Written by: Mary Liu, BitpushNews

Financial markets were relatively quiet on Tuesday, with no obvious market catalysts emerging ahead of this week's Jackson Hole global central bank annual meeting.

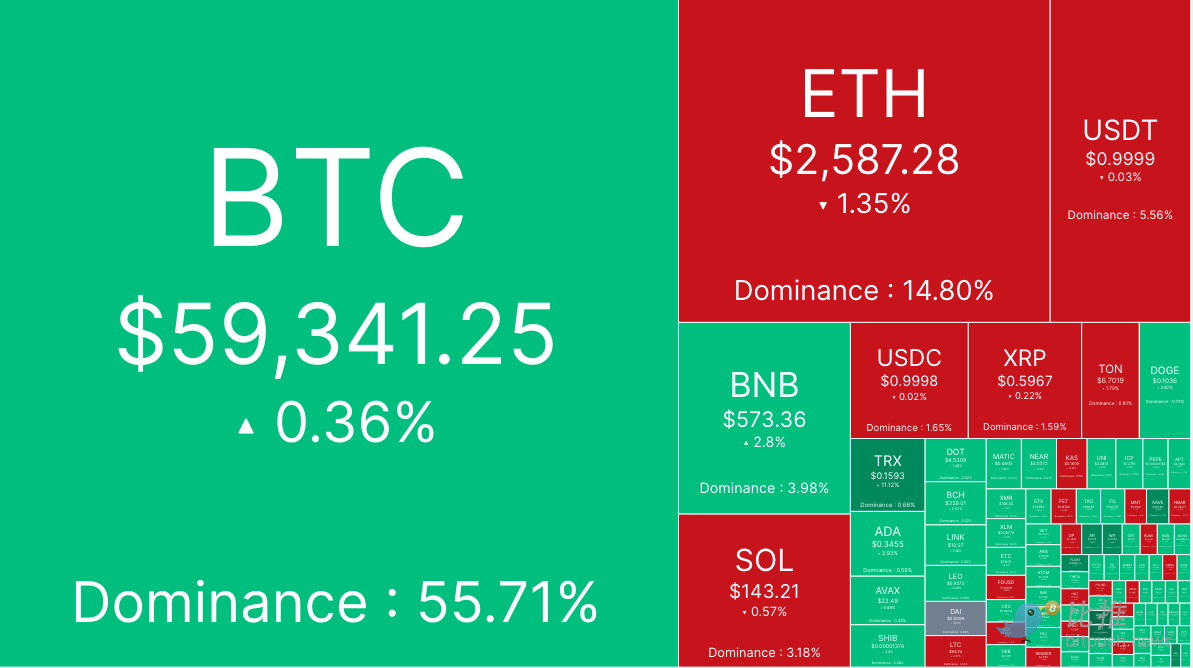

According to Bitpush data, Bitcoin soared to over $61,000 in the early hours of Tuesday morning, but failed to continue to break through and fell back to the support level of $59,000 after lunch. As of press time, Bitcoin was trading at $59,341, up 0.36% in 24 hours.

In addition, most of the top 200 Altcoin by market capitalization rose. Meme coin Brett (BRETT) rose the most, up 18%, followed by BitTorrent (BTT) and BinaryX (BNX), up 16.4% and 12.3%, respectively. Litecoin (LTC) fell the most, down 3.3%, dYdX (DYDX) fell 3.2%, and MANTRA (OM) fell 2.6%. The current overall market value of cryptocurrencies is $2.11 trillion, and Bitcoin has a market share of 55.7%.

As for U.S. stocks, at the close, the S&P 500 and Nasdaq fell 0.20% and 0.33% respectively, while the Dow Jones Industrial Average was flat.

