Mystery of Crypto, a popular analyst and cryptocurrency expert, has identified 10 Altcoins with strong potential amid the current uncertain market conditions.

The cryptocurrency market is recovering positively after Monday's shock, leading some to believe that this is a good time to buy promising assets.

Altcoin Picks for Optimal Performance Amid Market Concerns

Amid market concerns, the crypto industry has seen over $1 billion in liquidations. This is the largest single-day collapse since the FTX crash in November 2022. Identifying them for their stability and growth prospects, the analyst has identified 10 Altcoins as safe bets in uncertain market conditions.

#1. Toncoin (TON)

Toncoin is the first choice, thanks to the number of decentralized applications (Dapps) built on the platform. These Dapps include areas such as gaming, social networking, and DeFi, which have seen significant growth in users over the past six months.

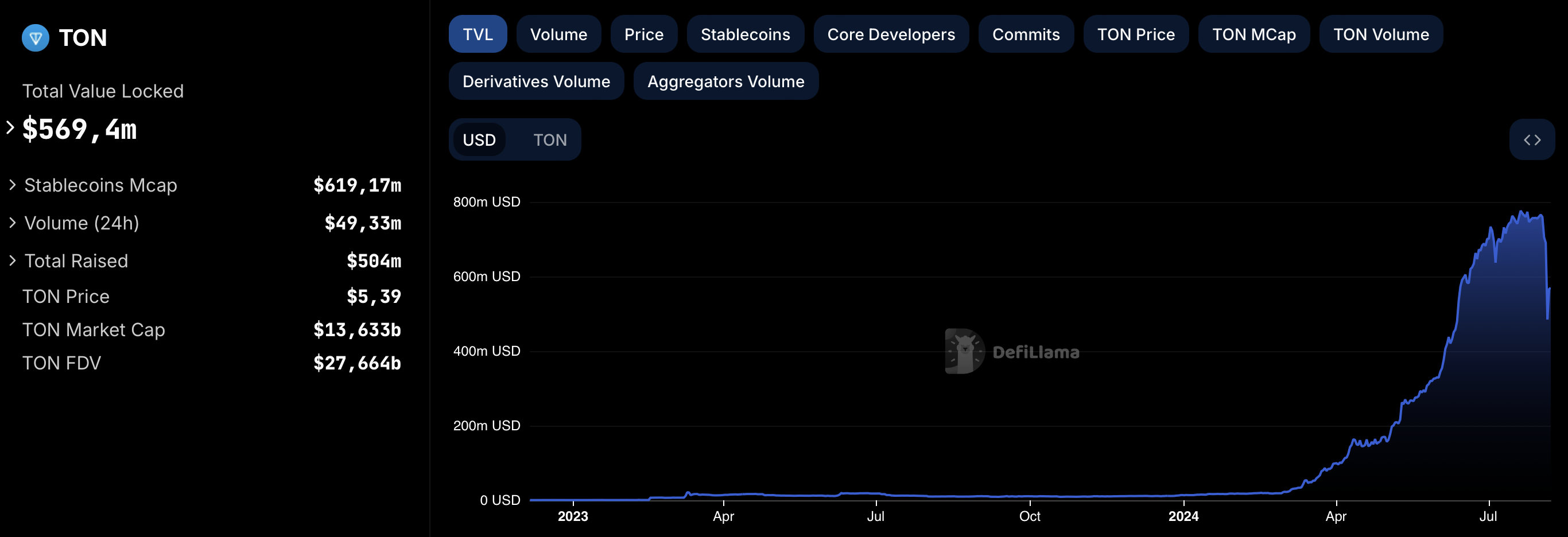

According to data from defillama, the TON blockchain records over four million daily transactions. The latest data shows that it has a Total Value Locked of over $560 million, up 20% since Monday, adding credence to the analyst’s pick.

