Although the expectation of a rate cut in September has been confirmed, many will use this opportunity to inject FUD (fear, uncertainty and doubt) into the market. It is best to view macro news rationally.

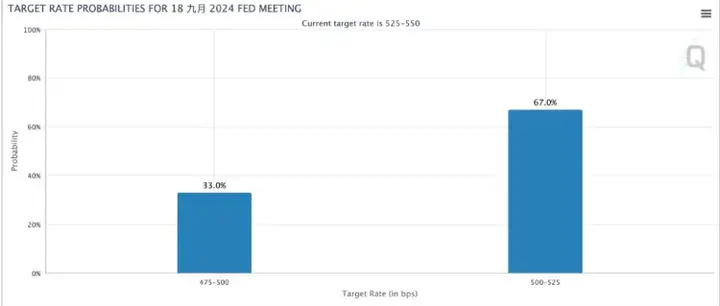

With less than a month left until the September FOMC meeting, a rate cut is basically a certainty; the only question is whether the rate cut will be 25 basis points or 50 basis points. Judging from Bitcoin’s weekly chart, Bitcoin is currently in an accumulation zone.

More information Tuanzi Finance

VX:TTZS6308

Minutes of the U.S. Federal Open Market Committee (FOMC) meeting showed that due to progress on inflation, the vast majority of policymakers believed that "if the data continues to be in line with expectations, it may be appropriate to ease policy at the next meeting." Simply put, policymakers are confident about the progress of fighting inflation and will start cutting interest rates if the data continues to match.

The market currently believes that the probability of the Fed cutting interest rates by one percentage point in September is 67%, and the probability of cutting interest rates by two percentage points is 33%.

As for the job market, many policymakers believe that employment growth may be exaggerated and risks to employment targets have increased.

As a result, the U.S. Bureau of Labor Statistics (BLS) released the latest data last night (21st), which showed that the number of employed people from 2023/03 to 2024/03 was initially revised down by 818,000. This is not only the largest downward revision since 2009, but also the largest downward revision since records began. second highest.

It confirmed that the U.S. job market may not be as strong as previous data indicated, reinforcing pressure for the Federal Reserve to cut interest rates next month.

Bitcoin rises more than 3%

Perhaps benefiting from the imminent interest rate cut by the Federal Reserve, Bitcoin briefly touched $58,815 last night and then fluctuated upwards, reaching a maximum of $61,823 at 4 a.m. earlier in the morning. At the time of writing, it was trading at US$60,896, with an increase of 3.12% in the past 24 hours.

Ethereum's trend is the same but the increase is smaller. At the time of writing, it was trading at $2,628, up 1.82% in the past 24 hours.

The entire network was liquidated to US$100 million in the past 24 hours

In the past 24 hours, the liquidation amount of perpetual contracts across the cryptocurrency network reached US$100 million, and a total of nearly 40,000 people were liquidated. Overall, it is not particularly high. If the main force intends to clear short positions, it may rise again in the future.

Lao Bao’s speech on Friday was the final word

What everyone is most concerned about at the moment, and it can be said to be what the entire market is most concerned about, is the interest rate cut.

The Federal Reserve’s defensive interest rate cuts are already on the way. What is defensive style? It refers to cutting interest rates before the economy has yet to recession. This type of interest rate cuts has historically triggered a rise in U.S. stocks, with an average rise of about 20% in the following year. Recently, The strength of U.S. stocks is that they are trading in anticipation of defensive interest rate cuts in advance, rather than trading in recessionary interest rate cuts. Therefore, we must continue to pay attention to the employment situation, inflation and economic trends in the United States in the future. As long as the economy can maintain a strong momentum, then U.S. stocks and crypto Assets and other risk assets will continue to strengthen.

Bitcoin has been trading sideways for almost half a year, and it is getting closer and closer to the beginning of the Q4 bull market that we have pinned on. Since the pin was inserted below 50,000 on August 5, I have been emphasizing to everyone that you can enter the market and add positions. The gap between the 50,000 yuan pie and the current market is just over 20%.

Recently, it has repeatedly drawn doors around 60,000, further washing away unstable chips. These trends are all preparing for the main rise in Q4. There is still a chance to break through new highs before the end of the year. Global inflation will continue, and US stocks are making huge profits. A part of the total market will flow into the cryptocurrency market as a new asset allocation, and the cryptocurrency market will become a new U.S. dollar reservoir. Bitcoin, as the risk asset most resistant to inflation, will naturally be further favored by institutions. Visible wealth will definitely come, it just comes sooner or later.

Ethereum has received relatively little attention recently and is relatively sluggish. It is expected to continue to be linked. Nothing new has been played, so we will not pay attention to it for the time being. Other public chains have begun to take action in the past two days. TON and TRX have recently introduced new things and new ways to play. The trend is likely to change at this point. At this moment, we need to pay closer attention to the market and not miss the golden period.