Yesterday, the crypto market fell into a panic spiral along with the global market. BTC fell from over $600 million to $490 million, and ETH fell from over $3,000 to around $2,100. When the market generally predicted that the U.S. stock market would open with a circuit breaker, a major counterattack from the bottom was ushered in, and the crypto market also rebounded quickly.

Dividing the market into the plunge period from the evening of August 4 to yesterday afternoon, and the rebound period from the opening of the US stock market to this morning, which tokens fell the most and which tokens rebounded the fastest? In this article, Odaily sorted out and analyzed the data of 249 tokens in Binance's spot trading section (excluding stablecoins, gold stablecoins PAXG, and ASI) on the above two aspects, and concluded as follows:

Crash time

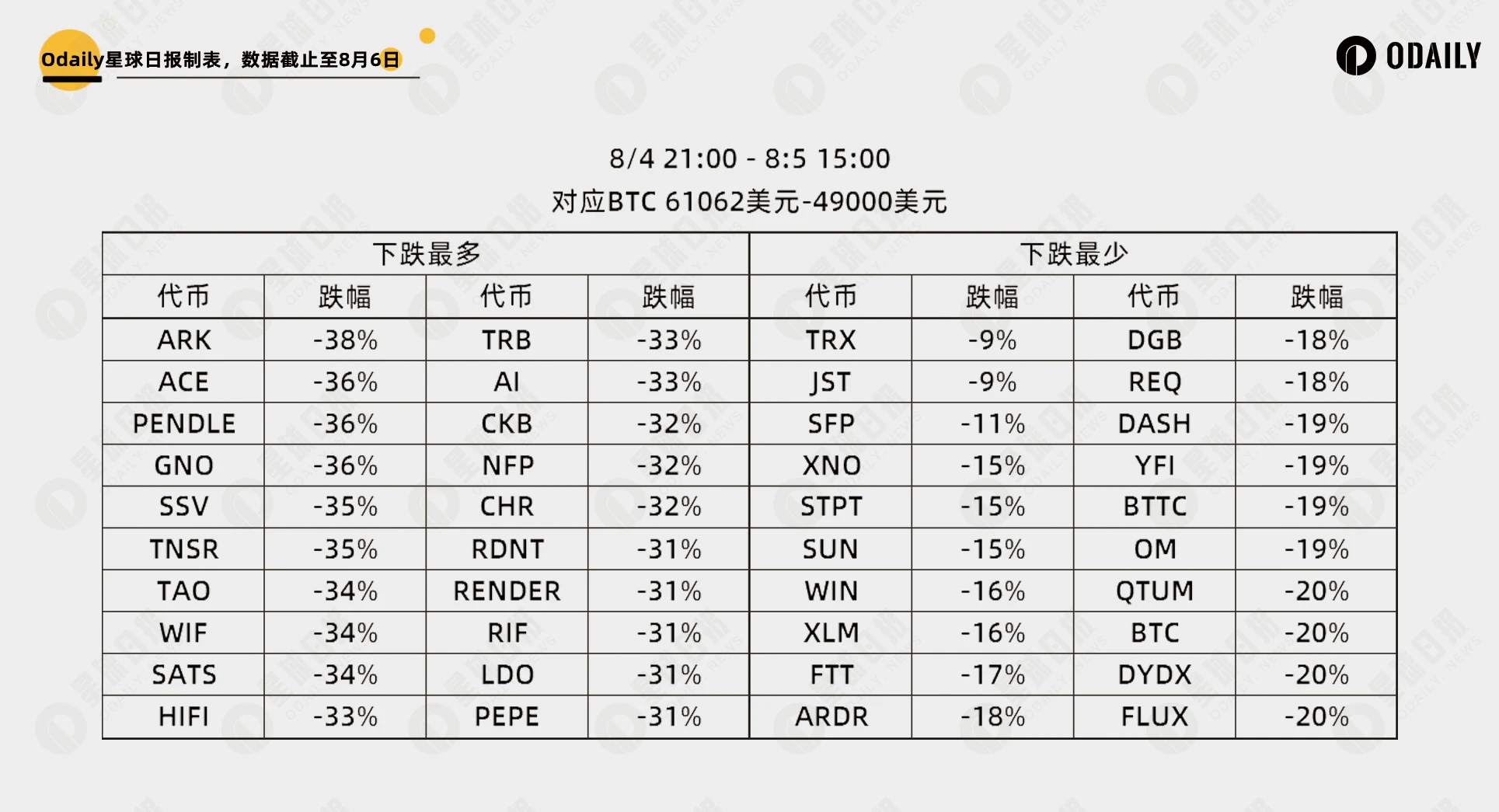

Taking 21:00 on August 4 as the benchmark, its opening price as the starting point of the decline, the period when Bitcoin fell to US$49,000 at 15:00 on August 5 as the statistical end point, and the lowest price during the period as the end point of the decline, the data is shown in the table below.