#2. Solana (SOL)

Solana ranks second on the list thanks to its strong performance in 2024. The analyst highlights its key features: High scalability and low transaction fees, making it an attractive option. Strong interest from developers and institutions also supports SOL 's position as a top Altcoin.

Solana recently surpassed Ethereum in weekly turnover. More specifically, it remains the most popular blockchain for meme coin traders. There is also the prospect of a Solana ETF, further providing momentum for SOL.

#3. Arbitrum (ARB)

Arbitrum is a major player among Ethereum’s Layer 2 (L2) scaling solutions, with over 408,000 daily active users. Data shows its TVL is over $2.5 billion, higher than Polygon (Matic), Optimism (OP), and other L2s.

Following the launch of Kwenta and the expansion of Orbit, Arbitrum offers a top-notch trading interface and is regularly praised for its best user experience in DeFi. This, coupled with the backing of Pantera Capital, positions ARB for good performance, according to Mystery of Crypto.

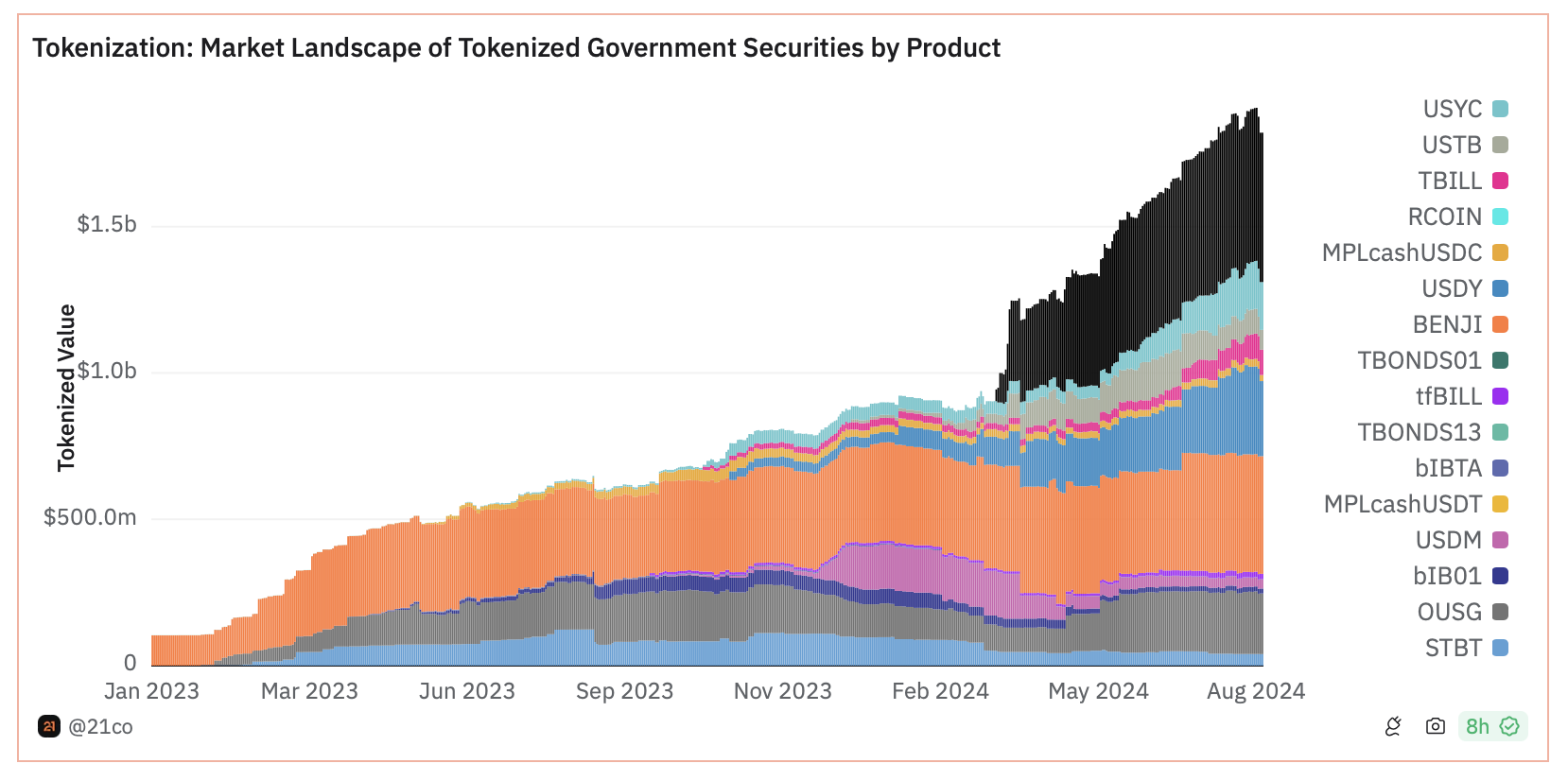

#4. Ondo Finance (ONDO)

Ondo Finance appeared on the lists of many analysts, including AltcoinDaily, with both mentioning the ability to convert real-world assets (RWA) into digital Token .

Its network has strong partnerships with BlackRock and Coinbase Ventures which also form a solid foundation for the project. Furthermore, Pyth Network has launched a USDY/USD price feed in collaboration with Ondo Finance, which also adds to the list of fundamentals of the project.

#5. NEAR Protocol (NEAR)

NEAR Protocol is known for its resilience and innovation, according to analysts. Its developer-friendly platform continues to attract more projects, and it has an $800 million ecosystem fund to seed and support new projects. It has the highest number of daily active users among L1 scaling solutions, second only to Solana, which positions NEAR to do well in uncertain times.

#6. Mantra (OM)

Mantra has lived up to analysts’ expectations, thanks to its ability to enhance Ethereum’s functionality and promote accessible financial services. With the growing interest in Token real-world assets (RWA), the project also has good prospects for profitability.

The project has launched Season 2 of the 50,000,000 OM GenDrop, while the DYDX ecosystem has added OM to its chain , bringing exciting new opportunities. Furthermore, with over $50 million in OM Token Staking , the reduced supply has increased the potential for a price increase for OM Token .

#7. EtherFi (ETHFI)