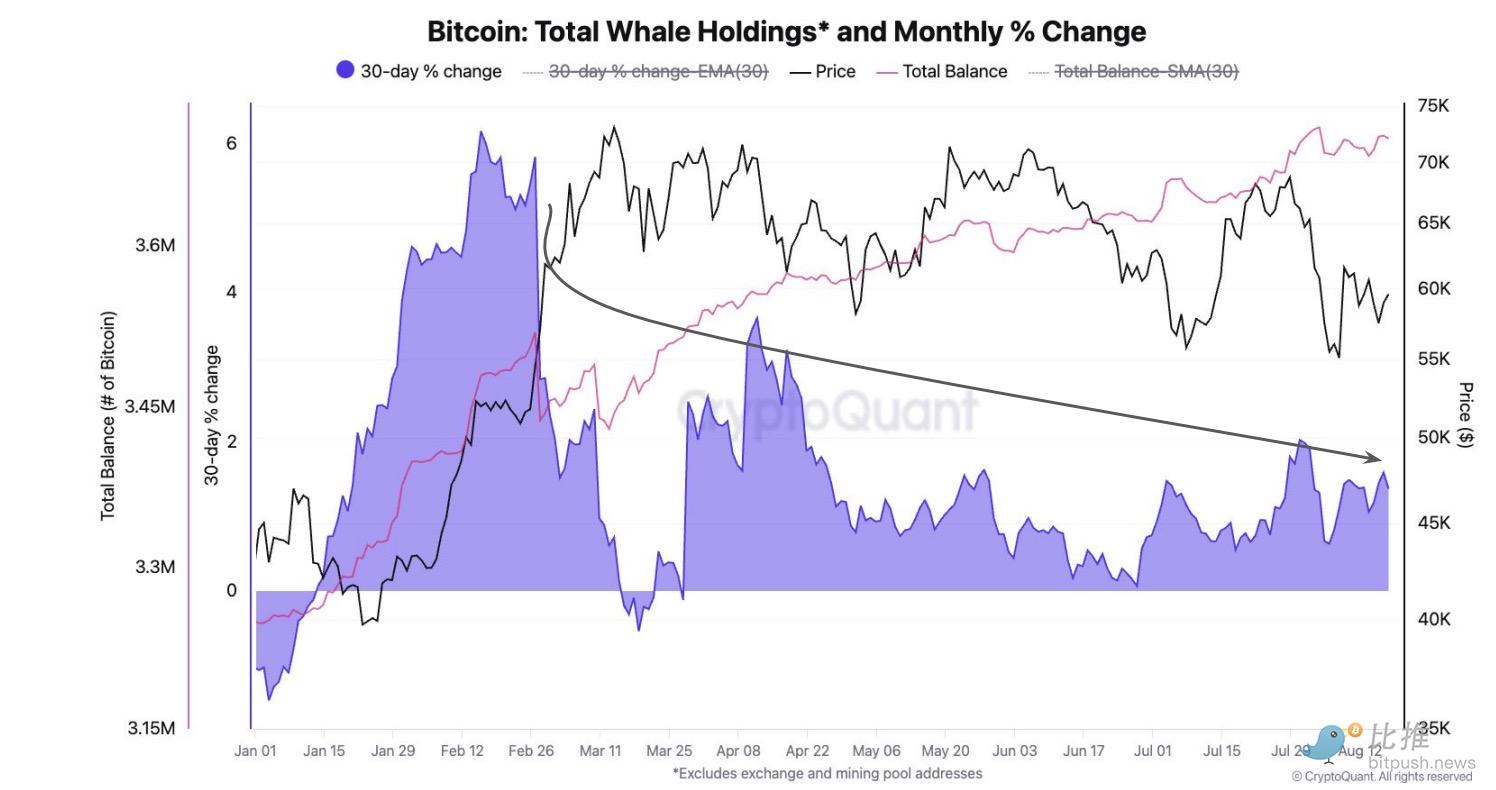

The increase in holdings by whale slowed down

On-chain analysis firm CryptoQuant said that "most" demand indicators are currently showing weakness. CryptoQuant data shows that larger BTC holders (equivalent to whale) have significantly reduced their coin hoarding speed since the all-time high in March.

The report shows: "The 30-day percentage change in whale holdings has dropped from 6% in February (the fastest pace since February 2019) to 1% currently. Historically, monthly growth rates of whale holdings exceeding 3% have been associated with higher Bitcoin prices, but this is not the case at present."

