If you’re looking for airdrops, yield, or points programs, some of the following DeFi protocols may have potential.

Here are eight potential projects hand-picked from the broad DeFi space, most of which are relatively unknown with untapped opportunities like airdrops.

Do your own research (DYOR) before interacting.

1/ Abstract Chain

While every L2 is pursuing the goal of becoming the next arbiter, Abstract has found its uniqueness in the consumer space, which is to bring the next billions of people on-chain through a combination of culture, community building, and dedicated builders. Its zk rollup is built on Ethereum through zk stack and EigenDa as data availability to provide cheap, fast and secure transactions.

Abstractchain also has an impressive list of contributors, including leading well-known Ethereum NFTs — Pudgy penguins, Frame, and Kubernet. They raised an undisclosed amount of funding, with participation from Igloo (Pudgypenguins parent company) and Electric Capital.

The network is currently in testnet and you can participate through roles on Discord, which are designed to reward active community members. The exclusive roles are Elite Chad and Gigachad, which can only be obtained manually based on your activity and contribution to the protocol.

People with these roles are added to a private Telegram to distinguish them from other members. They look for other things before granting a role:

2/ Curvance

Defi’s most defining characteristic is composability — the ability for dApps to interact with each other in a standard way, enabling the development of innovative and complex liquidity products.

The Curvance protocol leverages the broad composability of yield assets and ERC-20 tokens, allowing for the borrowing of tokenized treasuries, NFT markets, and other primitives in a decentralized peer-to-peer manner. In Innovative Yield, products include Pendle yield assets, Gmx Glp, and other long-tail assets available on multichan to give users more exposure.

Curvance’s core goal is to become the ultimate Defi and Defacto (everything app) in the lending and yield space, and they received $3.6 million in investment and participation from Sandeep and Wormholes.

The network is currently in testnet status and has allocated 4% of the supply to active testnet users.

The testnet is in private mode, so you need to gain access via codes given away through their social media, which makes it more profitable and less crowded.

Curvance, as one of the purple ecosystems (monad, wormhole, and pyths), may also get you airdrops there, so it's worth working towards a high-level role on their discord to get future airdrops.

