Since the beginning of this round of bull market, except for the strong performance of Bitcoin and several mainstream tokens, the overall market performance has been mediocre. It is not that there are no new tracks emerging in the crypto market, but it is difficult to form a craze in the end. Many people even doubt whether the crypto market has entered the bull market stage. However, with the Federal Reserve about to enter a rate cut cycle, optimism in the market continues to rise, and expectations for the upcoming bull market are also beginning to rise.

Bitcoin price retreats to $57,500, with the Crypto Fear & Greed Index showing fear in the market.

For more information, please visit Tuanzi Finance VX: TTZS6308

Bitcoin S&P Index Shows Buying Opportunity at Lows

Bitcoin recently challenged $65,000 and then fell back. As of today (2nd) when writing, it is quoted at $57,500. The Cryptocurrency Fear and Greed Index is 26, indicating that market sentiment is in a state of fear.

However, an on-chain indicator shows that investors don’t need to be too pessimistic, and there is even a chance to buy the dips? The Bitcoin Puell Multiple Index has seen a slight decline, which may be a favorable buying opportunity for investors.

The Bitcoin S&P Index is an indicator of miner sales activity, and when the index falls below 0.6, it is generally seen as a time to buy Bitcoin regularly. Currently, the index is 0.69, close to the "decision range", which is between 0.6 and 0.8. This is one of the best buying opportunities in more than two years.

Bitcoin enters "Red September"

Historical trends show that Bitcoin usually performs poorly in September each year, with an average drop of 4.5%.

If the support between $55,500 and $56,500 fails to hold, it may further drop to around $51,000. According to the historical halving cycle, Bitcoin may break through the “post-halving accumulation range” at the end of September, but the whole of September will still be a roughly consolidation trend.

Bitcoin needs to secure $58,450 on a weekly basis to consider the $58,000 range as support, which is currently being tested.

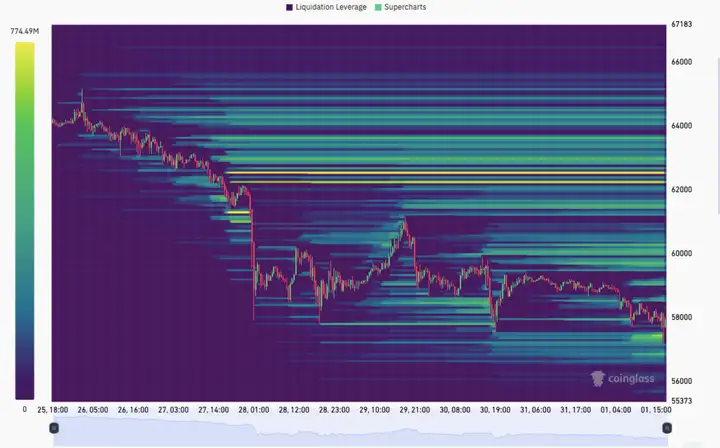

$61,300 may become resistance

In the last week of August, shorts continued to enter the market. In the future, there may be a two-way liquidity sweep, that is, a situation of long and short double killing. From a trading perspective, I prefer to long. I hope that Bitcoin can first drop to around $56,600 to fill the CME gap (CME launched Bitcoin futures in 2017 and will be closed on weekends, so there will be a gap between Friday's closing price and Monday's opening price, which is often called a "gap". These gaps are usually filled as prices change), and then long.

If Bitcoin rebounds after falling to around $56,000, a potential upside target could be $61,300, where there is a large sell liquidity and could be an important short-term resistance level.

The daily chart shows that Bitcoin is testing the 56,000 support level, and the relative strength index (RSI) has fallen below the 50% mark, which further shows a potential bearish trend. If the 56,000 support level is lost, the next important support point may be around 52,000.

Bitcoin on-chain data and market sentiment

While Bitcoin prices fluctuate, on-chain data provides valuable insights into the internal dynamics of the market. One of the key indicators is Bitcoin exchange reserves, which assesses the amount of Bitcoin held in exchange wallets. Recent data shows that this amount is declining, indicating that the market is in an accumulation phase. As Bitcoin reserves in exchanges decrease, the possibility of a supply squeeze increases, which could trigger a new price rally.

Despite the overall market decline, the number of Bitcoin holders holding more than 100 Bitcoins reached a 17-month high, with 283 new wallets added in August alone. Therefore, when predicting Bitcoin price trends in September, the increase in large holders indicates their growing confidence in Bitcoin's long-term profitability, which could bring bullish momentum in the coming months.

Bitcoin may see a recovery in September, but the road will not be smooth. We should pay close attention to the key support levels of 56,000 and 52,000, while monitoring market sentiment and on-chain data. We should watch more when we should watch more and take action when we should take action.

I plan to accept two more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.

If you are fully invested or your position is heavy, and you don’t know what to do, you can contact me to help you see if your position needs to be adjusted.