From Bitcoin facing the psychologically important $60,000 mark to XRP about to form a “golden cross,” here are some of the top stories in the crypto market.

Bitcoin has broken through the $60,000 barrier once again, but the market remains cautious about this strong resistance level in the near future.

BTC is currently trading just above the 200-EMA at $59,548 after a brief surge above $60,000. However, a wave of selling pressure quickly pushed the price back down. While hitting $60,000 is XEM as a positive sentiment boost, traders should still keep an eye on key levels that could determine Bitcoin’s short-term direction.

The $60,000 mark holds great psychological significance in the market. In the past, bulls and bears have fought fiercely to control this level, making it an important battleground.

BTC/ USDT Chart | Source: TradingView

Bitcoin tends to attract both buying and selling activity whenever it crosses $60,000, which increases volatility. If the market can gain enough traction, BTC could test higher resistance levels.

The next resistance level lies just above $60,000, which coincides with the 50-EMA on the daily chart. In the past, when BTC reached this level, it often experienced sharp retracements due to its inability to sustain the upward momentum. However, breaking and holding above $61,000 could open the door for a longer-term rally.

Support is currently around the 200 EMA at $59,548. This moving Medium will be crucial in determining Bitcoin’s next move as it has Vai as a strong support level. If it holds, this level could become a springboard for a recovery; otherwise, further downside could emerge with a possible return to the $57,000 – $58,000 region.

Vitalik Buterin registered the new ENS domain “ETH” today, where DACC stands for “defensive accelerationism” (d/acc), as opposed to “effective accelerationism” (e/acc) – a hotly debated topic in Silicon Valley.

D/acc supports technological advancement in areas such as cybersecurity and privacy protection, while promoting healthier, more liberal governance.

XRP is about to form a “golden cross,” when a longer- Medium like the 200-day EMA crosses above a shorter-term moving Medium like the 50-day EMA. This is XEM a strong bullish signal by traders and investors.

In a bullish scenario, the next important level to watch would be around $0.6. If cleared, XRP could head towards $0.65, a strong resistance level in the past.

XRP/ USDT chart | Source: TradingView

XRP could be headed for higher targets, possibly hitting $0.7 or $0.75 if the overall market sentiment improves, especially with positive inflows into ETH and BTC ETFs.

Conversely, if the “golden cross” fails to produce a bullish breakout, XRP may struggle to hold its current price levels.

$0.55 would be the first support level to watch. If XRP falls below this level, it could retest $0.50. Even if the overall market remains neutral or negative, a drop below $0.50 would indicate a long-term bearish trend. In this case, XRP could be stuck in a range, unable to break out, and vulnerable to downside pressure.

Arkham shows that BlackRock's two funds (IBIT and ETHA) have a total Assets Under Management (AUM) of $21.6 billion, slightly higher than the $21.3 billion held by Grayscale's four funds including GBTC, BTC Mini, ETHE, and ETH mini.

BlackRock's crypto ETF is now the largest holding among all providers.

