Ethereum is good:

Ten reasons to be optimistic about ETH

1. Low inflation:

Despite lower gas fees, ETH’s annual inflation rate remains below 1%.

In comparison, other major L1 competitors have higher inflation rates, such as SOL at around 4%, and it is expected that the VC unlocking range of most other L1s (SUI, APTOS, etc.) will increase significantly in the next few years.

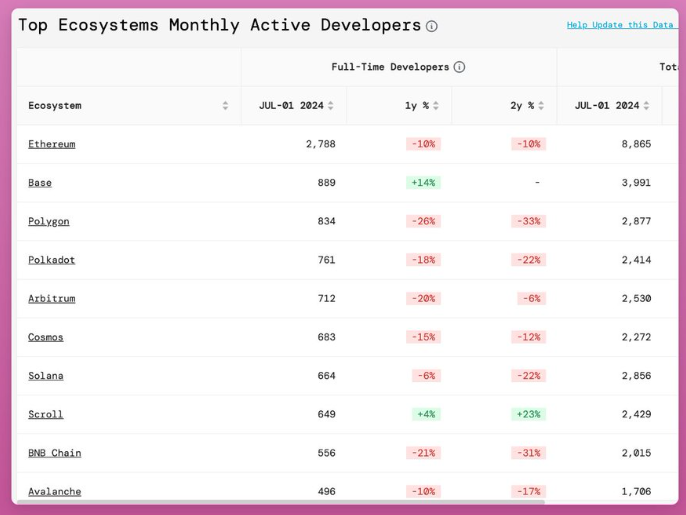

2. Development capabilities :

The strong developer community and accumulated intellectual capacity within the Ethereum ecosystem supports continued innovation and growth.

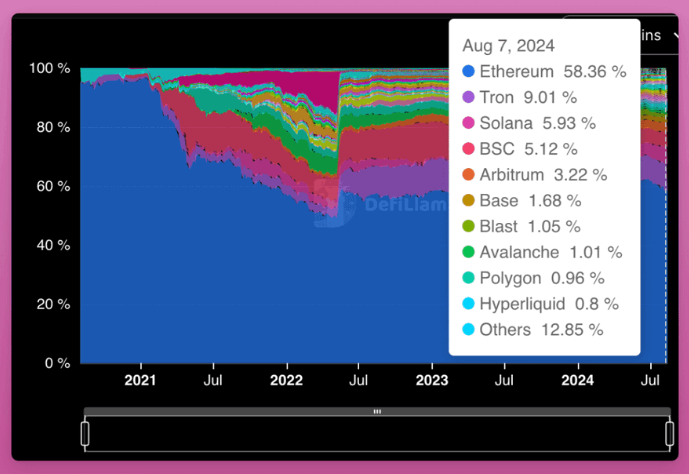

3.TVL, dApps...

Ethereum with all L2 adoption remains the top smart contract platform with 58% TVL (but ~65% for platforms with all L2 adoption).

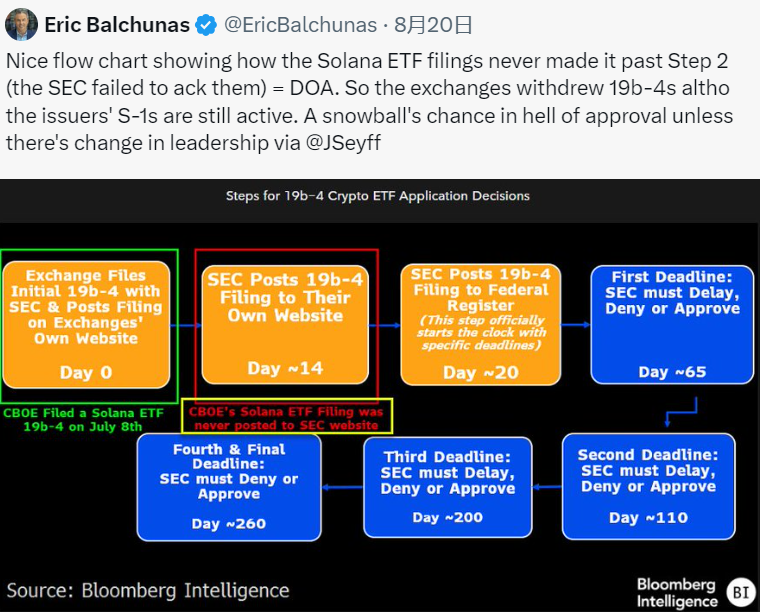

4. Regulatory Certainty:

ETH and BTC are not securities. SOL may be a security???

Greater regulatory clarity in the U.S. and EU is boosting confidence, opening the door for entry by institutional players such as BlackRock.

