This year, no one wants to miss the BTC ecosystem.

WBTC, as the most important Wrapped Bitcoin, is an important bridge between the Bitcoin and Ethereum ecosystems. It has recently been controversial due to changes in custody rights.

Coinbase then said it would launch a token called cbBTC, and Base protocol head Jesse Pollak added, "I love Bitcoin and am very grateful for its pioneering role in the cryptocurrency field. We will build a huge Bitcoin economy on @base."

Wrapped Bitcoin is not the only solution to bring BTC into the Ethereum ecosystem. Corn is a new Ethereum layer 2 network that uses hybrid tokenized Bitcoin ($BTCN) as gas and redirects network revenue back to users and protocols.

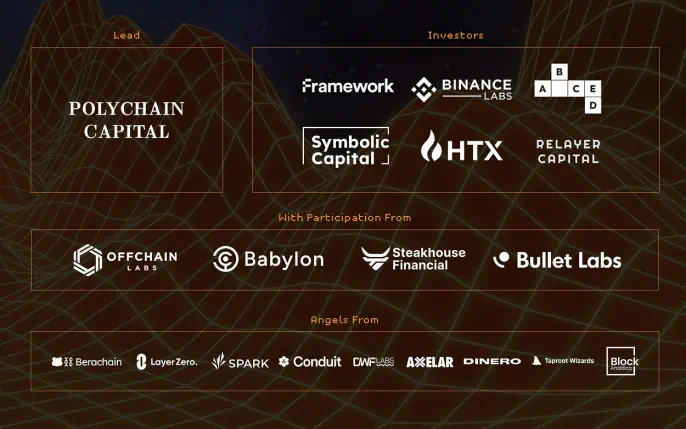

Recently, Corn completed a $6.7 million financing led by Polychain Capital. The seed round of financing attracted many investors, including Binance Labs, Framework Ventures, ABCDE, Symbolic Capital, HTX Ventures and Relayer Capital. In addition, well-known project developers such as Sandeep Nailwal, Smokey and Papa Bear (Berachain) also participated in the investment in their personal capacity.

Corn's founder once said that at present, there are more and more activities and actions around Bitcoin DeFi. The ETH community has always had an atmosphere of "I like BTC, but I won't say it out loud." This situation has changed, and builders hope to get that trillions of dollars of net new capital.

What is Corn?

Corn claims to be “the first Ethereum L2 to use $BTC as a gas token.” Using $BTCN as a hybrid tokenized Bitcoin. $BTCN is backed 1:1 by native $BTC and is not bound by a single centralized custodian or cross-chain solution.

Team Background

The Corn team was founded by a team that has been engaged in DeFi construction for a long time. They have launched projects such as Badger, Code4rena, Slingshot and 0xBow. Founder Chris Spadafora is also the founder of BadgerDAO, and has also founded Alwayshodl and North Block; co-founder Zachary Cole is the managing partner of Number Group, and was previously the co-founder and CTO of Slingshot and the co-founder of Code4rena.

How does Corn work?

- Ecosystem composition and operation:

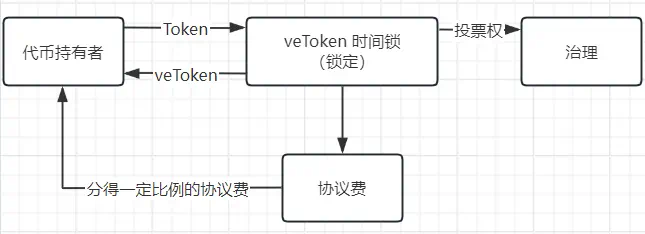

Corn is a new Ethereum L2 network that uses its hybrid tokenized "Bitcoin" (BCTN) as a gas token. Corn's operating model is inspired by veTokenomics, which was pioneered by Curve Finance. (veTokenomics requires users to voluntarily lock their tokens in exchange for governance rights and part of the protocol revenue, while veTokens are tokens that token holders voluntarily lock for a period of time in exchange for the right to participate in protocol governance. These tokens are usually non-transferable and usually come with other benefits in addition to governance rights.)

(The example of veTokenomics is shown below)

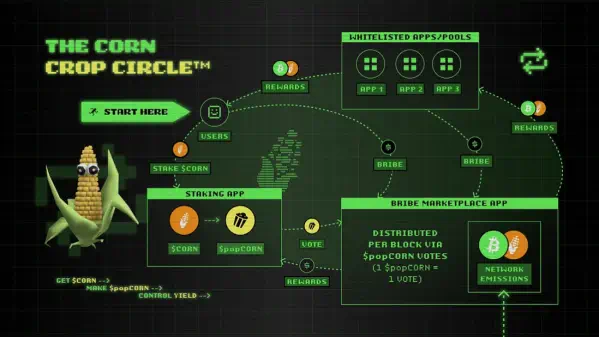

Therefore, in Corn, it incentivizes users and developers by issuing CORN. CORN can be directed to any application on the chain. Staking CORN can obtain popCORN, and the amount of popCORN may determine the governance weight of the CORN staker. CORN stakers can decide what proportion of CORN to issue to which applications, and users who interact with the applications favored by the stakers will receive these incentives. In addition, CORN stakers can earn income through Corn's native Bribe market-by authorizing CORN stakers to directly accept quotes from applications to complete the automated liquidity supply in the Corn network.

