Affected by the U.S. non-farm payrolls data for August, which intensified market concerns about the U.S. economic recession, Bitcoin plummeted from around $57,000 on Friday, reaching as deep as $52,550 on the 7th, setting a new low since August 5.

Although there was a rebound on Saturday, it fell again after 0:00 today (8th) and once fell below US$54,000. It rebounded slightly to US$54,288 before the deadline. It is worth observing whether it will hit the bottom again.

The price of Ethereum has also been sluggish, falling from around US$2,400 on the 6th, reaching as high as US$2,150 on the 7th, also hitting a new low since August 5. It has now rebounded slightly to US$2,276, up 2% in the past 24 hours.

The founder of Blur bluntly said that the bear market has arrived

As the currency market continues to decline, Pacman, the founder of Blur and Blast, tweeted yesterday (7th) that the bear market has arrived, but it is much better than previous bear markets:

The bear market in 2019 was actually depressing, there was no heat anyway, there were no users at the time.

Today we have DeFi, decentralized perpetual contract exchanges, NFTs, profitable stablecoins, and most importantly, there are still quite a few users on the chain who are very active (in terms of transaction volume and scale).

While it’s difficult to predict whether coin prices will rise or fall in the coming days and weeks, this space is here to stay. New category leaders emerge every cycle, and these new leaders are almost always established in bear markets (Blur was also established in bear markets), which is counterintuitive, but times like these are the best opportunities location.

Whale sells coins frantically to avoid liquidation

It is worth noting that the whale seem to be taking collective preventive measures, selling coins one after another to avoid the fate of being liquidated. According to the monitoring of on-chain data analyst @ai_9684xtpa, the whale address 0x1dF...A8eE9, which is long ETH, was in the short-term yesterday. In just four hours, 5,178 pieces of wstETH and stETH were sold to avoid liquidation, worth $12.84 million, with an average selling price of $2,481.

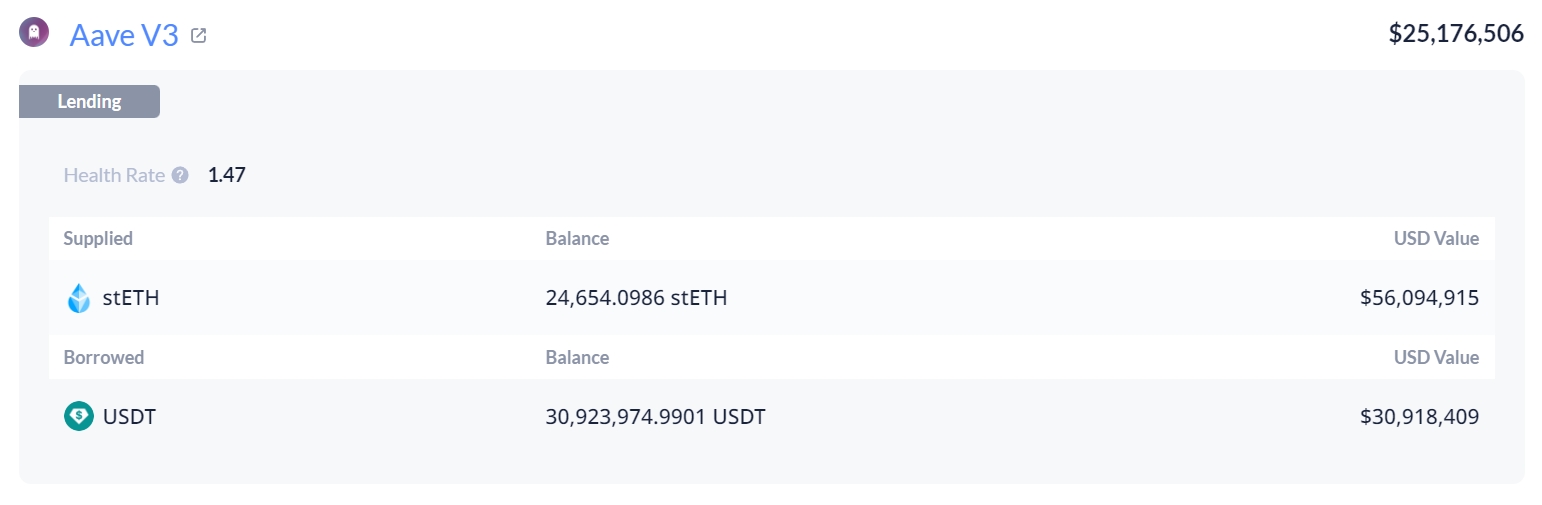

Currently, this address still holds 24,651 stETH as margin, worth US$56.09 million, and has lent 30.91 million USDT, with a health level of 1.48. Liquidation will be triggered when ETH falls to US$1,823.

In addition, according to on-chain data analyst Ember's monitoring , the address of James Fickel, an Ethereum whale and a "dead long" in the ETH/BTC exchange rate, sold 3,000 ETH and exchanged it for 124 WBTC to repay the price after Ethereum plummeted on the 6th. loan.

Ember pointed out that James Fickel's long on the ETH/BTC exchange rate has been reduced a lot as the ETH/BTC exchange rate continues to decline. At its peak, the address borrowed and sold as many as 2,981 WBTC at the end of May, but now it only has There are 2,316 pieces left.