During Bitcoin’s recent price rebound, signals from key market indicators currently predict that Bitcoin’s price could break through $70,000.

Bitcoin [BTC] has gradually recovered after a sharp drop to $50,000 earlier this month on August 5. Currently, the leading cryptocurrency is trading at $63,083, up 4.25% over the past week. This price action has sparked discussions among many cryptocurrency investors and analysts about the potential trend of Bitcoin in the coming weeks.

More information Crypto Tuanzi

Will it break $70,000?

Bitcoin’s current sideways trend is not necessarily considered bearish. Before every major move, Bitcoin usually goes through a period of consolidation within a specific range.

Historically, these consolidation phases have typically lasted between 8 and 30 weeks.

Currently, Bitcoin is 25 weeks into its current consolidation phase. While it is difficult to predict the exact duration of this phase, Bitcoin is likely still in a bull market.

If this pattern holds, he believes the eventual breakout could be significant. As Bitcoin approaches the critical $70,000 resistance level, more investors are also considering the possibility of a breakout.

Although Bitcoin bulls seem to be in the driver’s seat at the moment, the real test is yet to come. A retest of the $70,000 resistance level is expected this week, but it remains to be seen whether the bulls have the strength to break through this key level.

Fundamental indicators

To understand Bitcoin’s potential to continue to surge, it’s necessary to examine the asset’s fundamentals. According to Coinglass, Bitcoin’s open interest has slightly declined by 1% over the past day and is currently valued at $34.39 billion.

Open interest refers to the total number of futures, options and other derivative contracts that have not yet been settled.

A drop in open interest could indicate a reduction in market activity or a shift in trader sentiment. However, despite this drop, Bitcoin’s open interest, a measure of the total value of these contracts, has increased by 1.84% to $39.06 billion during the same period.

The increase shows that while the number of contracts has decreased, the value of the remaining contracts has increased, which may indicate that traders are becoming more confident in Bitcoin's near-term prospects.

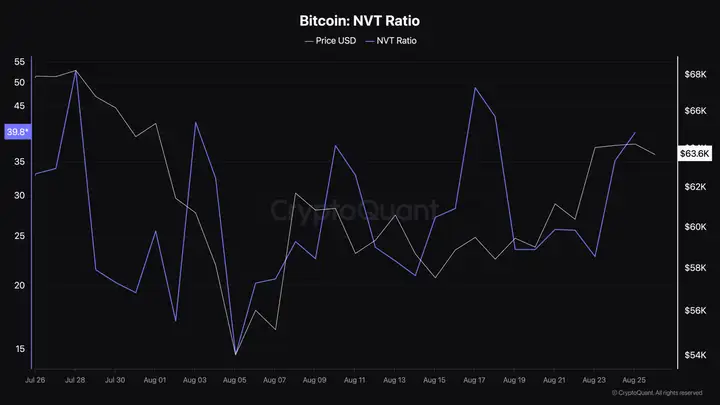

Another key metric to consider is Bitcoin’s Network Value to Transactions (NVT) ratio, which is currently rising and stands at 39.8 according to data from CryptoQuant.

The NVT ratio is a valuation metric that compares Bitcoin’s market capitalization to the transaction volume on its network.

A high NVT ratio could indicate that Bitcoin is overvalued relative to its trading volume, which could indicate a need for caution. However, it could also indicate that the market expects future volume growth, which would justify the current valuation.

In the case of Bitcoin, a rising NVT ratio could mean that investors expect the price of Bitcoin to continue to appreciate on the back of broader market trends.

In simple terms

Currently, Bitcoin has rebounded 4.25% and is approaching the key $70,000 resistance level. At the same time, key indicators such as open interest and NVT ratio indicate strong market interest and potential for further gains.

In summary, I believe that BTC indicators support a bullish outlook in the short term, with good upside potential. In the long term, bulls dominate, and with the support of market trends and the above factors, it is expected that prices will be pushed up in the future, thereby retesting the resistance level of $70,000. However, it should be noted that the rebound process may weaken bulls and cause BTC prices to enter consolidation, and potential market fluctuations will also have an impact on prices.