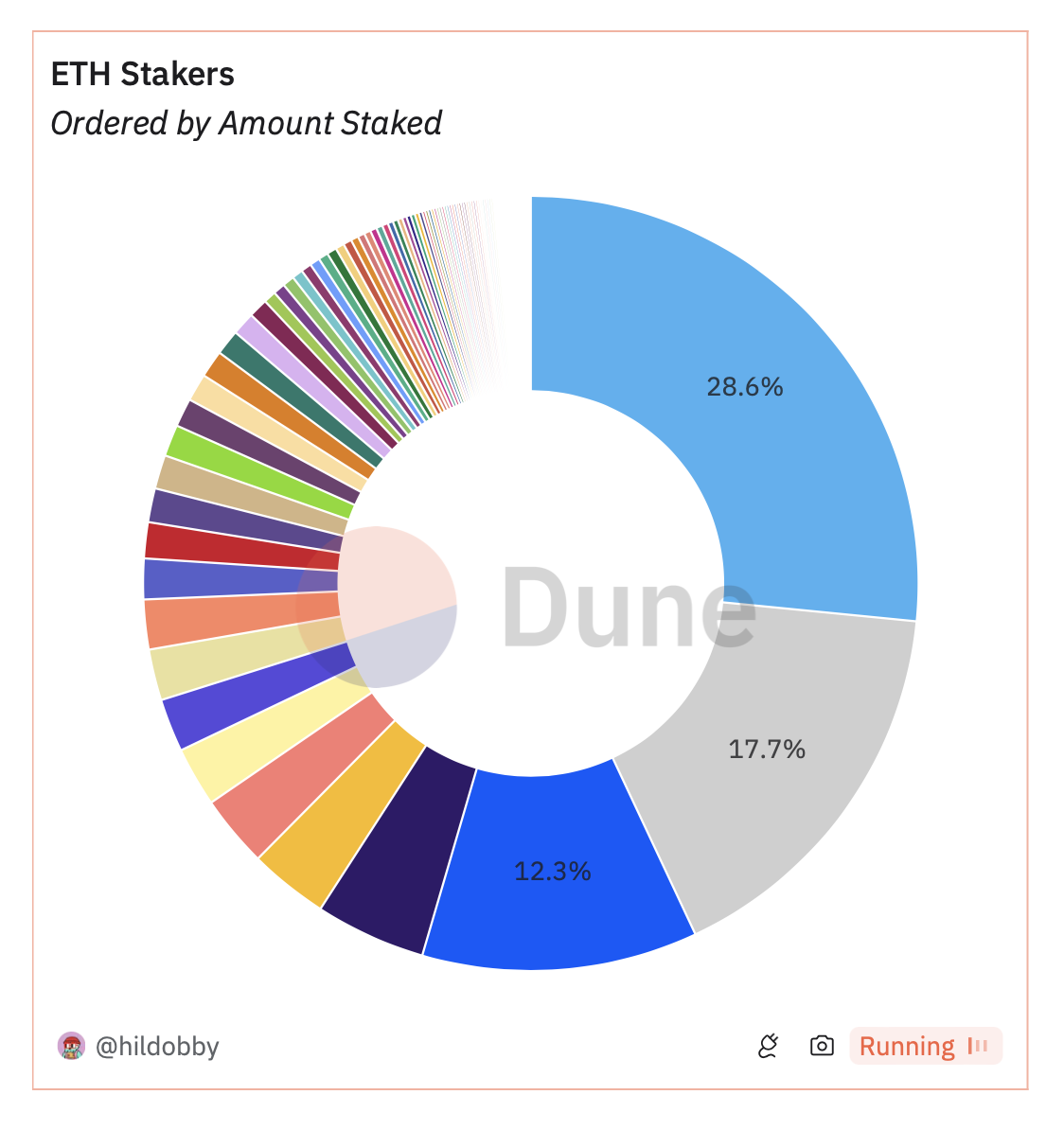

EtherFi is a leading re Staking platform running on Ethereum. The project recently launched Season 2 of claim checker, distributing over 53 million ETHFI Token worth around $100 million. The participation in the rewards model, which promises more exciting opportunities for users, could further attract interest in the ETHFI Token . Furthermore, the project also has Cash, a mobile wallet that integrates Visa credit cards.

#8. Polygon (Matic)

Polygon Blockchain partners with Axie Infinity 's Ronin Network through its Chain Development Kit. As a scaling solution for Ethereum, over 17,800 Dapps are active on Polygon. It is popular in DeFi and Non-Fungible Token projects, with 35 million Matic Token allocated to projects in its ecosystem.

#9. Render Network ( RNDR)

Render is one of the AI cryptocurrencies with a decentralized GPU network service, making it essential for gaming and movies. Recent social dominance, active addresses, and whale transaction figures are all at six-month highs due to the AI hype, making RNDR a strong candidate.

#10. Arweave (AR)

Arweave has proven its strength in the blockchain industry. The network offers a permanent data storage service, with users taking advantage of it to store data for a one-time payment. Over a petabyte of data is stored on the Arweave network, connecting those who need storage with those who have hard drive space.

The project has announced a 100% fair launch for its new Token with no premine or presale. This, coupled with the recent partnership with InQubeta, a technology-enhancing blockchain company, makes AR a notable coin.

Mystery of Crypto also highlights Chainlink (LINK) as a strong candidate, thanks to the launch of the Digital Asset Sandbox for Token creation experiments. Its partnerships with tech giants like Google and Oracle make LINK a good choice.

However, traders should not rely solely on analysts' predictions. Doing their own research is always advisable.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.