According to statistics from SoSo Value, the total net outflow of U.S. Bitcoin spot exchange-traded funds (ETF) yesterday (29th) was approximately US$71.73 million, which has been a net outflow for three consecutive trading days.

The Bitcoin spot ETF with the largest net outflow yesterday was FBTC issued by Fidelity, with an amount of US$31.11 million, followed by Grayscale's GBTC, with an amount of US$22.68 million. Notably, BlackRock’s IBIT recorded its first net outflow of $13.51 million since May 1, when Bitcoin prices were at relative lows before the month’s rally began.

ARKB, jointly issued by Ark Investment (Ark) and 21Shares, recorded a net inflow of US$5.34 million yesterday after two consecutive days of considerable net outflows. It was also the only Bitcoin spot ETF to show a net inflow yesterday.

The total single-day trading volume of these 12 funds yesterday shrank to US$1.64 billion from US$2.18 billion the day before yesterday, and the cumulative total net inflow has reached nearly US$17.8 billion.

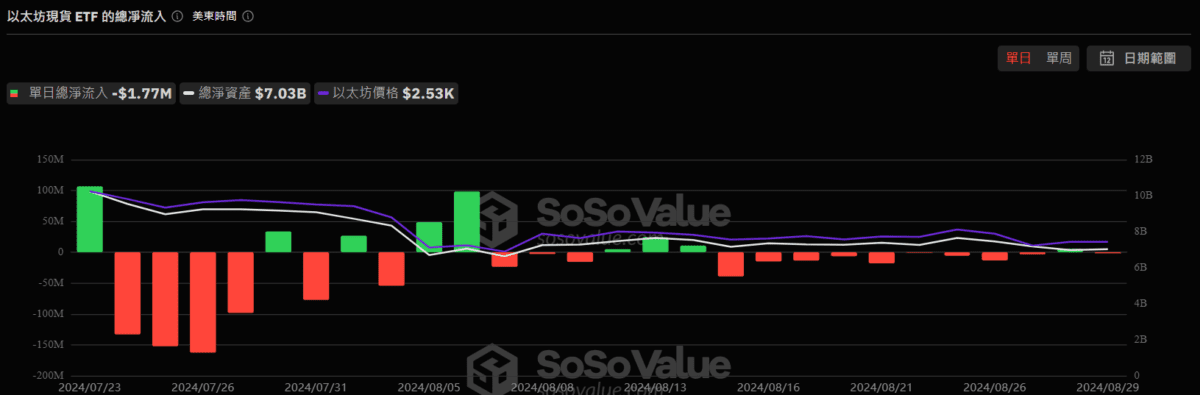

Ethereum spot ETF experienced small net outflows

The day before yesterday, the U.S. Ethereum spot ETF ended its nine-consecutive trading day trend of net outflows, but yesterday it again recorded a net outflow of US$1.77 million.

ETHE issued by Grayscale was the only Ethereum spot ETF to record a net outflow of $5.35 million, which was offset by a net inflow of $3.57 million from the Grayscale Ethereum Mini Trust (ETH). The net fund flows of the other seven funds were zero.