The Altcoin market has experienced significant volatility this year, leaving many investors on edge. However, with the US election and interest rate cuts around the corner, the market could be in for some big changes.

No Altcoin season

Many are disappointed that there has not yet been an Altcoin season in this cycle.

Altcoin have been underperforming since November 2022, as shown by TOTAL3/BTC.

The ratio of the top 125 cryptocurrencies (excluding BTC/ETH) to BTC has dropped from 1.05 to 0.49.

Market breadth is a concern

The market is currently highly concentrated and dominated by a few large-cap coins.

Only 13% of the top assets outperformed BTC.

Picking outperforming Altcoin is as difficult as finding a needle in a haystack.

Key events affecting the market

Key market-moving events have had a significant impact on the performance of Altcoin versus Bitcoin.

The debut of spot Bitcoin ETF, Bitcoin halving, the debut of spot Ethereum ETF and Ripple's partial victory in the SEC lawsuit have become important turning points in the Altcoin market this year. The launch of spot Bitcoin ETF is undoubtedly one of the most watched events.

While this is positive for Bitcoin, it breaks the traditional “Altcoin season path” where a short-lived Altcoin rally is followed by a sharp drop. This suggests that Bitcoin’s “trickle-down effect” is significantly overestimated.

Investors originally expected that the rise of Bitcoin would drive the rise of Altcoin, but the actual situation was not the case. This also gave investors a deeper understanding of the operating mechanism of the market.

Macro uncertainty

Recent macroeconomic changes have significantly increased market uncertainty.

Rising unemployment, high interest rates and the yen carry trade are all important factors.

In this risk-averse environment, Altcoin, which reflect consumer confidence, have performed poorly.

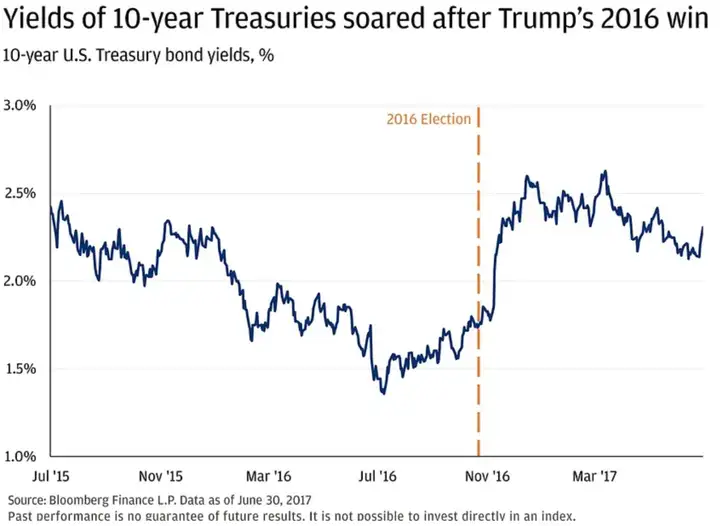

Trump deal

Another important factor is the Trump deal.

It reflects market expectations about the possibility of a second Trump presidency, with a focus on pro-growth policies.

Small-cap stocks surged after Trump's 2016 victory, outperforming large-cap stocks by nearly 8%.

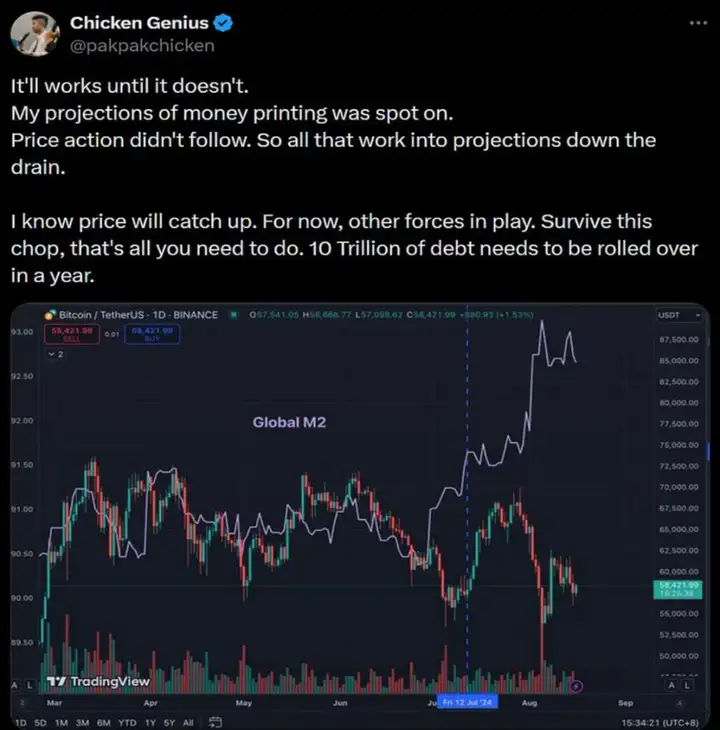

When will money printing begin?

One key indicator is the global M2 money supply, which suggests prices may eventually rise.

An increase in M2 typically boosts market liquidity and asset prices, including cryptocurrencies.

Unemployment and recession concerns

As the U.S. unemployment rate rose to 4.3% in July, Sahm's rule signals the possibility of a recession.

In this environment, investors tend to move to safer assets, which can have a negative impact on Altcoin. However, it is important to note that trading based on macro data is difficult due to the forward-looking nature of the market.

In simple terms

The Altcoin market has been volatile this year, and the expected Altcoin season has not occurred. In summary, it is mainly affected by macroeconomic changes, the impact of Trump's transactions, and changes in Bitcoin's dominance. By the end of the year, if interest rate cuts stabilize the economy, Bitcoin's market dominance may decline. If recession concerns intensify, Bitcoin's market dominance may remain high. In either case, the differentiation between Altcoin is expected to increase.

However, as global awareness of cryptocurrencies continues to increase, more and more institutional investors may begin to pay attention to the Altcoin market, bringing more funds and liquidity to it.