Dehydrated posters help you filter and sort out important market views and research reports every day. Every Sunday at 21:00, there will be a market sharing session from several main creators. Welcome to add customer service WeChat and communicate together: ganbeiccc

Last Monday, global risk markets plunged due to the liquidation of carry trades caused by Japan's interest rate hike and the US recession trade. But the market rebounded quickly afterwards. The most concerned issue at present is whether this adjustment has bottomed out, and whether there will be another crash similar to that on August 5?

The dehydration view holds that the premise for the market to collapse again is the emergence of evidence that meets the expectation of a severe recession in the US economy, or the recurrence of market liquidation caused by similar arbitrage transactions. At present, the possibility of a recurrence in a short period of time is very low. Of course, this does not mean that there is no pressure from above. Bitcoin is still suppressed by multiple resistance levels such as 62,000 and 68,000, and shocks are inevitable.

01

Industry and Macro

Last week was the most volatile week for risk markets this year. On Monday, the Dow fell 1,000 points, and the S&P 500 fell 3%, the largest single-day drop since 2022. By the close of Friday, the three major U.S. stock indexes closed slightly higher, and the losses of the major stock indexes this week were almost wiped out. The trend of the crypto market is exactly the same as that of the U.S. stock market, which also rebounded after a sharp drop.

The market generally believes that there are two reasons for the rebound: first, the Bank of Japan promised not to raise interest rates again in the event of market instability. Second, the fundamentals of the US economy have not completely deteriorated, and the recession expectations cannot be verified.

As to whether this adjustment has bottomed out, the views of different parties are not consistent. Pessimists emphasize the need to see evidence of US economic growth, while optimists emphasize the need to see evidence of US economic recession.

In fact, market trading expectations need to be constantly verified and confirmed. At this stage, the expectation of interest rate cuts is certain, while the expectation of recession needs to be verified by evidence. At least until the next data can further prove the economic recession, the market is unlikely to collapse again.

Let's pay attention to the release of the US July CPI data this week. The dehydrated view is that the CPI in June was 3% year-on-year. The CPI in July quickly reversed and fell to the point that people thought the United States was about to enter deflation, which is too unlikely.

02

On-chain data

According to coinglass data, after a brief period of net inflows, Bitcoin ETF funds continued to decline. From the trend point of view, there are still signs of net outflows from Bitcoin ETFs, and short positions remain strong.

According to glassnode data, Bitcoin on-chain transaction fees continue to be sluggish, which indicates that Bitcoin on-chain activity is still relatively weak and market activity is relatively low.

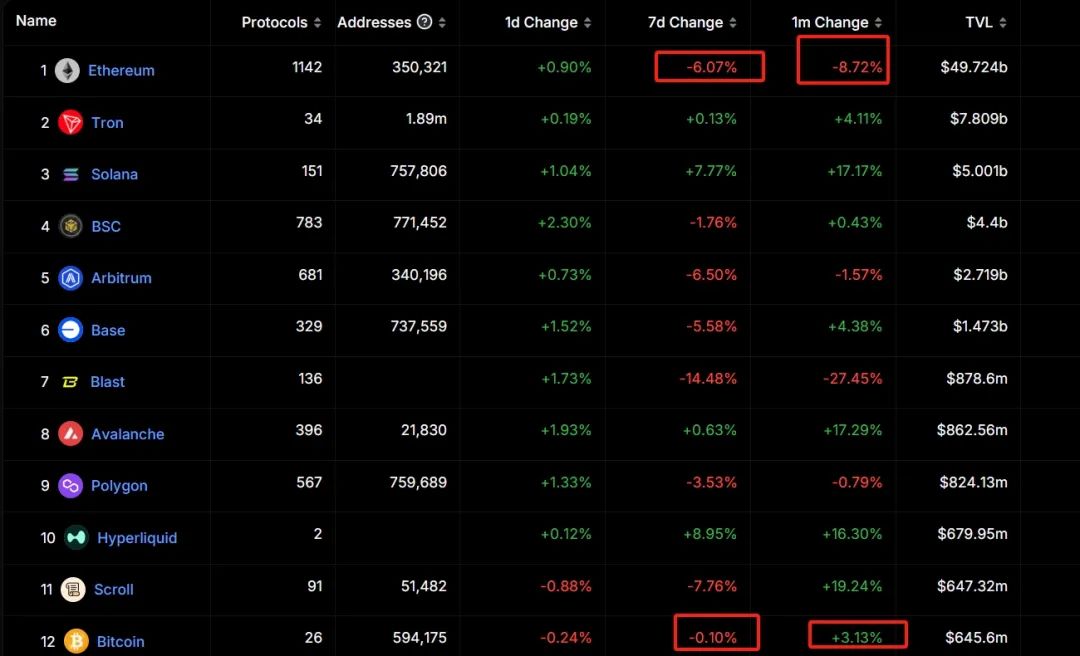

According to Deflama data, the net capital inflow into the Bitcoin ecosystem was 3.13% in the past month, and -0.1% in the past week. Today, there was a certain net inflow of funds (-0.24%), and market sentiment has improved to a certain extent.

Overall, after a sharp drop, the market has rebounded to some extent. However, the selling pressure in the crypto market still exists, there are still many uncertainties in the macro market, the activity on the chain is still relatively low, and the overall short position is still relatively strong.

03

Technical Analysis

BTC has experienced a very exciting week. The sudden drop at the beginning of the week was beyond the expectations of most people, and it directly fell through the important support range. However, it should be pointed out that this kind of decline led by the sudden market sentiment does not necessarily represent a truly effective break. We saw that the market quickly returned to around 60,000 and began to fluctuate. From the current price, the price encountered the upper red frame resistance range and began to fluctuate and consolidate. It is expected that the price may fall again, and then we need to pay attention to the rebound strength of the price. If a new rebound high can be created, the market will continue the rebound upward trend. The real strongest resistance is above 68,300. If the market retreats, the support range is below 57,500.