Author: Binance Research Source: Binance Translation: Shan Ouba, Jinse Finance

Key Points

This article reviews Binance Research's recent report, which discusses the major developments in the cryptocurrency market over the past month. The cryptocurrency market grew 6.1% in July, driven by positive developments such as the SEC's approval of 9 spot ETH ETFs and Germany's sale of 50,000 BTC. However, concerns remain about Mt. Gox's repayments and the U.S. government's BTC transfers.

The spot Ethereum ETF saw strong volume in the first week after its launch (about $5.8 billion), but net outflows (about $484 million), mainly due to outflows from Grayscale's ETHE. Excluding ETHE, the ETF saw net inflows of $1.5 billion.

The number of decentralized exchanges (DEX) grew significantly in July. This trend was driven by improved user experience, increased liquidity, and the popularity of meme coin trading. Influenced by the development of the election cycle, the prediction platform Polymarket also hit a record high in trading volume and the number of active traders.

This article explores key Web3 developments in July 2024 to provide an overview of the ecosystem’s current state. We analyze the performance of the cryptocurrency, DeFi, and NFT markets, then preview major events to watch for in August 2024.

Crypto Market Performance in July 2024

The crypto market grew 6.1% in total value in July, driven by several positive developments. The German government reportedly completed the transfer of 50,000 BTC to centralized exchanges, alleviating market concerns. In addition, the U.S. Securities and Exchange Commission approved the S-1 applications for nine spot Ethereum ETFs, which began trading on July 23. Donald Trump announced at the 2024 Bitcoin Conference that if elected, he would establish a strategic BTC reserve with the goal of making the United States the crypto capital of the world.

In addition to these developments, concerns about a potential sell-off were raised as Mt. Gox began to repay more than $9 billion to victims of its 2014 hack and the U.S. government transferred 29,800 bitcoins.

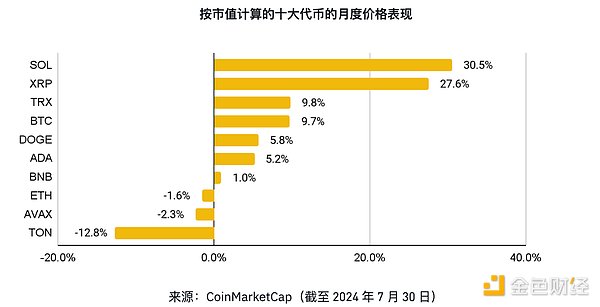

Solana (SOL) was a standout performer in July, with a 30.5% price increase. This growth was driven by a 42.2% month-over-month increase in decentralized exchange (DEX) volume to $54.6 billion, driven primarily by memecoin trading. Solana’s average daily active addresses reached a record high of 1.7 million, with daily transactions up 18.2% to 1.3 million. Several developments in the decentralized finance (DeFi) market bolstered the positive sentiment in the ecosystem, including the introduction of Jito restaking and the announcement of the Drift prediction market. Solana’s ecosystem continues to expand, attracting significant attention from both individuals and institutions.

XRP also outperformed other major cryptocurrencies, gaining 27.6% in July. The rally began after CME and CF Benchmarks announced the launch of an XRP index and reference rate. Further boosting sentiment, Ripple Labs CEO Brad Garlinghouse said the ongoing legal dispute with the U.S. Securities and Exchange Commission (SEC) could be resolved. TRON (TRX) maintained its positive momentum, gaining 9.8% in July to enter the top 10 digital assets by market cap. TRON founder Justin Sun announced plans to develop a gas-free stablecoin, adding to the positive outlook for the token. After a poor performance in June, BTC rebounded in July, gaining 9.7% as selling pressure from the German government eased and Donald Trump's appearance at the Bitcoin 2024 conference sparked positive sentiment. The Trump campaign raised $21 million during the conference, receiving a lot of support from BTC and cryptocurrency enthusiasts.

However, not all cryptocurrencies experienced a positive month. AVAX fell slightly by 1.2% despite significant progress, including the launch of the Interchain Token Transfer (ICTT) system and updates to its validator launch time and block building process. Similarly, Ether (ETH) fell by 1.6% after the SEC approved nine spot ETH ETFs, with an initial net outflow of $484 million. Additionally, TON, which has performed strongly since March, also faced a 12.2% retracement as its ecosystem continues to grow with the success of the Telegram game Hamster Kombat and other initiatives.