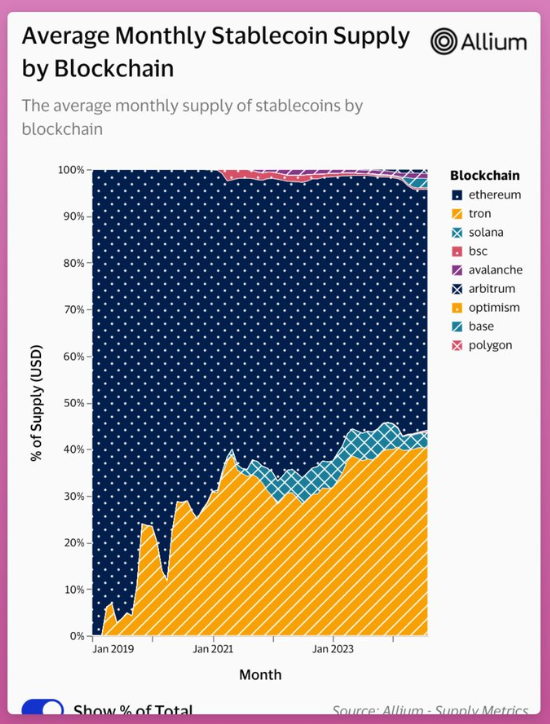

5. Dominance of Stablecoins:

More than 50% of all stablecoin supply is issued on Ethereum.

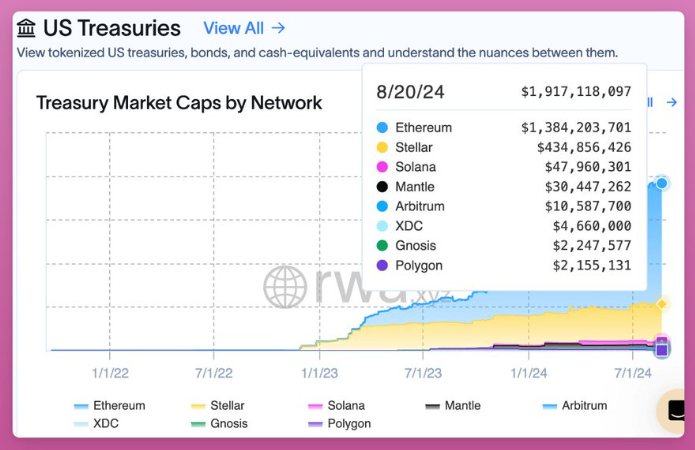

6. Ethereum is leading in RWA issuance.

The total amount of tokenized U.S. Treasuries issued on its platform is $1.9 billion, of which $1.3 billion.

7. Modular expansion:

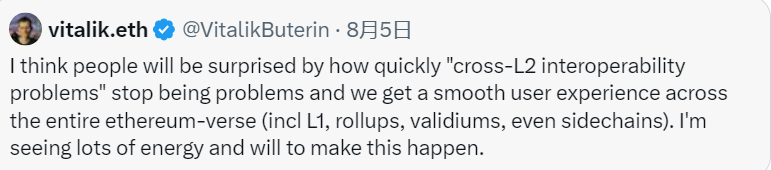

L2s are disliked by many due to fragmented liquidity and poor user experience.

But L2 provides scalable growth, making Ethereum flexible enough to adapt in the long term. Additionally, cross-L2 interoperability issues may be solved sooner than we think.

8. The upcoming Pectra upgrade will bring improvements to the user experience, making development smoother and more efficient.

at last,

9. Network Effect:

In summary, ETH’s strong network effects come from its early leadership, large developer community, mature DeFi ecosystem, institutional adoption, and strong security, making it the platform of choice for dApp builders.

One more thing: prejudice

I had accumulated too much ETH and was eager to market it to my followers.

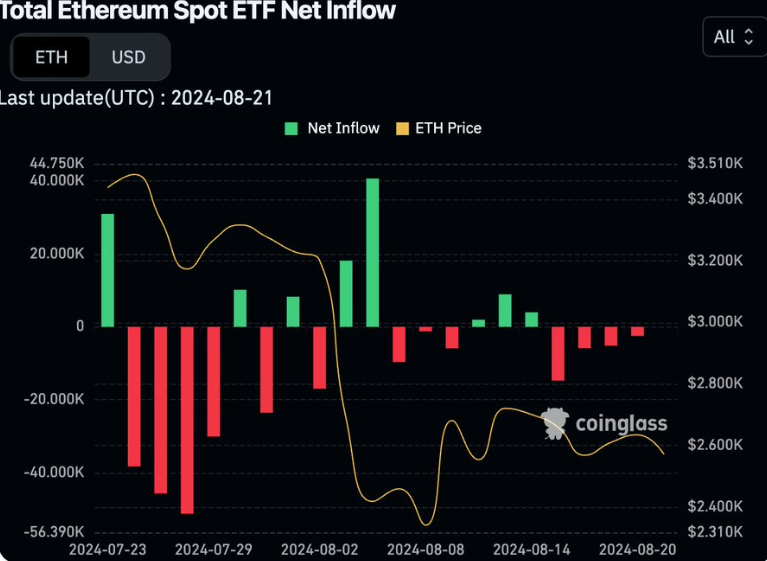

10. Don’t forget about the ETH ETF :

The flows are currently low but there is a potential for significant inflows when the market turns bullish.

The institutions haven't come yet. But if they want to come in, they have the means!