Today we are going to talk about the recent crypto market crash, which caught many people off guard. So, what exactly caused this crash? And how should we deal with it? In recent days, the crypto market has been like a roller coaster ride, with major cryptocurrencies such as Bitcoin and Ethereum experiencing sharp declines. This decline has left many people scratching their heads, because there is no obvious bad news in the market, but there are many good news. So, what are the factors behind it that are affecting the market? Let's take a look at them one by one: 1. Liquidity and market sentiment Changes in liquidity and market sentiment have a direct impact on market volatility. In the past two days, the market turnover rate has continued to decline, and the price drop has led to a decrease in investor participation, further reducing market liquidity. Liquidity refers to the level of activity of buyers and sellers in the market. In a market with high liquidity, transactions are easier to conduct and price fluctuations are smaller. Conversely, in a market with low liquidity, transactions are difficult and price fluctuations are larger. The recent decline in market turnover has led to reduced liquidity, further exacerbating price fluctuations. According to data disclosed by Bitcoin Magazine, nearly 75% of the circulating Bitcoin has not moved in the past six months.

Moreover, since July 30, long-term Bitcoin holders have accumulated more than 500,000 BTC. Judging from the current data, in the range of $64,000 to $69,000, the number of long-term investors leaving the market is very small, and the main pressure comes from short-term investors who have been buy the dips in the past two days. Most of them entered the market at high levels, and now many people have suffered floating losses. The continued departure of short-term holders has brought certain selling pressure to the market. 2. Macro factors Macro factors have also had a certain impact on the market. The annual rate of core CPI in the United States in July was 3.2%, which was the fourth consecutive month of decline and reached the lowest point since April 2021, which is also in line with market expectations. CPI refers to the consumer price index, which reflects the changes in the price level of goods and services purchased by consumers. It is also one of the important indicators for measuring inflation. Although this data looks like good news, the U.S. stock market has turned from rising to falling, and the cryptocurrency market has also declined. This incident clearly shows the linkage between the U.S. stock market and the crypto market. Now in the crypto, it is really not possible to understand the U.S. stock market. From a macroeconomic perspective, the PPI and CPI data in the United States show that inflation is indeed cooling, which laid the foundation for the interest rate cut in September. But the core CPI remains above 3%, which is a key point. Because the core CPI can be derived from the core PCE, and the core PCE is the indicator that the Federal Reserve pays the most attention to. PCE refers to the personal consumption expenditure price index, which reflects the price changes when we usually buy things and services. Unlike CPI, PCE includes a wider variety of goods and services, and the weights will change according to consumers' consumption habits.

The current monetary policy of the Federal Reserve has a great impact on the crypto market. The Federal Reserve controls inflation and promotes economic growth by adjusting interest rates. Recently, the market's expectations for the Federal Reserve to cut interest rates in September have increased significantly, which has had a relatively large impact on market sentiment. Federal Reserve Chairman Powell will give a speech next Friday night. Last month, he also said that if inflation and the labor market continue to cool, they may consider cutting interest rates at this meeting. Now the market is paying attention to the results of this Federal Reserve interest rate meeting.

Investors are now concerned that the Fed may reduce its interest rate cut from 50 basis points to 25 basis points in September.

According to the latest data from CME, after the release of the CPI data, market expectations for a 25 basis point rate cut increased significantly, while expectations for a 50 basis point rate cut decreased.

3. The US government transfers Bitcoin

The transfer of Bitcoin from the US government address also had a certain impact on market sentiment.

Recently, the US government transferred 10,000 bitcoins seized from Silk Road to a Coinbase Prime address, worth about $593.9 million, which caused a certain panic in the market.

Some analysts said the transfer was intended to hold the bitcoins in custody at Coinbase, meaning they would not be immediately sold on the secondary market.

But financial lawyer Scott Johnsson posted on Twitter that the U.S. Marshals Service is almost certainly selling Silk Road’s bitcoins. But the final sales will not be confirmed until the 2024 financial report.

4. US presidential election

There are less than 90 days left until the US presidential election. According to the latest poll data, Harris's approval rating has surpassed Trump, which has had a certain impact on market sentiment.

But even if Harris is elected, it will not push Bitcoin into a bear market.

Currently, the global central banks have entered a cycle of interest rate cuts, and it is only a matter of time before the Federal Reserve cuts interest rates. The increase in global liquidity will drive the Bitcoin bull market.

We need to pay attention to US Treasury Secretary Janet Yellen, who is in charge of US fiscal policy and treasury bond issuance.

Since he is also a member of the Democratic Party of the United States and has a high prestige within the Democratic Party, his decision-making obviously tends to support the Democratic Party. This is very important for understanding the future direction of monetary policy.

The latest move by the U.S. Treasury is a $50 billion Treasury bond repurchase program that will run from early August to the end of October.

It aims to provide stronger liquidity support for the US presidential election in November, with the goal of promoting economic growth, enhancing the American people's confidence in the Democratic Party through fiscal and monetary policies, and consolidating the Democratic Party's election advantage.

However, regardless of the outcome of the U.S. presidential election, whether Trump or Harris is elected president, Bitcoin will benefit from loose monetary policy.