In the Corn network, Corn yields consist of 2 tokens:

$BTCN (tokenized BTC; 1:1 ratio with BTC) — generated from network transaction fees

$CORN — Issued by the Native Network

$CORN stakers decide where the proceeds go.

The $CORN stakers can earn income from Corn’s native Bribe market. This permissionless market allows anyone to incentivize $CORN stakers with tokens to get their votes on a protocol or program that directly benefits from it.

Simply put, $CORN stakers can get popCORN by staking $CORN, and popCORN represents voting power. Others can use tokens to "bribe" $CORN stakers to obtain the voting rights in the hands of the stakers. Of course, the program decided by the vote is the "winner", and users who interact with the "winner" will receive the rewards of this round. Corn hopes to attract more Corn builders by letting stakers decide "which program is the "winner" and who can get the "winner" reward".

* Corn "Crop Circle": Get $CORN -> Pledge and get $popCORN -> Control the rate of return

- BTCN: A hybrid tokenized Bitcoin

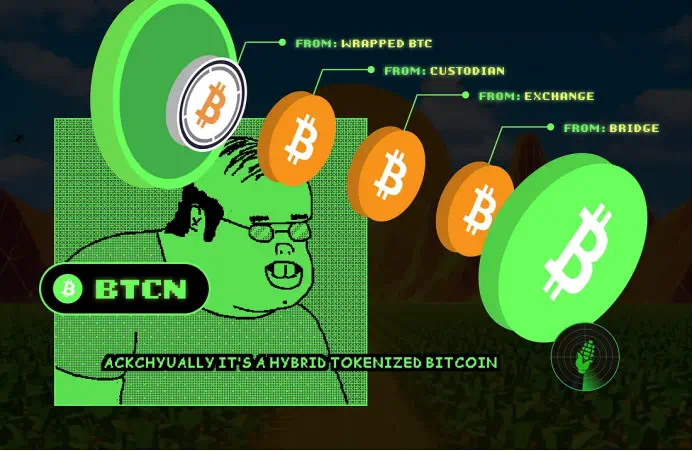

BTCN is the first hybrid tokenized Bitcoin and will serve as Corn’s gas token.

Corn developers adopted this design because they believe that Bitcoin for DeFi should not be a completely centralized or decentralized solution, but should take a hybrid approach that prioritizes solvency and scale.

BTCN is a tokenized Bitcoin backed by native Bitcoin at a 1:1 ratio through a certain technical mapping of $BTC. It is not bound by a single centralized custodian or bridge solution, but extends its minting rights to include multiple custodians, smart contracts and/or bridge protocols.

BTCN’s minting rights:

- Smart contracts can obtain the right to mint coins (similar to DAI);

- The most reputable and trusted counterparty can obtain the right to mint coins.

BTCN will unlock new use cases and greater capital efficiency in AMMs, swap facilities, and lending markets, which are the main demand drivers for Bitcoin in DeFi.

Corn Airdrop Program

Corn introduced Kernels in the first phase of the airdrop. Kernels will represent the share of $CORN that can be obtained from the airdrop after the Corn mainnet is launched.

Corn has issued retroactive bonus points, Kernels, to eligible users (users who started interacting with one or more partner apps in the past year). New users can also earn Kernels by depositing various assets, doing Galxe tasks, and inviting and referring new users.

1. Initial (retroactive) airdrop (for early DeFi users who cooperated)

The list of eligible users who can obtain Kernels includes DeFi users who have interacted with certain protocols of Corn within a specified period of time.

The airdrop snapshot time is: 4:20 on July 13, 2024 (Beijing time), covering more than 1 million addresses.

Eligibility requirements are as follows:

EVM related operations:

- Maker/Spark Protocol: Hold at least 0.01 sDAI for three months or more, or borrow against WBTC on Spark in the year before July 12, 2024;

- Arbitrum: Users who use the official bridge to bridge the mainnet Ethereum to Arbitrum within one year before July 12, 2024;

- Ethena: Users who hold USDe and stake SUSDe within one year before July 12, 2024;

- fi: Users who hold at least 0.01 eETH or weETH for two months or more in the six months before July 12, 2024;

- Kelp: Hold rsETH (from Arbitrum and Ethereum snapshots) or be among the top 500 liquidity providers in the past 3 months;

- Pendle: Users who traded on Pendle or provided liquidity with Silo-related assets, or pledged PENDLE as vePENDLE within one year before July 12, 2024; (Related Silo assets include: sDAI, USDe, SUSDe, eETH, weETH and rsETH)

- Galxe: Users who have staked at least 300 GAL since the launch of Galxe;

- Spark: Users who have borrowed with WBTC as collateral;

- wBTC: Users who hold at least 1 wBTC in the year before July 12, 2024.

