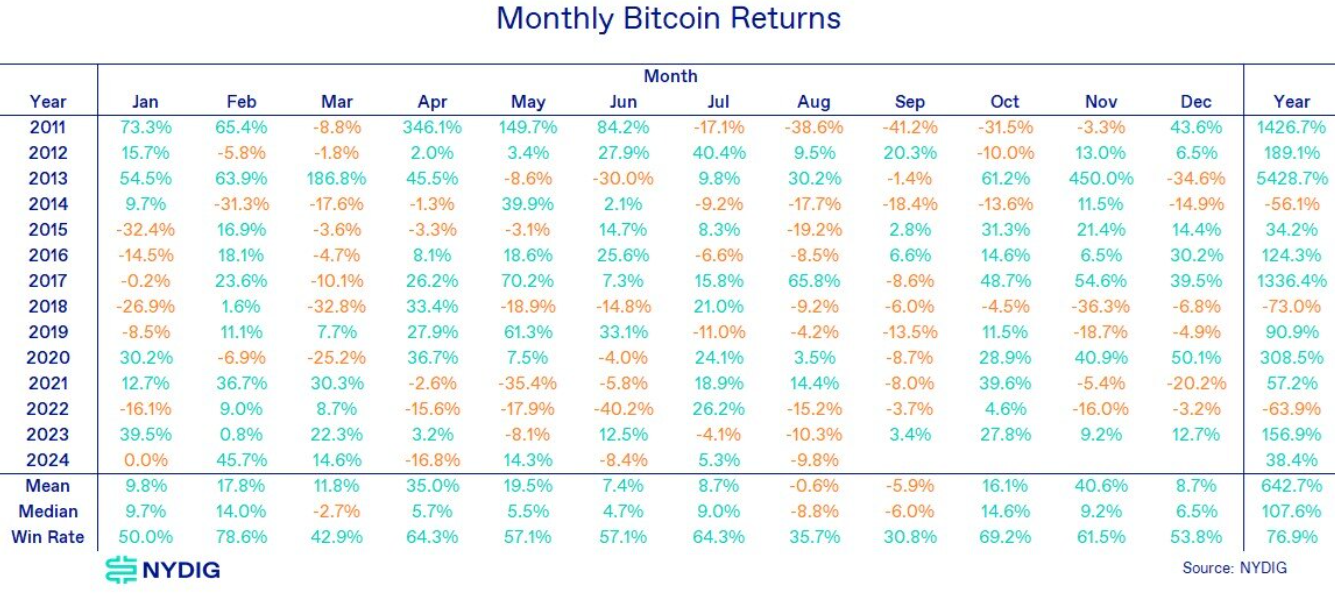

Bitcoin investors should brace for a “seasonally difficult period” in September, which delivered the worst Medium returns on record, according to the New York Digital Investment Group (NYDIG).

“Unfortunately, potential near-term catalysts for Bitcoin (BTC) are currently few and far between,” Greg Cipolaro, head of global research at NYDIG, wrote in a market update on Sept. 10.

Cipolaro added that Bitcoin investors can only look for a few catalysts outside the cryptocurrency market in the coming weeks, focusing closely on very specific macroeconomic developments.

“Most of the catalysts are related to macroeconomic data (inflation, unemployment, gross domestic product growth) or monetary decisions (Federal Open Market Committee interest rate decisions), and very few are closely related to the crypto market or Bitcoin.”