Sooner or later, the United States will start printing money to repay its debts. Once it starts printing money, it will drive the crypto market up. For more information, please visit QQ: 580869654

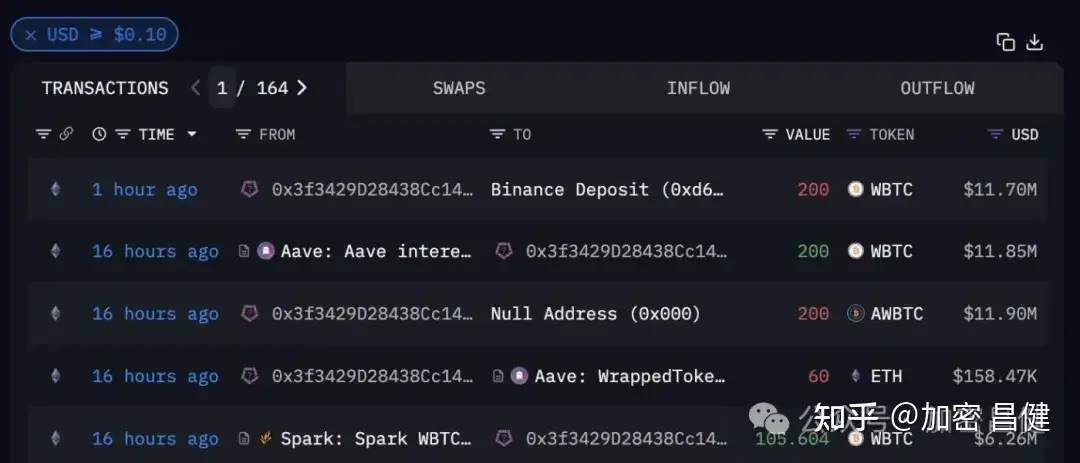

5. Justin Sun joins WBTC

Brother Sun’s entry into WBTC is also an influencing factor.

BitGo announced that it will move its WBTC business to a multi-jurisdictional and multi-institutional custody service. This cooperation also marks the deepening of the strategic cooperation between BitGo and Justin Sun, the founder of the Tron ecosystem.

There is market speculation that Justin Sun may have significant influence or control in the joint venture that manages WBTC.

Jupiter co-founder also said that the Bitcoin behind WBTC should not be used for any purpose, and hoped that BitGo would clarify the community’s doubts.

BitGo CEO responded to the controversy surrounding the WBTC project, saying he was willing to assist Maker DAO in due diligence to alleviate community concerns.

Justin Sun also issued a statement to clarify that he does not control the private keys of WBTC reserves and cannot move any BTC reserves. He also said that WBTC is an important part of the DeFi ecosystem and he also looks forward to its continued development.

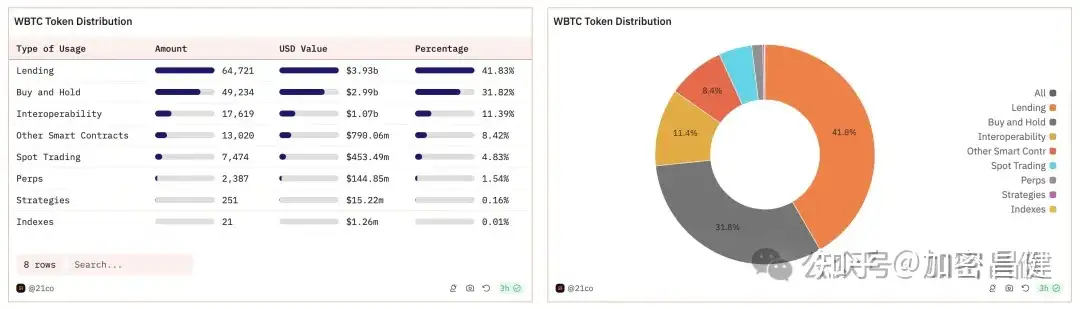

According to data, more than 41% of WBTC is currently used for lending, and MakerDAO is the largest acceptor.

In response to Sun's entry into WBTC, MakerDAO initiated a proposal to reduce the size of WBTC collateral in the executive vote on August 12 to cope with the potential risks of changes in custody rights.

Currently, MakerDAO has passed and executed a proposal to reduce the size of WBTC collateral and suspended new WBTC-backed loans.

6. Geopolitical conflict and Buffett's reduction of Apple shares

Geopolitical conflicts and Buffett's reduction of his stake in Apple also weighed on the market.

Tensions in the Middle East have increased market uncertainty, and Buffett's massive reduction of Apple shares has made the market worry about whether he has seen the potential risks.

The combination of multiple factors has led to the spread of panic in the market. In order to avoid risks, investors may transfer funds from risky assets to safer investments, which further exacerbates the decline of the crypto market.

So what should we do?

The current macro environment is full of uncertainty, and the US economy is at risk of recession. Investors are reluctant to act rashly, so not many people want to buy.

Everyone is waiting to see when the Fed will cut interest rates. If the United States really enters a recession and U.S. stocks continue to fall, the crypto market will definitely be affected.

The decline of Bitcoin and Ethereum is relatively limited, but Altcoin may fall badly, so you must control your Altcoin positions.

In the long run, the bull market is still there. We are in an upward trend, and a big market is brewing.

However, the short-term market fluctuations will still be large. It is recommended to watch more and act less, mainly hold spot goods, and avoid contract trading.

Please note that the above is just my personal experience sharing and does not constitute any investment advice. For more information, please visit QQ: 580869654