Source: beincrypto

Compiled by: Blockchain Knight

The BTC and Crypto asset markets are undoubtedly in a challenging environment right now, and seasonal changes in September have made the situation worse.

In a recent report, Kaiko researchers explored how potential U.S. rate cuts and other key economic events could impact BTC.

These four charts from analysts explain where BTC could head in the coming weeks .

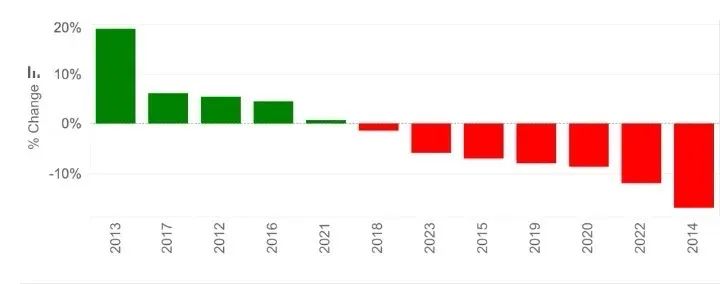

According to Be In Crypto, the third quarter has historically been challenging for BTC and the broader crypto asset market, with September often being the worst month for returns . Kaiko highlighted that BTC has fallen in September seven of the past 12 years.

This pattern has continued in 2024, with BTC down 7.5% in August and 6.3% so far in September.

As of now, BTC is trading 20% below its all-time high of nearly $73,500 reached more than five months ago.

However, according to Kaiko Research, the upcoming US interest rate cuts may boost risk assets such as BTC . Bitget Wallet COO Alvin Kan holds the same view.

"At a microblogging conference in Jackson Hole, Federal Reserve Chairman Jerome Powell hinted that it might be time to adjust policy, sparking expectations of future rate cuts. The U.S. dollar index fell sharply in response and is currently fluctuating around 100."

Kan said: "With the September rate cut becoming a consensus expectation, the official start of the rate cut transaction may improve the overall liquidity of the market, thereby providing impetus for Crypto assets."

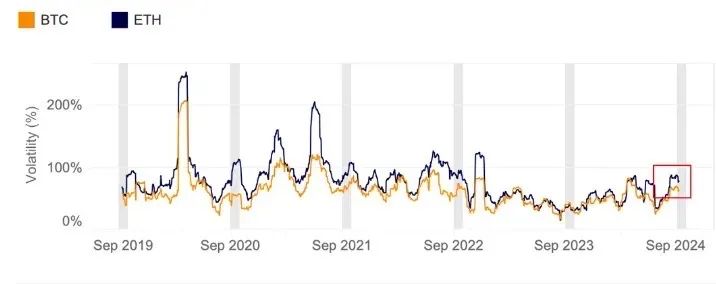

The report shows that September will be a highly volatile month, with BTC’s 30-day historical volatility surging to 70% . This indicator measures the volatility of asset prices over the past 30 days, reflecting the sharp fluctuations in asset prices during this period.

BTC’s volatility is now almost double last year’s levels and is approaching its peak in March, when BTC hit an all-time high of over $73,000.

Ethereum has also experienced significant volatility, exceeding March levels and BTC levels, driven primarily by Ethereum-specific events such as the liquidation of Jump Trading and the launch of the Ethereum ETF.

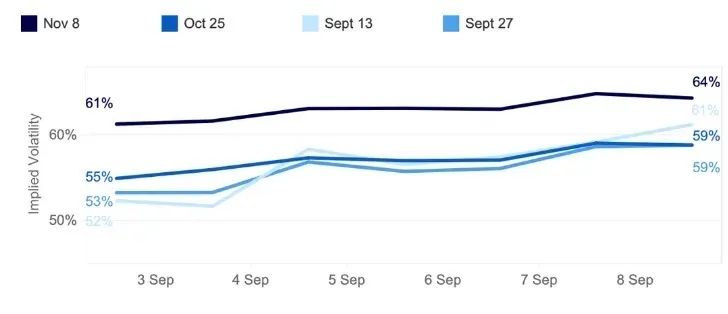

Since early September, BTC’s implied volatility (IV) has increased after falling in late August . The IV indicator measures the market’s expectations for future price volatility based on current options trading activity.

A higher IV value indicates that traders expect greater future price volatility, but it does not indicate the direction of the volatility.

Notably, the largest gains were seen on short-term option expiries , with the September 13 expiration jumping from 52% to 61%, surpassing the end-of-month contracts.

For ordinary people, when short-term implied volatility exceeds long-term volatility, it indicates that market pressure is increasing, which is called an "inverted structure."

Risk managers often view inverted structures as a signal of increased uncertainty or market stress. Therefore, they may interpret this as a warning to reduce the risk of their portfolios by reducing exposure to volatile assets or hedging against potential downside risks.

“ Market expectations are in line with last week’s US jobs report , which dampened hopes for a 50 basis point rate cut. However, the upcoming US CPI data is still likely to influence market expectations,” Kaiko researchers noted.

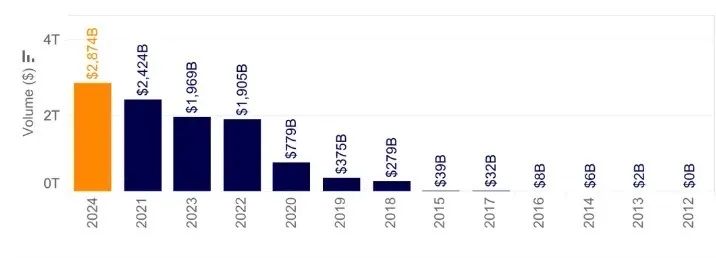

The BTC volume chart also highlights the current market volatility, showing increased trader participation . Cumulative trading volume is close to a record $3 trillion, up nearly 20% in the first eight months of 2024 after reaching the previous peak in 2021.

Traditionally, BTC investors view rate cuts as positive market catalysts. However, the market’s interpretation of a larger-than-expected rate cut remains a concern.

Markus Thielen, founder of 10X Research, warned that a 50 basis point rate cut could be seen as a signal of urgency, potentially triggering a pullback in risk assets such as BTC .

"While a 50 basis point rate cut by the Fed could signal to markets deeper concerns, the Fed's priority is to mitigate economic risks, not manage market reactions," Thielen said in a note to clients.

In addition to speculation about interest rate cuts, other factors causing volatility in the Crypto asset market include the upcoming US election .

According to relevant reports, the debate between Trump and Harris is expected to trigger market volatility, especially for BTC and Ethereum.