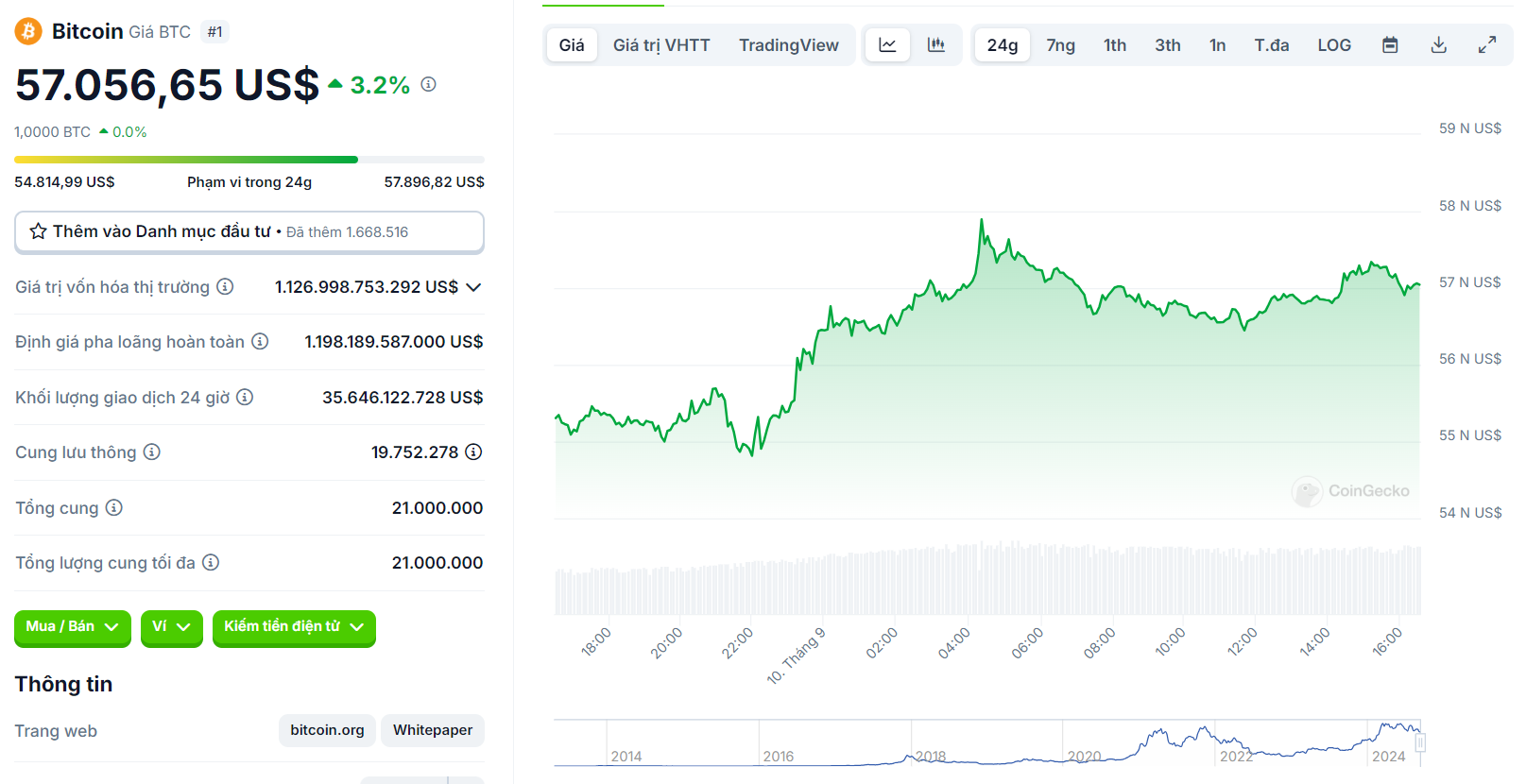

Bitcoin has gained more than 3% in the past 24 hours, boosted by the positive performance of the S&P 500 and Nasdaq, both of which closed with respective gains of 1.16% on September 9.

Bitcoin up 3.2% on the day, along with stocks rallying | Source: CoinGecko

Some commentators have noted that September has historically been the worst month for Bitcoin price movements, with the largest cryptocurrency recording an Medium loss of 5.9% over the 13 years since 2011.

Bitcoin's Medium monthly loss since 2011 is -5.9% | Source: NYDIG

The fourth quarter of the year – now less than three weeks away – is typically the strongest for Bitcoin, with October and November posting Medium gains of 16.1% and 40.6% respectively, according to NYDIG data.

Cipolaro said a “looming” concern for the cryptocurrency market is the upcoming U.S. presidential election in November.

Former President Donald Trump has made his mark as a crypto-friendly candidate, but little is known about Vice President Kamala Harris’s stance on digital assets, which could lead to instability and increased volatility in the near term.

“We won’t predict which candidate will win the election, but November could be a pivotal moment for the industry. Until then, however, Bitcoin will likely be influenced by the broader market backdrop,” Cipolaro said.

You can XEM coin prices here.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decision. We are not responsible for your investment decisions.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

SN_Nour

According to Cointelegraph