The cryptocurrency market sell-off has seen Bitcoin, ETH, XRP and other Altcoin fall sharply, but macro events, geopolitical tensions and technical weaknesses will further influence prices.

The cryptocurrency market sell-off has intensified as global affairs, macroeconomic events and technological weakness have caused investor panic. In the past 24 hours, the global cryptocurrency market has lost more than $100 billion, with the market value falling to $2.05 trillion.

Bitcoin and Ethereum prices fell more than 4% to intraday lows of $58,207 and $2,513, respectively. Other top Altcoin such as BNB, SOL, XRP, TON, and ADA fell 4-7% in the past 24 hours. AI coins and meme coins saw a significant sell-off.

Reasons why the market continues to be under pressure and further liquidations are possible:

Speculation of a Bank of Japan rate hike next year

Even though the Bank of Japan (BOJ) has made it clear that it will not raise interest rates this year following recent market turmoil, the yen carry trade continues to plague the market. Experts and traders expect a second wave of selling in the cryptocurrency market as people abandon cash and carry trades following the launch of a Bitcoin ETF.

Former Bank of Japan board member Makoto Sakurai recently said, "They will not be able to raise rates again for at least the rest of this year." However, it remains unclear whether the Bank of Japan will raise rates again in March next year.

Japan’s Financial Services Agency chief Hideki Ito has also expressed caution about approving a cryptocurrency ETF, saying there are no concerns about long-term value and investor protection. The move comes amid a recent market rout following Japan’s interest rate hike.

Geopolitical tensions, U.S. recession concerns, etc.

The cryptocurrency market continues to see a sell-off amid the outbreak of war between Russia and Ukraine, and tensions have recently been raised over a fire at Europe’s largest nuclear power plant. Russia and Ukraine have accused each other of starting a fire at the Zaporizhia nuclear power plant in the Russian-occupied territory of Ukraine.

There are currently several reports that Israel is expecting a large-scale Iranian attack within days. According to The Times of Israel, a large-scale Iranian attack could occur before the resumption of ceasefire hostage agreement talks on Thursday.

Meanwhile, Hindenburg Research has raised the stakes by directly alleging that the SEBI chairperson holds stakes in unnamed offshore entities linked to the Adani fund misappropriation scandal. SEBI chairperson Madhabi Puri Buch has denied the allegations. But Hindenburg Research, in a new post on the X platform, claims that Buch’s new statements raise serious questions about her consulting firm and involvement.

Fears of a U.S. recession remain as some economists believe the economy could fall into a recession, contradicting the view of CEOs and business people that the U.S. economy is resilient and shows no signs of a recession. The cryptocurrency market is also awaiting employment data this week for further insight into the state of the labor market.

US inflation data

This week there are key macro data from the US. The US Producer Price Index (PPI) will be released on Tuesday, the US CPI inflation data will be released on Wednesday, and the initial jobless claims and US retail sales data will be released on Thursday. The Federal Reserve will consider these factors before deciding on its monetary policy plan. Lower inflation data will prevent the cryptocurrency market from selling off.

According to the CME's FedWatch tool, the probability of a 25 basis point rate cut at the Fed's September meeting is 53.5%, and the probability of a 50 basis point cut is 46.5%.

Bloomberg's latest survey of economists shows that nearly four-fifths of respondents expect the Federal Reserve to cut interest rates by only 25 basis points in September, and the average expectation shows that the probability of an emergency rate cut before the September meeting is only 10%.

Cryptocurrency market cap correction

The total cryptocurrency market cap is cooling after a recent rally, during which the total cryptocurrency market cap added more than $210 billion in a single day. Over a three-day period, the total cryptocurrency market cap saw outflows of more than $100 billion, bringing the total market cap to $2.00 trillion.

The total value of all crypto assets is expected to rebound if the $2.00 trillion support level holds. This level has been tested as support and could prevent further declines.

However, regaining support at $2.11 trillion could help the total cryptocurrency market cap recover from the $100 billion drop. This would also allow the cryptocurrency market to recover further.

Bitcoin price loses key support, could trigger further sell-off in cryptocurrency market

Bitcoin price has fallen below the important psychological and technical support level of $60,000 and is currently trading at $58,500. The largest crypto asset of all time is trying to secure $58,200 as a support floor as a break below this level could result in a drop to $54,500.

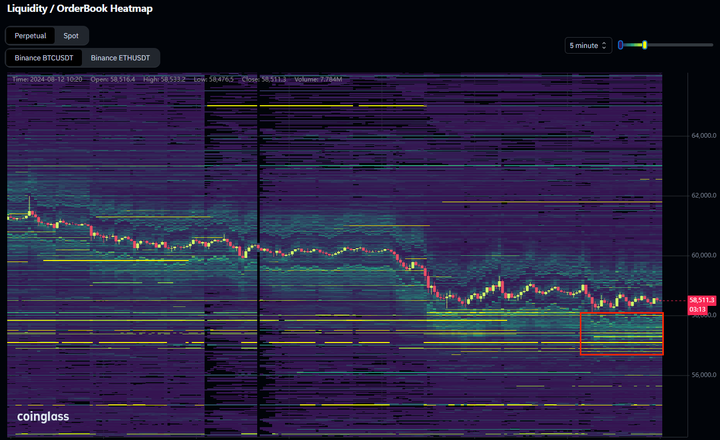

Meanwhile, the BTC liquidity/order book heatmap shows weakness. It predicts that the BTC price could fall further to $56,800. However, if the rebound is strong, BTC will test higher levels. However, if the rebound is weak, the price may fall to lower levels. It is worth noting that the Bitcoin death cross may trigger further cryptocurrency market sell-offs.

To prevent this from happening, BTC needs to secure a small recovery to at least $60,000 or move sideways. Once $60,000 becomes support again, the price of Bitcoin is likely to continue to rise.

BTC’s target remains at $70,000; however, to achieve this goal, Bitcoin will face multiple resistances. The next most critical resistance level currently lies at $65,000.

In simple terms

The cryptocurrency market has been sold off. In summary, I believe that the market is facing selling pressure due to market weakness. In the short term, the market will experience a period of consolidation and correction, and the upside potential is limited. BTC faces multiple resistances. If it falls in a short period of time, it will trigger further market selling, but its price is still strong above $58,500 and $58,200 is determined as the bottom line of support. This slight rebound prevents the intensification of selling pressure. In the long run, if $60,000 becomes a support level in the future, it is expected that the price of BTC will continue to rise and drive market recovery.