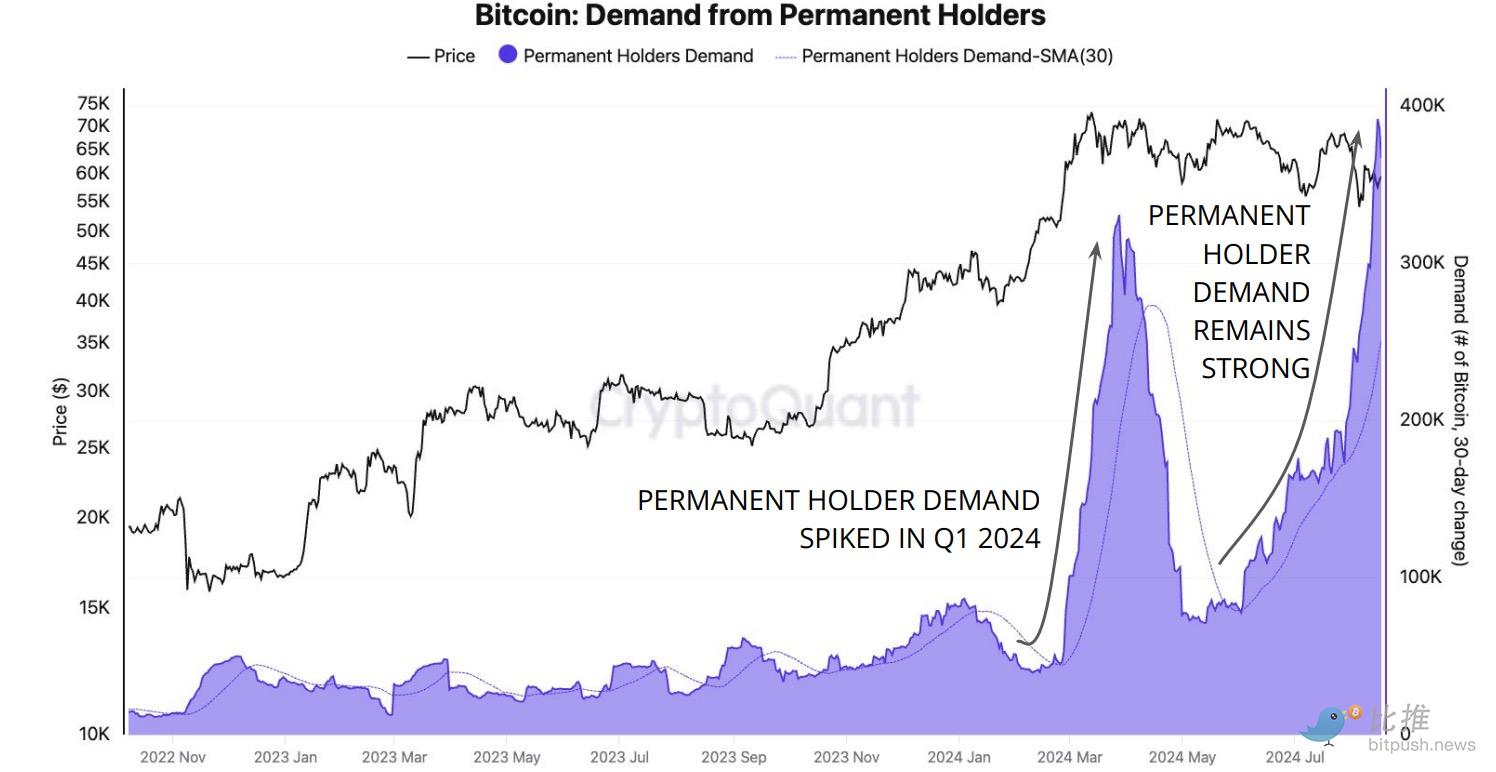

However, one exception to the “summer doldrums” the market is facing are “forever holders” — entities that only buy and never sell BTC.

The report states: “Despite the slowdown in overall Bitcoin demand growth, permanent holders continue to accumulate Bitcoin at unprecedented levels. The total balance of these holders is growing at a record rate of 391,000 Bitcoins per month. The demand of permanent holders is growing even faster than when the Bitcoin price exceeded $70,000 in the first quarter of 2024.”

Analyst: The market is gradually recovering

Bitfinex analysts believe that the market is gradually recovering. After a large outflow of funds in early August, unlike the Ethereum ETF, the Bitcoin spot ETF received a net inflow of US$32.4 million last week, indicating that the interest of passive investors continues. The BTC price has broken through the range low of about US$60,000 several times.

“There has certainly been some bargain hunting and profit taking in the ETFs over the past week, with investors buying below $50,000 and then taking at least some of their profits,” they said. “This is in stark contrast to the Ethereum ETF, which saw net outflows this week despite the price of Ethereum falling much more than the price of Bitcoin.”