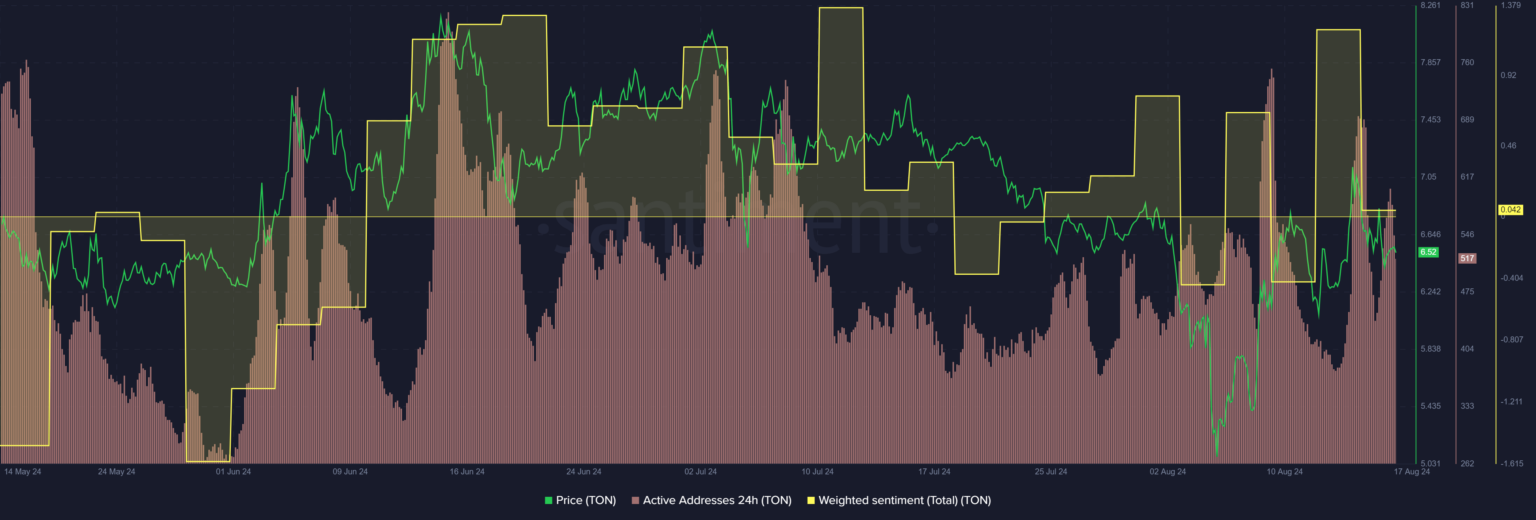

Toncoin (TON) faced rejection from the $6.8 resistance zone late last week, but buyers showed resilience. At the moment, the bulls are struggling to establish an uptrend.

Source: TradingView

The 1-day chart shows a bullish structure, although it retraced to $4.72 in early August. OBV has been rising over the past ten days, indicating high demand.

Additionally, the RSI shows that momentum is on the verge of turning bullish.

The touch of the $6.8 resistance level on Wednesday, August 14, was a very important signal. It reversed the daily market structure to the upside and touched the range that Toncoin had been trading in from early June to late July.

Source: Santiment

This bullish structural break comes with strong social data growth.

Daily active addresses have also been trending upward since mid-July. These two signals point to a good opportunity for sustained demand and adoption.

With whale volume dropping to alarming levels, the Shiba Inu is currently going through one of its toughest times.

A sharp drop from previous activity levels was observed in the past 24 hours, with only 16 large transactions with a total value of only SHIB 392.05 billion recorded.

This sudden drop implies that large investors, sometimes referred to as whales, are pulling out of SHIB and reducing their exposure to the Token.