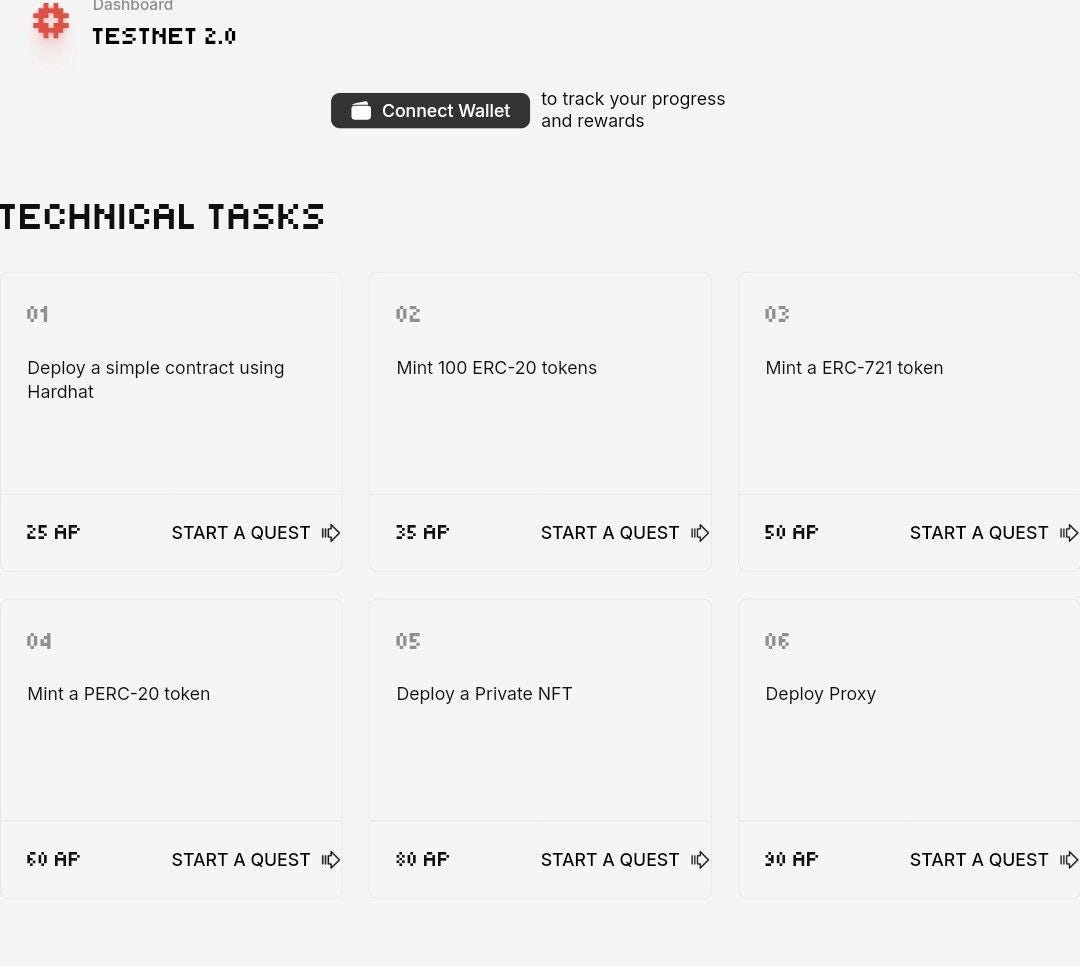

3/ Swisstronik

It is an L1 blockchain solution built on the Cosmos SDK. It utilizes Evm to ensure composability with Ethereum-based applications, while combining additional features such as Intel SGX for secure areas. This combination makes Swisstronik a versatile and powerful blockchain suitable for decentralized applications (dApps), providing a secure environment and being developer-friendly.

The network is currently in the testnet phase and incentives include $Swtr, Usdt and many other projects to be announced soon. Self-explanatory, Main Tasks — These are the must-do tasks to better explore the Swisstronik ecosystem, such as downloading the wallet, completing tasks, Additional Tasks — involve going outside the matrix to get more points, such as writing posts about Swisstronik, and Achievements — The more tasks you solve, the higher your achievements will be, and there are currently 8 achievements in total.

The higher the achievement, the higher the points multiplier:

The testnet will run from July 22 until the mainnet launch. The testnet is profitable because most people are marginalized by the Cosmos ecosystem, which means fewer participants, and the rewards are not just tokens, but also USDT for those who achieve higher achievements.

4/ LayerAkira

It is the first hybrid spot CLOB dex on starknet. LayerAkira enables traders to benefit from precise price discovery, increased liquidity, a wider variety of order types, and enhanced order control. Core features include gas-free order creation, fast transactions, and integration with aggregators, making it seamlessly connected to starknet dApps.

LayerAkira is one of the OG buildings in the starknet ecosystem. Currently, there are no derivative protocols on starknet, which gives them a first-mover advantage. They also received seed funding from the Starknet Foundation. There is currently a "Roast and reward" program going on on the testnet, and people participating in the program can get $7,000 in bonus pool points:

The competition will end on August 4 and enter the next stage of product iteration - mainnet launch.

5/ Scope protocol

Unlike other analytical tools, where users face an extreme learning curve due to their complexity, Scope Protocol leverages AI to overcome challenges associated with web3, such as high barriers to entry and information asymmetry, and is used to discover on-chain insights, smart currencies, and AI-trained assistants to provide on-chain insights into the market. Scope Protocol raised a total of $8 million in funding rounds, including participation from S-level investors such as Hashkey Capital.

The airdrop has not been confirmed yet, but according to what they spoke to Cointelegraph: “The company is also building an economy powered by crypto tokens,” meaning a token for a decentralized ecosystem.

6/ Parsec

Despite the transparency of blockchain, a significant number of people still find it difficult to interpret blockchain data through popular browsers such as Etherscan because the data is too complex and users must go through in-depth exploration to understand how to use it correctly. Parsec abstracts all of this complexity and builds an intuitive blockchain browser and professional terminal for on-chain market depth.

Parsec differs from other blockchain explorers in that it is easy to use, has wallet analytics, and an in-depth dashboard with features like loan markets, chain information, token accumulation, etc. Parsec has also raised $5.25 million from S-level investors like Polychain and Galaxy Capital

Similar to Arkham’s trajectory, Parsec has not hinted at what token they will be launching in the future. Arkham was one of the more lucrative airdrop projects, rewarding people with $150 just for signing up for an account, and I think Parsec may be more profitable due to their S-level funding round and low-farming nature.

To participate, register your email on the platform, refer users for more opportunities, and let’s be honest, Parsec is a great product, so I bet you’ll stay and use this product. For now, parsec launching a token is still speculative.

7/ Satori

Orderblock is a derivatives exchange that works with a wide range of market makers to provide broad exposure across a wide range of assets. It is available on Base, Scroll, PolygonZkevm, Zksync, Linea, and X Layer. Satori raised $10 million from Polychain, with participation from Jump Crypto and Coinbase. I think Satori is the best farm right now for three reasons, first, it is one of the underfarmed projects, even though their TVL is almost 1/2 of their raised capital:

Second, Satori supports de facto tokenless L2-style rolling and Base, allowing you to interact with them while farming. Third, you can deposit USDC in the Satori liquidity provider vault with a net annual interest rate of 132%.

8/ aPriori

aPriori is a MEV-based liquidity staking platform on the monad network, where users can use aPriori to stake their monad tokens for rewards and receive liquidity staking pool tokens that can be reused in other Defi dApps. At the time of writing, aPriori is the best-funded project in the monad ecosystem, with a $10 million funding round at a $100 million valuation, with participation from S-level investors such as Pantera, and undisclosed funding from Binance.

According to an interview with Block’s CEO , they have close ties with the Monad ecosystem and they plan to launch a testnet on the same day as Monad’s mainnet launch, but have not provided a timeline yet. They have no ongoing events, but you can follow their social accounts to stay informed of future events.