Inflows into the BlackRock iShares Bitcoin ETF (IBIT) and the Fidelity Bitcoin Fund (FBTC) helped prevent further downside losses, with Bitfinex referring to this as “‘passive’ demand, a term they use to define ETF inflows that invest systematically in a price-agnostic manner.”

Analysts said: "This divergence in Ethereum ETF inflows reflects the broader market's confidence in Bitcoin as an asset, despite challenges such as the potential oversupply of BTC from large holders such as the U.S. government and Mt. Gox. The starkly different fates of BTC and ETH ETFs highlight the different dynamics of the two markets. While Bitcoin ETFs have successfully attracted sustained inflows, Ethereum ETFs have struggled to maintain momentum. The exhaustion of Grayscale's ETH supply could be a turning point for Ethereum ETFs, but the next few months will be critical in determining whether demand can support this market."

The report added: “It is also worth noting that BTC is currently attempting to break out of a four-month range low. As such, we are at resistance and do not expect any explosive moves to follow, as the summer weakness and illiquidity are still prevalent now, lacking any potential catalysts.”

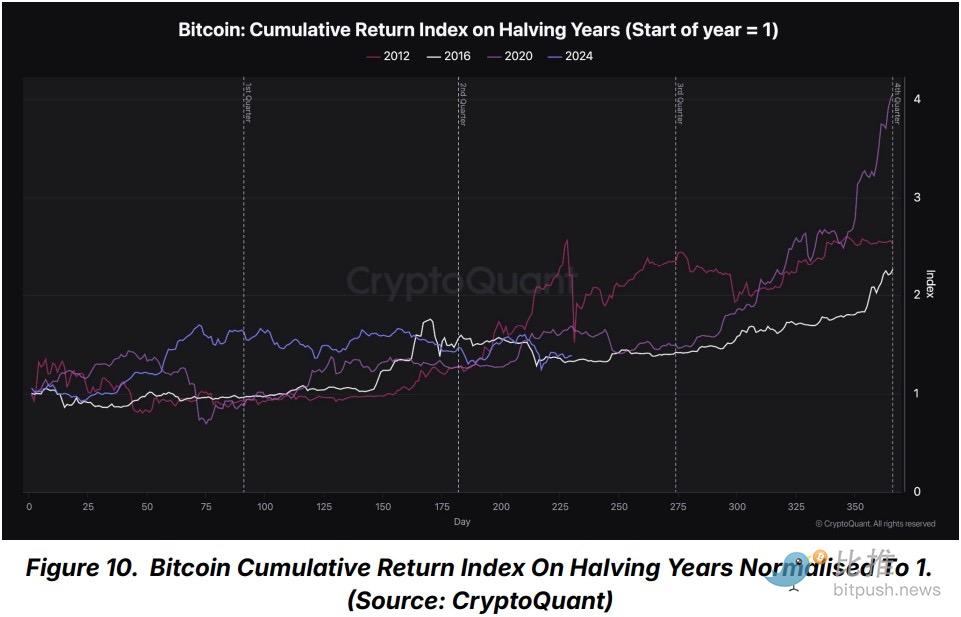

Bitfinex said that by looking at Bitcoin’s historical performance after halvings, the chart below “shows that despite the recent decline, BTC is still following a similar trajectory to past bull runs and halving cycles.”

“These patterns suggest that post-halving cycles are typically followed by large rallies, even if preceded by a short-term decline,” they said. “As of day 230 (August 17) of the 2024 halving, the year-to-date normalized return is 1.38 (38%).”

They noted: “During the same period, we achieved a reward ratio of 1.32 and 1.68 after the 2016 and 2020 halvings respectively; therefore, the current correction is not uncommon, and while the recent drop below $50,000 may be the traditional last correction after the halving, we are still expected to follow the trajectory of past bull runs and may have one more final correction in the third quarter, consistent with the trajectory after the 2020 halving.”

Bitfinex analysts concluded: “It can be expected that illiquidity will continue during the summer. The broader macroeconomic environment, including possible rate cuts from the Federal Reserve, will also play an important role in shaping future ETF flows for BTC and ETH. Investors should pay close attention to these developments as they can provide further insights into market trends.”