Rumors that Pump.fun derivatives will be launched on the Cardano network have sparked interest. Cardano’s price is expected to rise.

Cardano price surged on August 21 before encountering resistance around $0.37. The asset has been hovering around this price for most of the time as bulls have been rejected. Most traders are hesitant as they are still determining if the hype is over or if this is just the first wave.

Meanwhile, speculation circulates in the Cardano X community about the imminent launch of a Pump.fun derivative on the network.Will cornering the Cardano memecoin niche finally take ADA to $0.5?

Cardano Price Prediction: Can Pump.Fun Derivatives Save ADA?

Cardano’s price has barely moved in the past day. After briefly entering the top 10, it fell just 1.1% to $0.3715, falling to second place behind Tron (TRX) and Dogecoin (DOGE). Still, this is better than a full-blown bearish reversal.

As Cardano price struggles to break through a strong resistance level, rumors are circulating that Pump.fun derivatives are coming to the ADA network. This could be just what is needed to clear the price barrier.

According to speculation, three different projects are working on launching spinoffs of the famous Solana-based token issuance platform.

The most anticipated launch is Snek.fun from the Snek (SNEK) team, the biggest meme coin on the Cardano network. No official launch date has been announced yet.

Whale Checkout

On-chain analysis shows some bearish trends for ADA prices and investors. It remains to be seen if sentiment changes as the Snek.fun news subsides.

Data from Santiment shows that Cardano’s price and volume are showing a bearish divergence. ADA price increased from August 16 to August 22, while the volume decreased, indicating that the price buying momentum was weak and would not be sustained. Therefore, bears are likely to take over and push the price down.

Additionally, IntoTheBlock’s large volume metric shows that whale activity increased from August 18 to August 22. Furthermore, the net flow of large holders decreased from August 21 to August 22, suggesting that whales may be cautiously unloading their holdings in anticipation of a price drop.

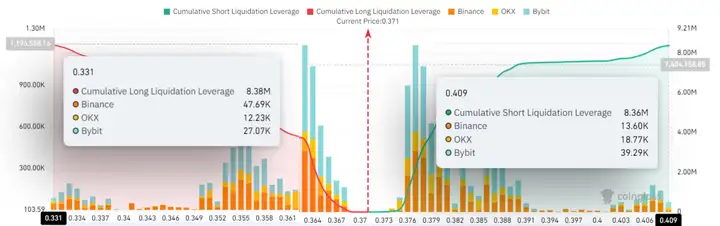

Coinglass’s liquidation chart data shows that the number of ADA shorts and longs is almost equal. However, short positions are slightly higher, indicating that the market is slightly bearish on ADA prices.

ADA open interest (OI) has increased by 0.7% in the past 24 hours, while the price has fallen by 1.1%. This divergence suggests that traders are short, which could lead to further price declines.

ADA Price Analysis: $0.50 on track if this hurdle can be overcome

Despite the short-term recovery, the overall ADA price trend is down as the price is trading below the 200-day EMA. The recent candlesticks are showing indecision around the 50-day EMA ($0.3773), suggesting that the market is trying to decide whether to continue the downtrend or start a reversal.

If Cardano price breaks above $0.3773, it might target $0.4368 as the next resistance, which is a 19.74% increase from the current price.

The MACD line remains below the signal line, showing weak bullish momentum, and the histogram is starting to turn positive, suggesting that the downtrend may be losing strength, but it is not yet a strong buy signal.

The Chaikin Money Flow (CMF) value is 0.08, indicating a slight inflow of funds, which is positive. However, like the MACD, it is not strong enough to confirm a significant rise.

Cardano Price Prediction Chart

Cardano price prediction shows that if the asset fails to break out and sustain above $0.3773, it could confirm market weakness, leading to a further drop to $0.3145. This would invalidate the current bullish thesis

In simple terms

Currently, Cardano price is stuck at major resistance levels, with weak bullish momentum and a risk of falling, while Pump.fun derivatives may enter the Cardano network. In summary, technical indicators and other indicators support ADA's bullish outlook in the short term, but currently facing major resistance levels, bullish momentum is weak and the upside potential is limited. In the long term, Pump.fun derivatives will land on the ADA network, which is needed to clear the price barrier, while the upcoming Chang hard fork upgrade will also boost the market, which is expected to push it to test the key resistance level of $0.3773.