Over the past few months, there has been an expectation that Bitcoin (BTC) will underperform Altcoins. However, this has not been the case, as only 6 of the top 50 Altcoins have outperformed BTC over the past 90 days.

Currently, BTCD is at 57.18%, indicating that its market Capital has increased faster than Altcoins. Despite BTC strong performance, these 3 Altcoins are expected to outperform BTC in the near future. Here are the detailed analysis and reasons for this forecast.

#1. TRON (TRX)

TRON (TRX), the cryptocurrency associated with controversial blockchain billionaire Justin Sun, recently hit a three-year high of $0.17. The milestone pushed TRX into the top 10 cryptocurrencies by market Capital , surpassing Cardano (ADA). Over the past 30 days, TRX ’s price has increased by 15%, outperforming Bitcoin (BTC) over the same period.

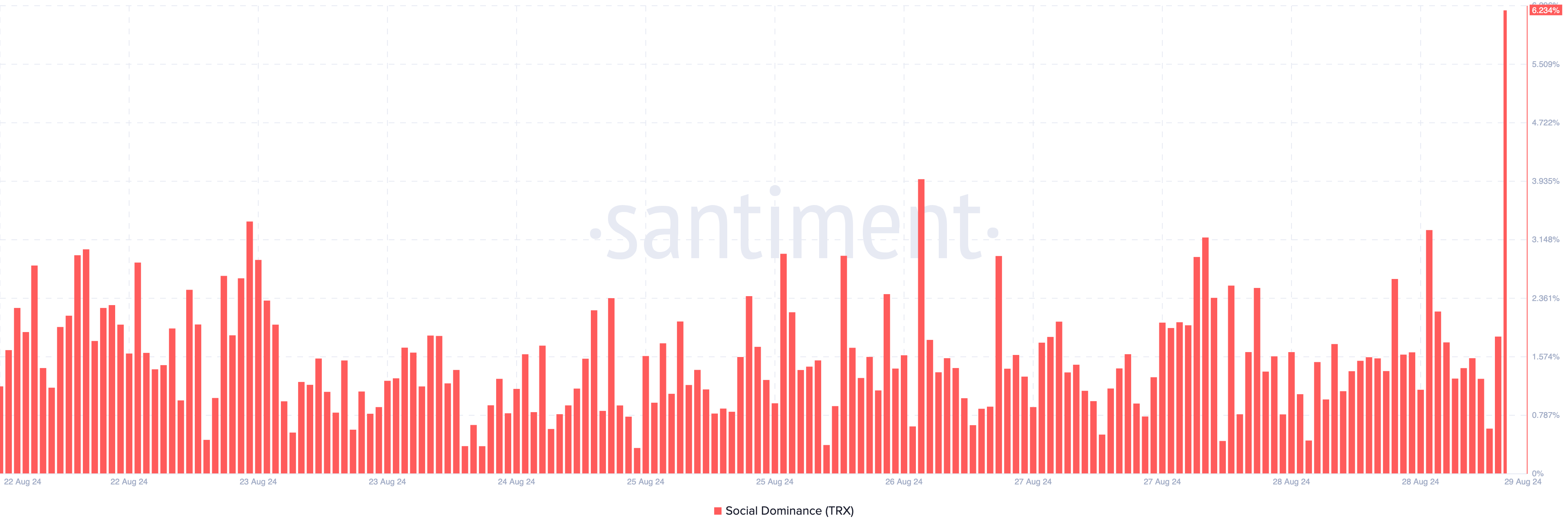

This price increase was mainly due to the launch of the meme coin creation platform SunPump in August, which boosted demand for TRX. The Altcoin's Social Dominance, currently at 6.23%, shows the growing attention towards the project.

From a technical perspective, TRON ’s On Balance Volume (OBV) indicator has increased on the daily chart, indicating strong buying pressure. A higher OBV reflects more buying activity, which is usually a sign that the price could rise further. If TRX ’s accumulation continues, the price could drop to $0.14 before recovering to the recent high of $0.17, and possibly even reach $0.19 in September.

However, this optimistic outlook could be challenged if Bitcoin outperforms top altcoins next month. In that case, TRX ’s upside momentum could face resistance, and the predicted price targets could be harder to achieve.

#2. AAVE (AAVE)

Over the past 30 days, the price of AAVE has increased by 18.68%. The cryptocurrency, which Vai as the Governance Token for decentralized finance (DeFi) protocol AAVE, has recently attracted significant interest from large investors. This interest puts AAVE among the bullish altcoins that could outperform Bitcoin (BTC) in September.

AAVE has also proposed to increase its involvement in the real-world assets (RWA) sector by integrating BlackRock’s BUIDL infrastructure. If this proposal is approved soon, it could lead to increased demand for AAVE.

On August 5, the price of AAVE dropped below $80. However, the altcoin began to form higher lows (HL), eventually reaching $146.49 on August 24. At this level, the relative strength index (RSI) showed that the Token was overbought. RSI measures momentum; a reading of 30.00 or lower signals that the asset is being sold off, while a reading of 70.00 or higher indicates that it is overbought. As shown, the RSI entered overbought territory last Saturday.

AAVE ’s price then fell to $118. The RSI has since remained above the neutral level of 50.00, suggesting a possible bullish reversal. For this to happen, the bulls need to defend the $118.01 support level and overcome the $129.64 resistance level. If successful, AAVE could become one of the altcoins that outperform Bitcoin in September. However, if the $118.01 support level fails to hold, the price of this altcoin could fall sharply.

#3. Cardano (ADA)

Cardano ’s place on this list is largely due to the upcoming major upgrade on September 1, known as the Chang Hard Fork. This upgrade will introduce on chain governance for the first time to the Cardano blockchain, marking the first stage towards the project’s ultimate goal, Voltaire.

ADA holders have shown considerable optimism ahead of the event. In 2021, a similar Hard Fork on the Cardano network led to a 130% price surge within a month. If history repeats itself, ADA could see exceptional price performance in September. Currently, ADA is trading at $0.35, down from $0.40 just three days ago.

The Moving Medium Convergence Divergence (MACD) indicator suggests that this recent price drop could be a buying opportunity for market participants. The MACD is used to measure momentum and helps traders identify potential entry and exit points. A positive MACD reading indicates bullish momentum, signaling a good time to buy, especially after a downtrend. Conversely, a negative reading indicates bearish momentum and a potential time to sell.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.