Bitcoin is a great store of value but a pretty poor yielding asset. Fortunately, the days of BTC yielding less than 0.5% are coming to an end. Emerging opportunities in Bitcoin’s decentralized finance (DeFi) and Layer-2 (L2) ecosystems are changing the game.

Join Bitcoin Magazine to learn how to prepare for the upcoming BTC profit explosion.

Bitcoin mining used to be the only way to earn large BTC rewards. Holder often faced sketchy Centralized Finance (CeFi) platforms, such as the now-defunct Celsius and Voyager, or dismal DeFi returns. As of September 5, DeFi lending platform AAVE paid Wrapped Bitcoin (WBTC) depositors a meager 0.04% APR.

That is changing. After years of quiet development, Bitcoin’s L2 scaling networks, such as the Lightning Network, Core Chain, Rootstock (RSK), and Stacks, are gaining traction.

According to data from defillama, the total value locked (TVL) on Bitcoin’s L2 has skyrocketed to around $1.4 billion as of September 5. This is up nearly 275% since the beginning of the year and a tenfold increase since 2023.

L2 CoreDAO developer Brendon Sedo said he expects Bitcoin's L2 to account for a significant portion of the top asset's more than $1 trillion market Capital in the coming years.

Several L2s, including Core Chain, Babylon, and Spiderchain, are exploring native Bitcoin Staking . Similar to proof-of- Stake (PoS) networks like Ethereum, Bitcoin L2 stakers lock up BTC as collateral to secure the network in exchange for rewards.

Meanwhile, liquidation Staking Derivative ( LSD ) protocols are making BTC Staking profitable for many L2s. These protocols issue Tokenize claims on Staking Pool, including Core Earn, Bedrock, Stroom, Pell Network.

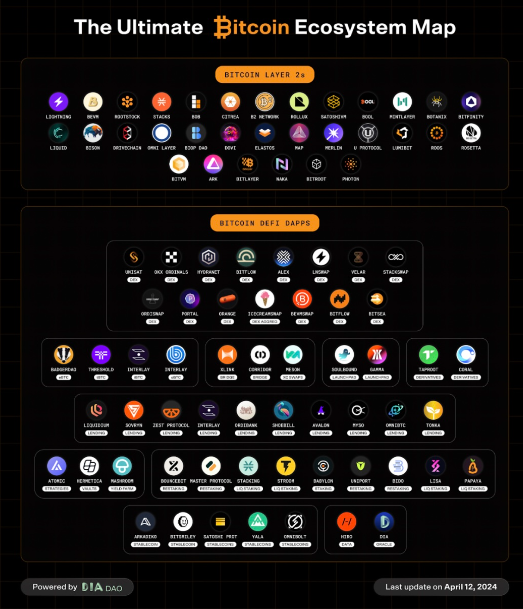

Bitcoin's DeFi and Layer-2 Ecosystem as of April 12, 2024 | Source: DIA DAO

Spiderchain is still in testnet phase and Babylon has not started issuing rewards yet. But CoreChain's LSD , stBTC, is already live and touting an 8.8% reward rate.

This is significantly higher than PoS networks on Solana or Avalanche, which yield 6.85% and 7.83% respectively, and much higher than Ethereum's 3.4% APR as of September 5.

Importantly, Core Chain pays stakers in CORE, its native Token , not BTC. So always do your own research and XEM carefully whether it suits your crypto strategy before deciding to participate.

Bitcoin L2 is about more than just Staking. Several projects including RSK, Merlin, and Stacks have hosted the native Bitcoin DeFi ecosystem, which includes decentralized exchanges (ALEX, Bitflow), lending protocols (MoneyOnChain, Zest), and multi-tenancy platforms like Sovryn. Merlin even promotes the native Bitcoin Derivative protocol, Surf.

The Lightning Network payment protocol launched in 2018 with nearly $300 million in TVL, according to defillama . Node operators, who provide BTC liquidation to Lightning payment channels in exchange for fees, earn an Medium of 5.62% APR in BTC.

Similar to Bitcoin mining, Lightning nodes are dominated by professional players like LQWD Technologies Corp, not retail holder .

Major institutional Staking services, including Kiln and Figment, already support Staking of Stacks’ native Token – STX, which pays rewards in BTC from network fees. They may soon add more networks.

In May, asset management firm Valour launched the Valour Bitcoin Staking (BTC) SEK ETP, an ETP listed on Scandinavia's Nordic Growth Market exchange. The firm Staking BTC on Core Chain. Valour launched its Core Chain validator node in June.

On September 3, asset management firm 21.co launched its managed BTC wrapper, 21.co Wrapped Bitcoin (21BTC). In the future, more liquidation from large institutions will flow into the space.

The most exciting possibilities for BTC in DeFi are towards Ethereum. The EigenLayer reStaking protocol launching in 2023 has been a game changer for crypto and BTC is no exception.

EigenLayer supports “actively validated services” (AVS), protocols that secure themselves using EigenLayer’s nearly $12 billion ETH restaked pool. In November, AVS will begin paying interest for that privilege from protocol revenue, generating profits for restakers.

EigenDA, EigenLayer's first and largest AVS, added native L2 Token reStaking in August. This extends restaking from Ether and EigenLayer's native EIGEN Token to any virtual asset, including wrapped BTC .

In August, liquidation reStaking protocol Swell launched swBTC to pay out returns on WBTC. EigenLayer is expected to add wrapped BTC reStaking soon.

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

According to Cointelegraph