After weeks of volatility, there are signs that Bitcoin may be approaching a pivotal turning point.

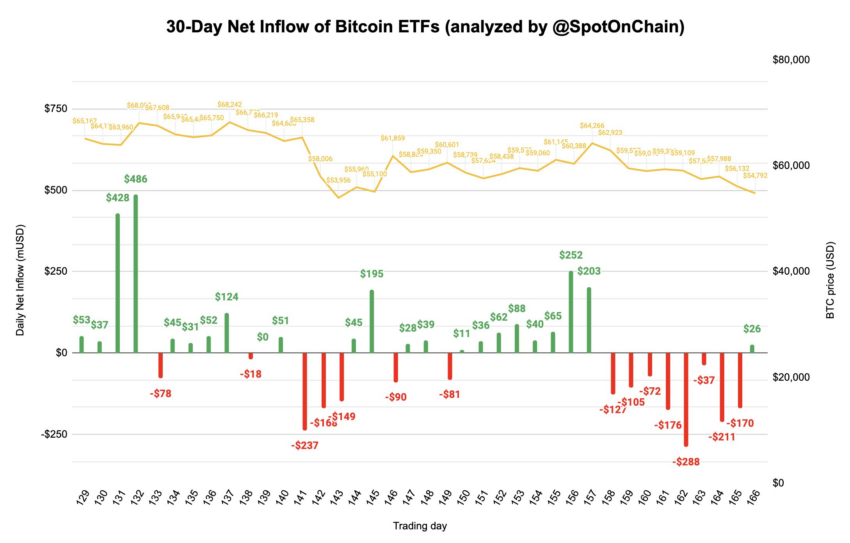

US-listed Bitcoin ETFs recorded net inflows of $28.7 million on September 9, marking a reversal after a prolonged outflow chain that saw $1.2 billion leave the market. This was the first net inflow since late August, coinciding with a 6% recovery in Bitcoin prices.

Bitcoin Buy Order Executed, Signaling Local Dip

The new inflows indicate growing interest among professional investors. While ETFs have suffered losses since August 27, the return of inflows could be an early indicator of a change in sentiment. September is traditionally a bearish month for Bitcoin, but this surge in ETF demand creates a potential counterweight.

Analysts at SpotOnChain said :

Net inflows turned positive after eight consecutive days of outflows. Yesterday's only outflows came from Grayscale (GBTC) and BlackRock (IBIT), the two largest U.S. Bitcoin ETFs.

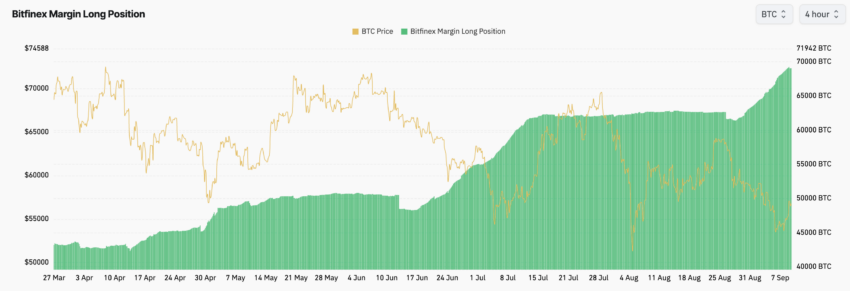

Meanwhile, a prominent whale on Bitfinex has been aggressively buying Bitcoin, accumulating around 450 BTC per day. The move comes as Bitcoin hovers below $60,000, a level where the whale appears confident in the asset’s long-term potential.

Accumulation patterns on Bitfinex, where these trades took place, show clear dominance in the Order Book , signaling strong confidence in Bitcoin's resilience.

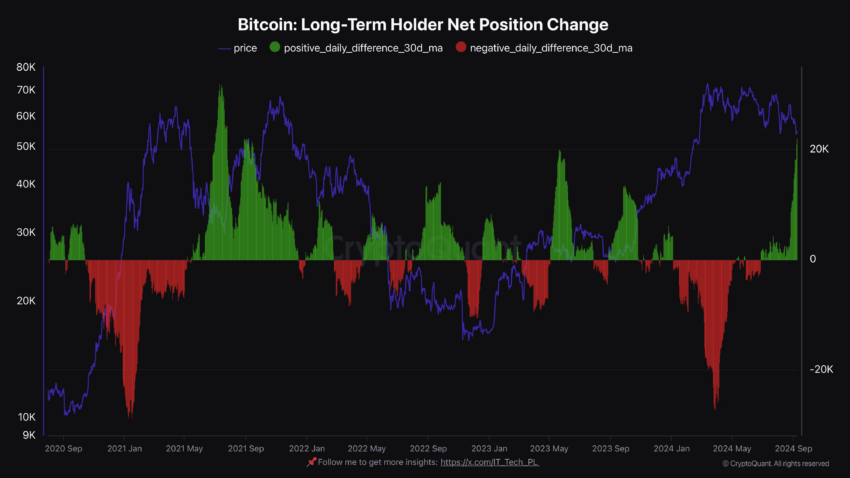

At the same time, long-term holders (LTH) are increasing their Bitcoin positions. The data shows a net increase in LTH positions, which is historically a bullish signal. When long-term investors accumulate, this typically shows confidence in the cryptocurrency's future growth potential.

The stability brought by LTH accumulation could help Peg Bitcoin's price and set the stage for a recovery.

Despite the increased buying pressure, analysts at Bernstein and even veteran trader Peter Brandt remain cautious. Brandt sees a 65% chance that Bitcoin could fall below $40,000 before hitting any new highs. Brandt’s technical analysis puts the probability of Bitcoin hitting $80,000 at 20% and soaring to $130,000 by September 2025 at 15%.

Meanwhile, Bernstein analyst Gautam Chhugani said the election results, regardless of whether Donald Trump or Kamala Harris prevails, could have a significant impact on Bitcoin's future performance.

Chhugani explains:

We expect the difference between the two political outcomes to be large. We expect Bitcoin to hit new highs again, if Trump wins, and by Q4 we expect Bitcoin to be close to $80,000-$90,000. However, if Harris wins, we expect Bitcoin to break the current floor of around $50,000 and test the $30,000-$40,000 level.

As ETFs, whales, and LTH continue to accumulate, the market is closely watching for any signs that Bitcoin may be nearing a Dip. For now, uncertainty remains, but increasing buying pressure suggests optimism is building.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.