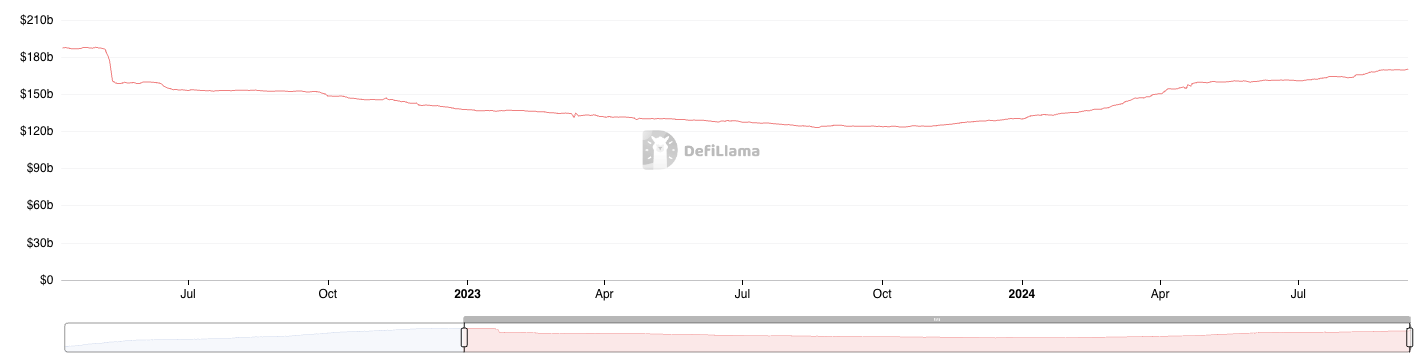

The stablecoin market has reached an incredible milestone of $170 billion in total market capitalization, the first time this has happened since TerraUSD (UST) collapsed in May 2022.

According to data from DeFiLlama, this is a 42.86% increase from its market cap of $119.1 billion in November 2023.

Analyst explains why increased stablecoin supply is positive for Bitcoin

Leading this revival are the top three USD-pegged stablecoins – Tether (USDT) , with a market cap of $118.43 billion; USD Coin (USDC ), with a market cap of $35.1 billion; and Dai (DAI), with a market cap of $527 million. Together, they account for 94% of the stablecoin market, with USDT accounting for nearly 69.54% of that figure.

Read more: Best Stablecoin Guide for 2024

According to a recent CoinGecko report , there are 8.7 million stablecoin users, with the top three—USDT, USDC, and DAI—accounting for 97.1% of those users. USDT is the most popular with over 5.8 million wallets, far more than its closest competitor, USDC.

Analysts now see the increasing stablecoin supply as a positive sign. CryptoQuant analyst Tarekonchain believes this suggests investors are ready to buy.

Additionally, the decline in Bitcoin holdings on cryptocurrency exchanges supports this positive outlook, which is usually a precursor to a price rally. This trend suggests that selling pressure is decreasing and supply is limited as more investors move Bitcoin into cold storage.

“The decline in Bitcoin holdings and the increase in stablecoin holdings sets the stage for a bullish price breakout. As Bitcoin supply decreases and purchasing power increases, the market becomes more likely to rise. Historically, this supply-demand imbalance has led to significant price increases,” Tarekonchain explained .

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Additionally, increased cash flow in global markets is positive for Bitcoin and the broader cryptocurrency market.

“Liquidity is picking up again, and Bitcoin, which is very sensitive to changes in liquidity conditions, has the potential to move explosively as new liquidity enters the system. The macro environment is changing. A major liquidity wave is coming, and when it arrives, Bitcoin is likely to see a strong rally in Q4,” said macro analyst Julien Bittel.

As the Global Money Index (GMI) rises, more money is being put into circulation, strengthening the outlook for Bitcoin. This liquidity increase is expected to continue into Q4, which could spark a strong year-end rally for Bitcoin and stabilize the cryptocurrency market.