The Bitcoin market in particular is currently suffering significant losses as its price has dropped below the predicted $54,000 mark before showing signs of a slight recovery. However, according to analyst Rekt Capital, it seems that the bull market is not over yet and BTC may peak in October 2025.

Historical data shows there is still upside potential for BTC

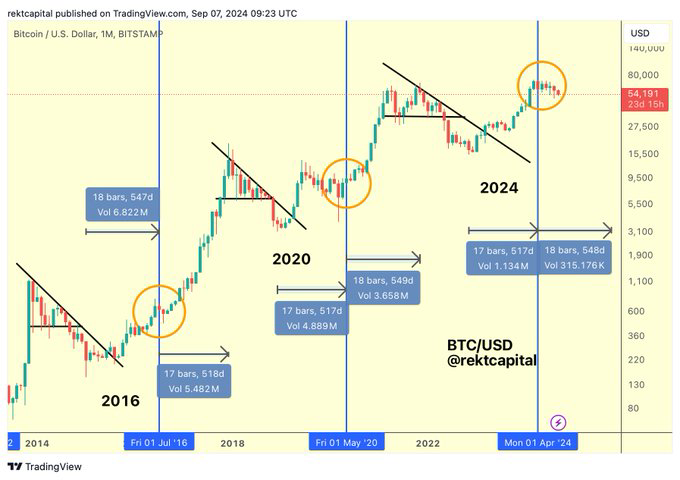

To prove its point, Rekt Capital turned to historical data from previous Bitcoin Halving cycles. In the chart Chia , Rekt showed the last three Halving cycles of 2026, 2020, and 2024.

- For the 2016 Halving cycle, Bitcoin bottomed Dip 547 days before the Halving cycle. But it peaked in the bull market 518 days after the Halving.

- For the 2020 Halving cycle, Bitcoin Dip 517 days before the Halving and peaked in a bull market 549 days after the 2020 Halving

From historical data, Rekt found that in the 2024 Halving cycle, Bitcoin is hitting a temporary Dip 517 days before the Halving. If the history of 2020 is repeated, Rekt predicts that BTC will most likely peak in the bull market around 549 days after the 2024 Halving. From that timeline, we can predict that BTC 's peak will be recorded in October 2025.

So, if we XEM the Bitcoin Halving as a common reference point, the Bitcoin bear market Dip occurred in a similar period of time before the Halving as the period of time it took for Bitcoin to form a bull market top after the Halving. In other words, we can understand that the current time is Vai as an accumulation phase in preparation for the growth season in October next year.

This also means that the bull market is not over as the community fears.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.