Bitcoin related operations:

- Babylon — users who have participated in the Babylon staking testnets Testnet-3 and Testnet-4;

- Thorchain — Users who swapped at least $100 of native BTC or provided liquidity on Thorchain in the year before the snapshot.

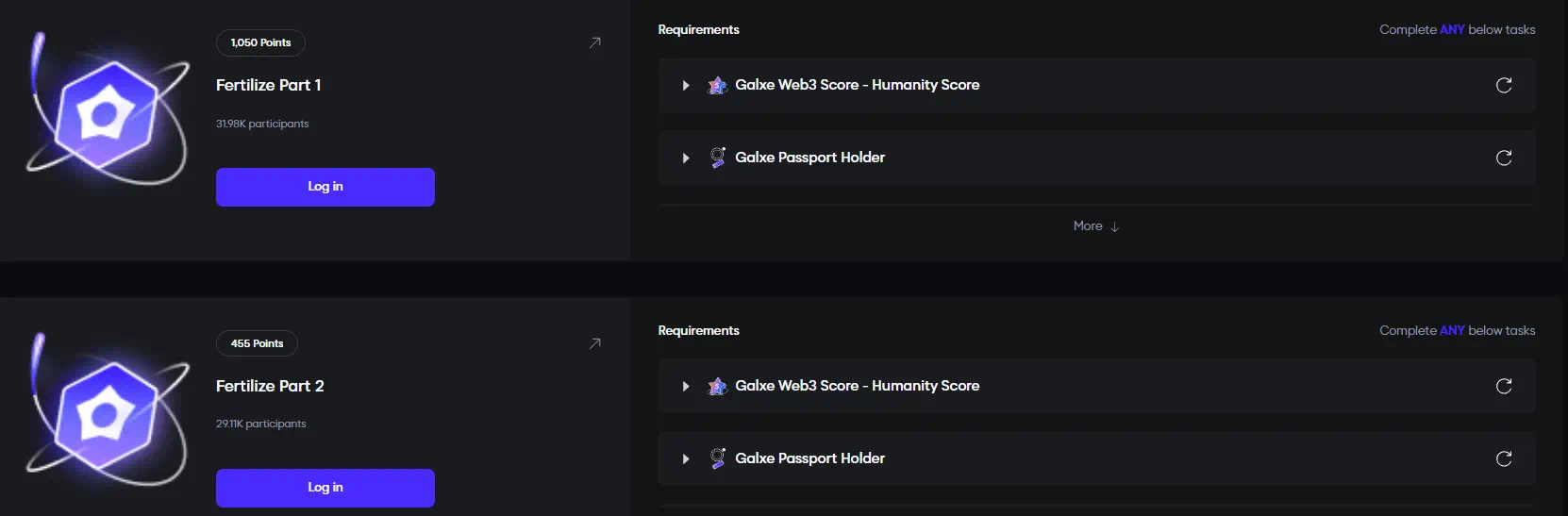

2. Earn points through Galxe task interactions and get airdrops

Corn's partner Galxe will issue Corn's native points, Kernels, to users who spread information about Corn through Galxe Quests and on Discord, X, Telegram or email before the live launch event.

The ratio of Galxe's points to Corn network's native kernels is 1:1.

Galxe provides two galactic missions, and you can gradually gain Points by completing them step by step.

Kernels can also be earned by depositing certain assets into Corn.

3. Get airdrops through deposits

The connected wallet must be eligible for the initial airdrop mentioned above; if the wallet does not meet the initial airdrop eligibility conditions, an invitation code is required to make a deposit.

The official currently supports 7 types of token deposits, namely: wBTC, wETH, rsETH, USDC, DAI, sDAI, and USDe.

In addition, deposit silos (silos, grain storage silos, here refers to fund pools) of certain tokens can currently receive additional Kernel rewards, as follows:

- BTCN silo (×2) (if deposited into WBTC, it will be converted to BTCN)

- weETH Silo (×25)

- sDAI Silo (×25 times)

The Kernel points rule is: users can get 1 Kernel for every 1 USD deposited (every 210 minutes), and all deposited assets can be withdrawn at any time without any penalties or fees.

4. Attract new customers

Eligible users can generate a one-time invitation code to their friends. They can earn Kernels based on their own deposits as well as the deposits of their invitees. Kernels points will continue to accumulate during the Kernel Airdrop event.

According to the official website, Corn is about to start the second phase of airdrops, which is from Kernel points to $CORN.