. The ETF with the largest net outflow was GBTC issued by Grayscale, with an amount of US$69.1 million.

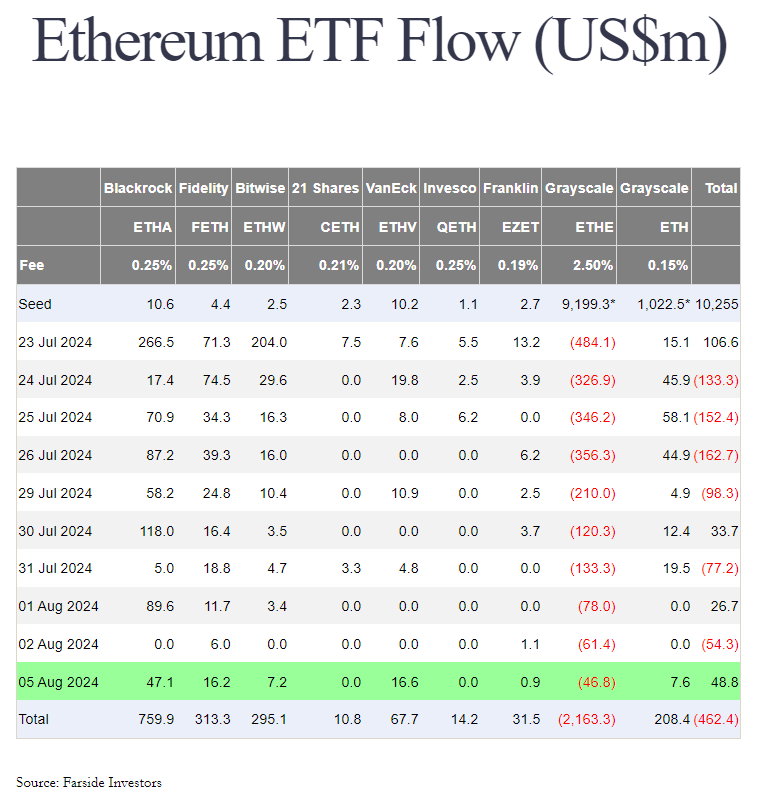

However, the performance of Ethereum spot fund products is "decoupled" from the overall market. Data shows that the U.S. Ethereum Spot ETF recorded a net inflow of US$48.73 million yesterday, second only to the US$106 million on the first day of listing. Among them, the Ethereum spot ETF with the largest net inflow is ETHA issued by BlackRock, with an amount of US$47.1 million, followed by FETH issued by Fidelity, with an amount of US$16.2 million.