It can be seen that the concepts with the largest declines include LST, AI and Meme, which are:

- LST: PENDLE, SSV, LDO

- AI: TAO, NFP, RENDER, (AI that does not fully fit this concept)

- Meme: WIF, PEPE, (SATS which doesn't quite fit the concept)

In the anti-fall sector, previous articles only counted the top ten, resulting in Justin Sun series of tokens being on the list every time. This time, it has been expanded to 20, but the tokens on the list are basically small-cap tokens, which are of little reference value.

The counterattack horn sounded

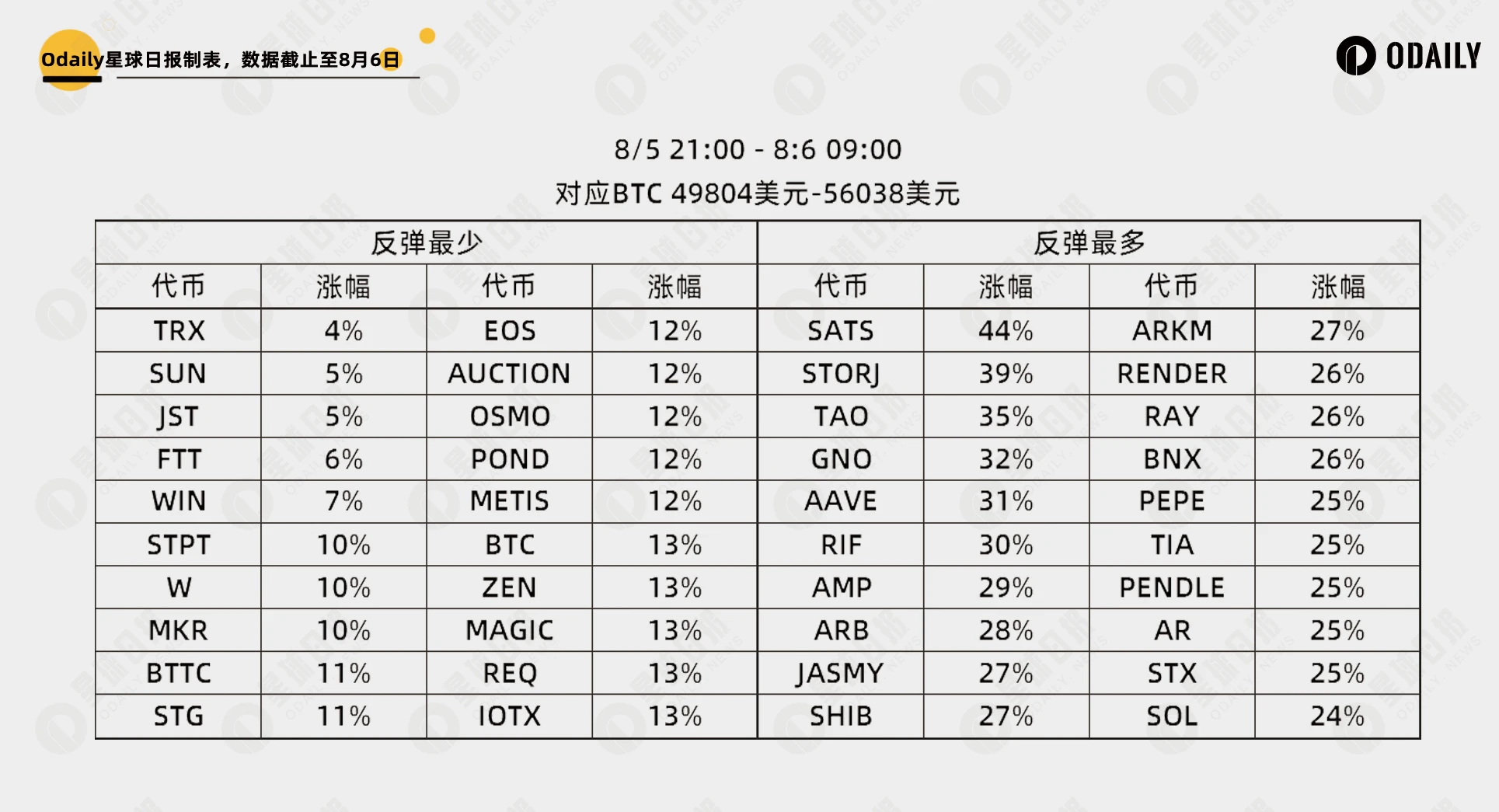

Taking 21:00 on August 5 as the benchmark, its opening price as the starting point of the increase, 9:00 on August 6 as the statistical end point, and the highest price during the period as the end point of the increase, the data are shown in the following table.

In this rebound list, no matter the one with the most rebound or the least rebound, there is no obvious concept sector. However, there are several tokens that appear on the decline list, which shows that such tokens have strong elasticity. If there is another round of decline, it is worth paying attention to. These tokens are:

- SATS (Bitcoin concept, some Meme attributes)

- TAO (AI)

- GNO(DeFi)

- RIF (Bitcoin Concept)

- RENDER (AI)

- PEPE (Meme)

- PENDLE (LST, LRT concepts)