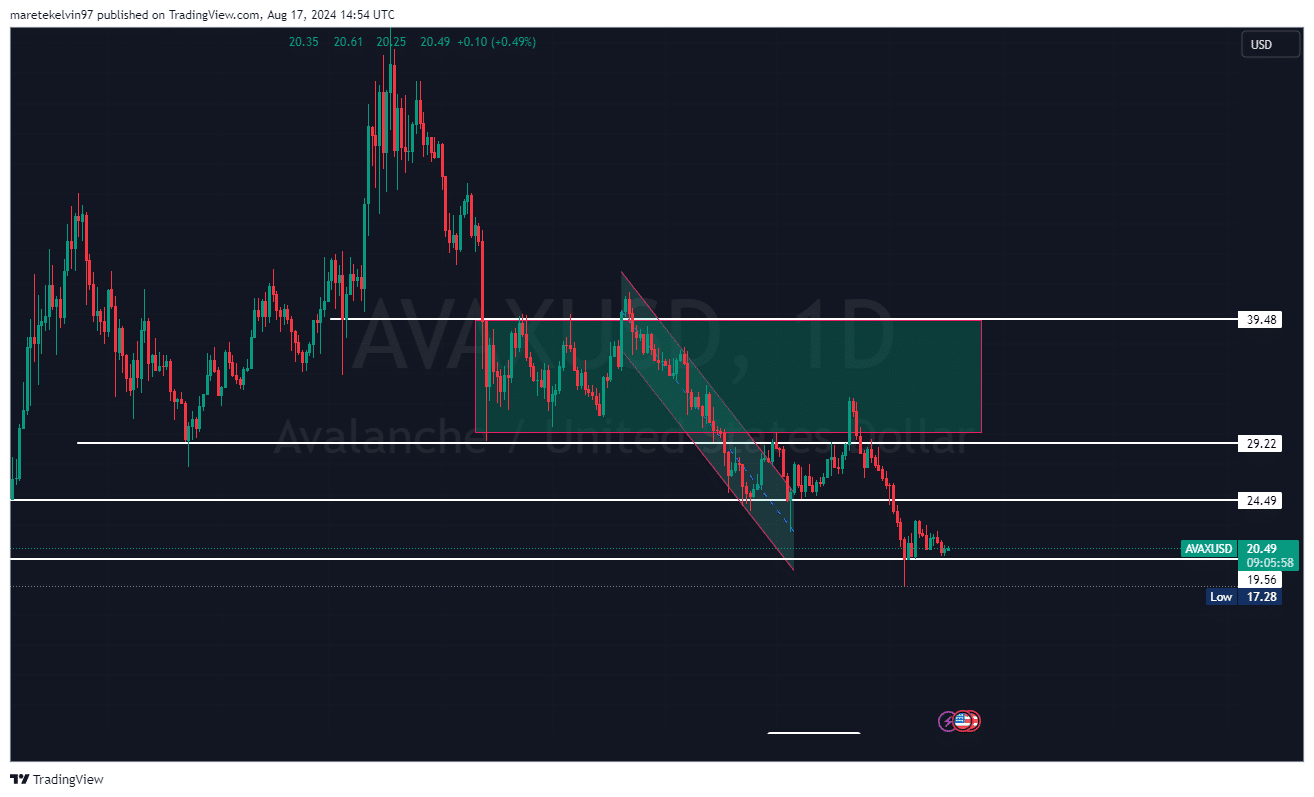

AVAX 's price has been under pressure recently. Specifically, the Token is consolidating above a key support level of $19.48. This point has historically provided a solid foundation during price declines.

Source: TradingView

Once AVAX holds this important support level, the price could surge above $25.

Despite the recent price struggles, increased on-chain activity has sparked hope for bulls, with the $19.48 support level providing the line of fire.

If this level holds and the on-chain momentum continues, AVAX could enter a trend reversal phase.

AVAX is currently trading just below the $21 mark, up nearly 3% over the past 24 hours.

SuperRare, a prominent project in the digital art market, has had a pretty good start to 2024, with a significant improvement in monthly visits, marking a 29% increase compared to January's figures.

However, in February, visits dropped to 240,000 before falling further to 180,000 in June 2024, the lowest level SuperRare has seen since 2021, marking a 45% drop compared to the same period in 2023 and a 10% drop compared to May 2024.

The United States, Spain, and South Korea had the highest visits in June on SuperRare. US users accounted for about 20% of total cumulative monthly visits, while Spain and South Korea followed at 17% and 13%, respectively. France and Russia accounted for 8% and 6%, respectively.

Indian authorities arrest man in crypto extortion case

The Indian Enforcement Directorate (ED) said Bhatt, who had invested in Bitconnect, kidnapped two employees of Kumbhani to reclaim his money, demanding 2,091 Bitcoins, 11,000 Litecoin , and a cash amount worth $17 million.

Bhatt has now been arrested and authorities have seized assets and real estate worth $53 million.

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine