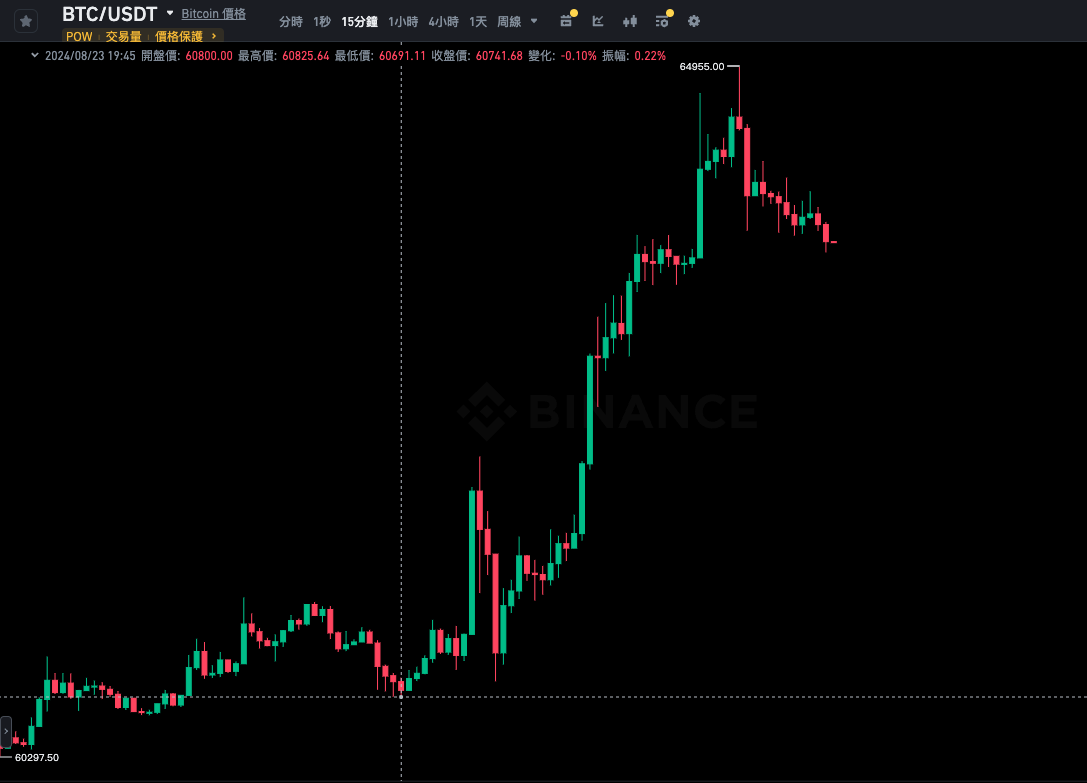

After U.S. Federal Reserve Chairman Jerome Powell stated at the Jackson Hole Economic Forum yesterday evening that the time was ripe for a rate cut, the crypto market immediately ushered in a new wave of gains.

Bitcoin prices have risen from a low of $60,691 before Ball's speech to a maximum of $64,955. The current price is 63,713 US dollars, up 5.02% in the past 24 hours.

Ethereum approaches $2,800

The trend of Ethereum is similar to that of Bitcoin. Its price has continued to rise from the low of US$2,646.82 before Bauer's speech, and once touched US$2,799.13. At the time of writing, it is currently trading at US$2,744.64, up 3.98% in the past 24 hours.

Performance of the top ten tokens by market capitalization

In addition, the top ten tokens by market value are also rising. The highest increases are DOGE and SOL, which have increased by 5.53% and 5.5% respectively in the past 24 hours; the smallest increase is BNB, which has increased by 0.17% in the past 24 hours.

The entire network liquidated US$177 million in the past 24 hours

According to data from Coinglass, in the past 24 hours, the liquidation amount of cryptocurrency across the entire network reached US$180 million, of which short orders liquidated US$139 million, long orders only liquidated US$41.19 million, and a total of 65,800 people were liquidated.

All four major U.S. stock indexes rise

On the other hand, stimulated by Ball's interest rate cut remarks, the four major U.S. stock indexes all closed higher yesterday:

- The Nasdaq index rose 258.44 points, or 1.47%, to close at 17,877.79 points

- The S&P 500 index rose 64.97 points, or 1.15%, to close at 5,634.61 points

- The Dow Jones Industrial Average rose 462.28 points, or 1.14%, to close at 41,175.08 points

- The Philadelphia Semiconductor Index rose 141.75 points, or 2.79%, to close at 5,228.65 points