After Bitcoin rebounded to $58,000, the market discussed whether it was a bottoming rebound or a false alarm. The $55,000 support is key, and the bullish divergence and large institutional buying of options are positive signals. However, potential catalysts are still limited, and macroeconomic variables need to be paid attention to.

VX:TTZS6308

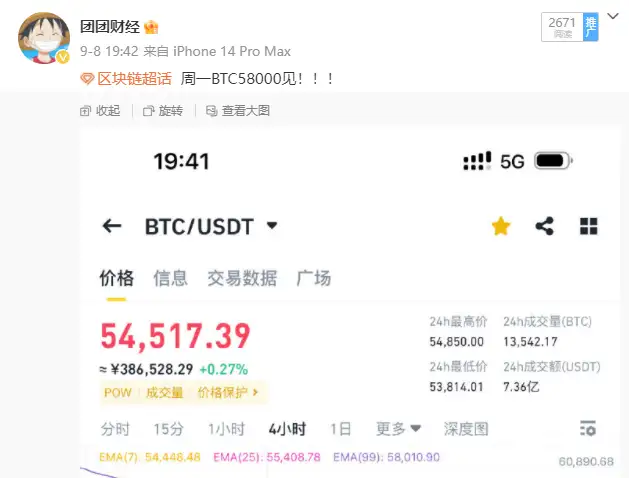

Bitcoin soared back to 58,000 overnight! Bottom rebound?

Bitcoin (BTC) has been weak in recent days, falling below $53,000 at one point, but this morning (10th) it rose back above $58,000. As of the time of writing, it was quoted at $56,822, a daily increase of 3.52%.

Bitcoin's weekly close above $53,250 is good news, holding the bottom of the "bargain zone". For the rally to continue, Bitcoin needs to recapture $55,881 as support to try to re-enter the bottom of the black channel in the figure below. At the current point, Bitcoin seems to be temporarily holding above this support, which is a good sign.

Looking at the 4-hour chart, Bitcoin's relative strength index (RSI) showed a bullish divergence before the price rebounded over the past three days. The RSI is a trend-following oscillating momentum indicator used to assess whether a market is overbought, oversold, or in an accumulation range. A bullish divergence occurs when prices fall but momentum increases, which usually leads to higher prices.

The bullish divergence could suggest that bulls are taking control of the market and plan to push the price towards $59,000, or near the 200-day exponential moving average (EMA), in the near term.

Rebound, but few catalysts

August and September have proven to be unusually weak months for Bitcoin prices, while October and the fourth quarter are generally favorable for price action. In the weeks leading up to the fourth quarter, Bitcoin bulls may only be looking forward to potential catalysts outside of cryptocurrencies. This includes macro news such as employment, inflation data and Fed policy, as well as the U.S. presidential election. Currently, Trump has shown a friendly attitude towards cryptocurrencies, while Harris has not mentioned it at this time.

Institutions buy large amounts of Bitcoin call options

Trump and Harris will have a candidate debate tomorrow, and the US will release the August CPI data on Wednesday evening (9/11), which is expected to increase market volatility.

Some institutions seem to think the market has bottomed out and are using this opportunity to increase their bullish bets in December and March, including buying a large number of Bitcoin call options with strike prices of $85,000, $100,000 and $120,000 expiring in March 2025.

The market recovery also confirmed what I said at the weekend that the market would reach 58,000 on Monday. Now it seems that it is exactly the same, just a few hours late.

Last week, during the panic, I kept telling everyone not to sell at a loss. As long as you don’t buy high-inflation garbage knockoffs, you’ll be fine.

In this kind of market, if you can't see the direction clearly and are dominated by emotions, you will suffer a big loss if you sell at the bottom or short.

It's best to hold on to it.

From the on-chain data, (1) the stablecoin inventory in the exchange began to rebound (2) BTC in Binance showed an outflow trend

Next, let’s look at the CPI data at 8:30 tomorrow night.

There is a high probability that it will be favorable. Even if there is unfavorable news, it will only be a pin at most.

The current situation is that the U.S. economy is in a slight recession, interest rate cuts are imminent, and the selling pressure in Mentougou has been digested; we are unsure about the short-term trend, so we are looking for a long-term profitable solution: hold on and wait for the price to rise.