Anand Raj, an analyst at Deribit , the largest cryptocurrency options platform, released an analysis report yesterday (22nd) stating that from a technical perspective, Bitcoin has tested the resistance level of $61,800 multiple times and has not appeared after these tests. An obvious retracement. Therefore, it is judged that Bitcoin is likely to break through this price soon and achieve an increase.

The current BTC price once approached the 60,000 mark late yesterday night, but it has successfully held up. It has not fallen below the previous low, nor has it broken through the previous high. It is in a triangle oscillation. We may have to wait for Bauer's speech at the central bank's annual meeting later. After commenting, there will be a more obvious direction trend.

The Federal Reserve cuts interest rates and Bitcoin spot ETF funds continue to flow in

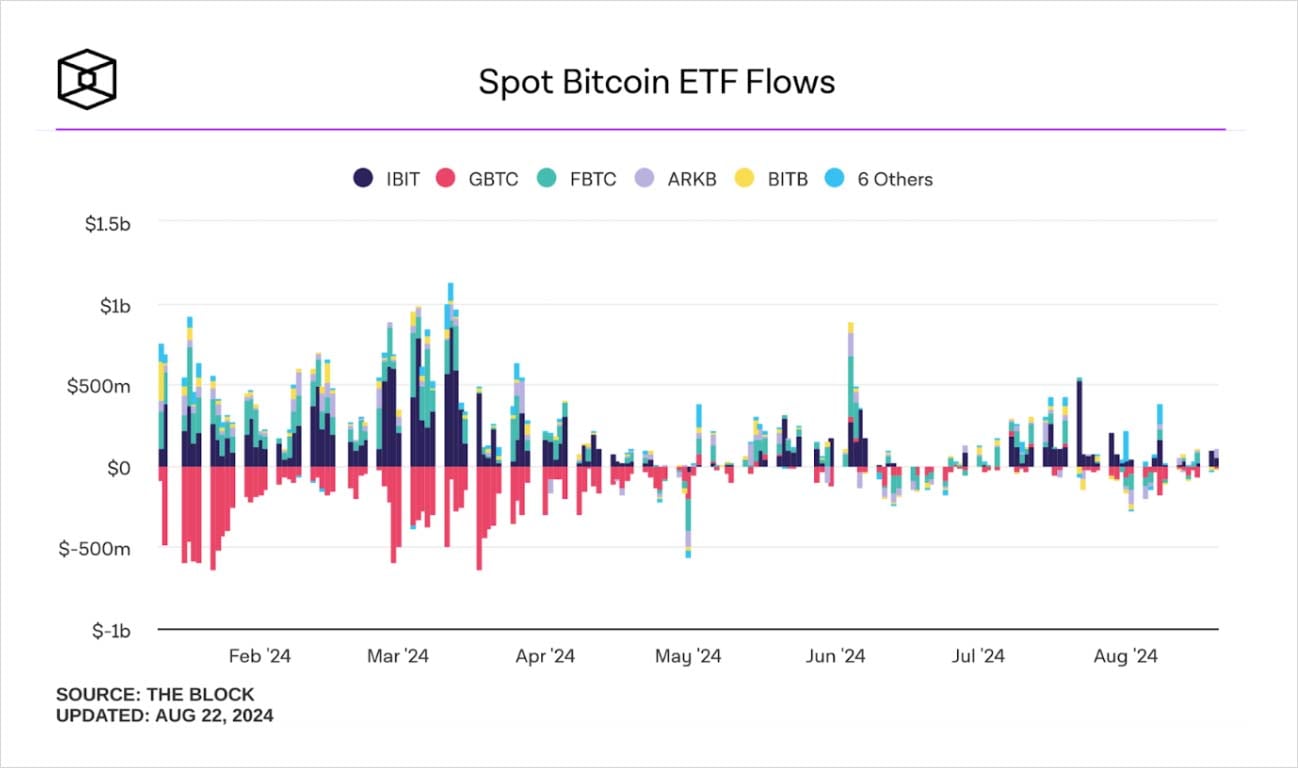

On the other hand, Anand Raj pointed out that the current U.S. economic conditions indicate that the Federal Reserve (Fed) will start cutting interest rates in September. At the same time, the U.S. Bitcoin spot ETF is also continuing to see inflows of funds. Therefore, with the dual support of the two, Bitcoin will also likely see an upward trend.

Extended reading: The Fed meeting minutes "clearly stated an interest rate cut in September", Bitcoin shot up to 61,800, and Ethereum stood at $2,600

Suggested Bull Spread Strategy

Based on the above analysis, Anand Raj suggests that investors can appropriately use the bull market spread option strategy and prepare an ambush in advance:

A trader can profit by buying a call option at a lower strike price, such as $62,000, while selling an option at a higher strike price, such as $63,000.