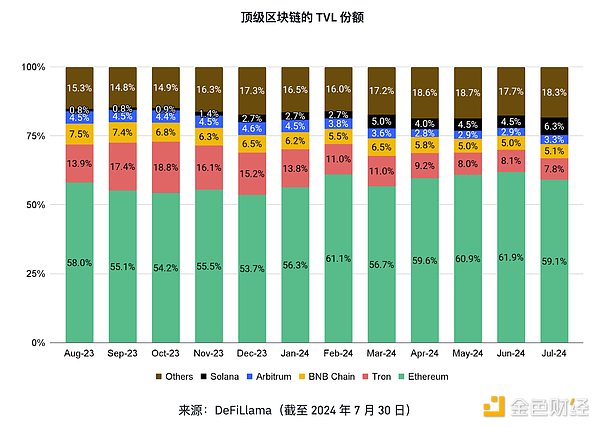

Decentralized Finance (DeFi)

In July, the total TVL of DeFi increased by 3.5%, in line with the overall market upward trend. The biggest gainers this month include CORE, Scroll, and Mantle, with increases of 121.2%, 66.0%, and 30.9%, respectively. Among the protocols, Polymarket achieved significant growth, with trading volume soaring to more than $387 million in July, more than 614% higher than January trading volume.

Symbiotic’s total locked value (TVL) surged 283% in July after the removal of pool caps, fueled by market interest in re-staking and partnerships with prominent protocols such as Mellow Protocol, Lido, Ether.fi, Ethena, and Pendle. As of the end of July, all pool caps were fully filled, accumulating $1.21 billion in less than two months. Mellow Protocol’s TVL also grew 69.6%, fueled by its role as a modular liquidity re-staking primitive, allowing users to double farm points to receive future token airdrops from Mellow and Symbiotic.

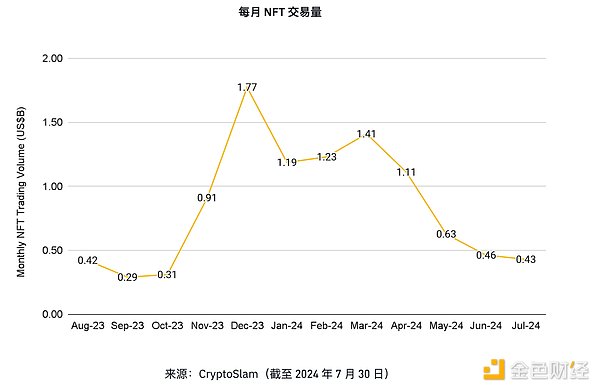

Non-fungible tokens (NFTs)

In July, NFT market sales fell 7.14% to $430 million. DMarket led with $16.2 million in sales, followed by DogeZuki on Solana with $13.9 million in sales. Solana collectibles such as Solana Monkey Business and Retardio Cousins saw a significant increase in sales, while major Ethereum collectibles and top Ordinals collectibles saw a significant decline.

Overall, sales of Bitcoin and Ethereum NFTs fell significantly, but Immutable sales increased by 75.68% due to ongoing game development (including the launch of Illuvium).

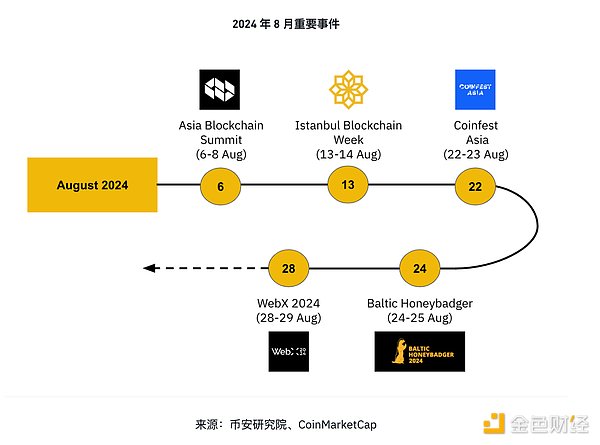

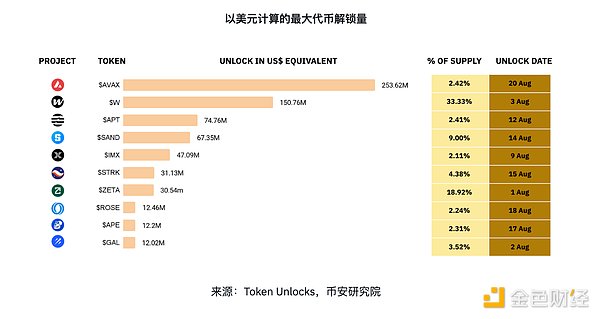

Upcoming Events and Token Unlocks

To help users stay up to date with the latest Web3 news, the Binance Research team has summarized the major events and token unlocks for the coming month. Stay tuned for these upcoming developments in the blockchain space.