After Bitcoin successfully exceeded US$58,000 after 10 o'clock last night (8), it accelerated its rise again this morning, hitting a maximum of US$62,750 at around 7 o'clock this morning (9). At the time of writing, there was a slight correction and it is currently trading at US$61,433, having risen sharply by more than 13% in the past 24 hours.

Ethereum breaks through $2,700

Ethereum's rise is larger than that of Bitcoin, and it currently continues to challenge to stand above US$2,700. At the time of writing, it was trading at US$2,680, once rising sharply by more than 16%.

Reason for the sharp jump?

As for the reason for the sharp rise in the overall cryptocurrency market, a big reason may be because the United States released data on unemployment benefits for the latest week last night: the number of people claiming initial unemployment benefits was 233,000, a decrease of 17,000 from the previous week, which was also lower than market expectations. Estimated 240,000. Employment was strong and fell more than expected, easing investors' concerns about a U.S. recession.

US stocks rebounded strongly on the 8th, with the four major indexes collectively rising:

- The Dow Jones Industrial Average rose 683 points, or 1.76%, to close at 39,446 points

- S&P 500 rises 2.3%, best since 2022

- The Nasdaq rose 2.87%

- The Philadelphia Semiconductor Index rose the highest, reaching 6.86%. Chip stocks led the gains, with Huida and TSMC ADRs rising more than 6%

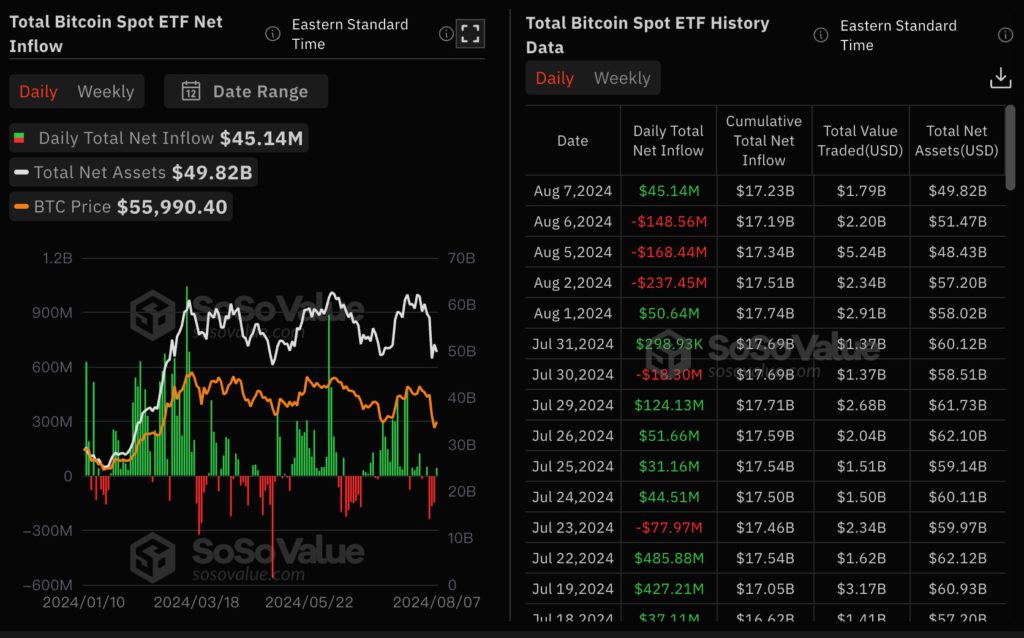

On the other hand, the continued reversal of capital inflows into the U.S. Bitcoin spot ETF from the 7th may also be the reason for the continued rise of the market.

The entire network liquidated over 200 million US dollars in the past 24 hours

Finally, short positions may also encourage currency prices to rise. According to data from Coinglass, in the past 24 hours, the amount of cryptocurrency liquidation across the entire network was approximately US$239 million, and more than 56,000 people were liquidated.