Market Analysis

The latest data released by the U.S. Bureau of Labor Statistics (BLS) last night (12) showed that the U.S. Producer Price Index (PPI) in August increased by 1.7% year-on-year, lower than the market expectation of 1.8%, hitting a new low since February this year ; the previous value was also revised down from 2.2% to 2.1%. Following the CPI data, it further showed that U.S. inflation was slowing down.

At the same time, the number of initial jobless claims in the United States was 230,000 in the week ending September 7, slightly higher than market expectations. The previous value was revised from 227,000 to 228,000, but the overall change was not large.

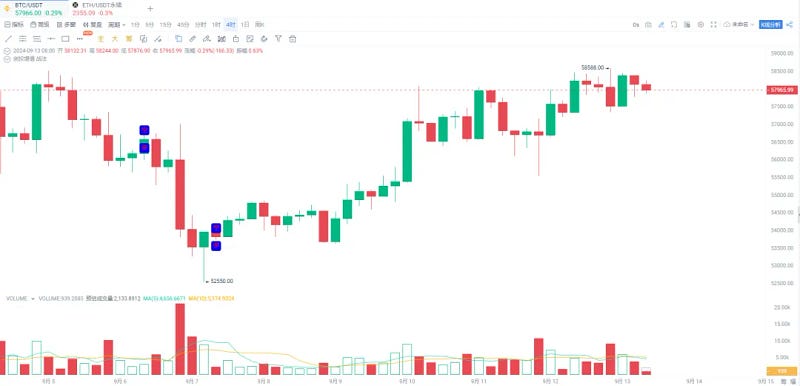

As the latest US macro data sent mixed signals on inflation, Bitcoin has been fluctuating in the $57,000-58,000 range, and the market is still waiting for the interest rate cut to take effect.

Fed rate cut expectations remain despite mixed data

Data from Cointelegraph Markets Pro and TradingView show BTC/USD falling below $58,000, still slightly up on the day.

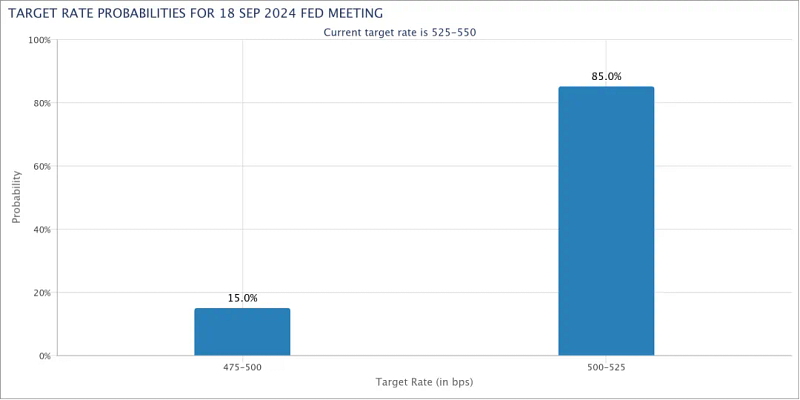

The Federal Reserve will still choose to cut interest rates slightly by 0.25% at its upcoming meeting on September 18.

Data from the CME Group's FedWatch tool showed that the market is pricing in an 85% chance of a 0.25% rate cut.

Trader, analyst and entrepreneur Michaël van de Poppe went on to point out that the European Central Bank (ECB) is already ahead of the Federal Reserve in terms of rate cuts.

He concluded: “The monthly data point was worse than expected, but overall, PPI was below expectations,” and told X followers that “this is going to be good for Bitcoin.”

The market has failed to break through 58,500 for many times, and there is a probability of a 25 basis point interest rate cut in September of more than 85%. What will happen next?

In fact, the closer we get to this time, that is, around the first interest rate cut, the more volatile the market becomes, as it is not as firm as it would be after suspending interest rate hikes and flooding the market with money. This is very obvious from the recent fluctuations.

Although the trend is shifting from tightening to easing, it is not so fast. The first interest rate cut does not mean that there will be liquidity entering the market for crazy buying. The main task of the 25% interest rate cut has been basically confirmed. After the implementation, we will continue to trade recession, soft landing, Japan's macroeconomics, and whether US inflation will continue steadily or repeatedly. These are all emotional speculations that affect prices. After all, it is still early for a large amount of liquidity to enter BTC.

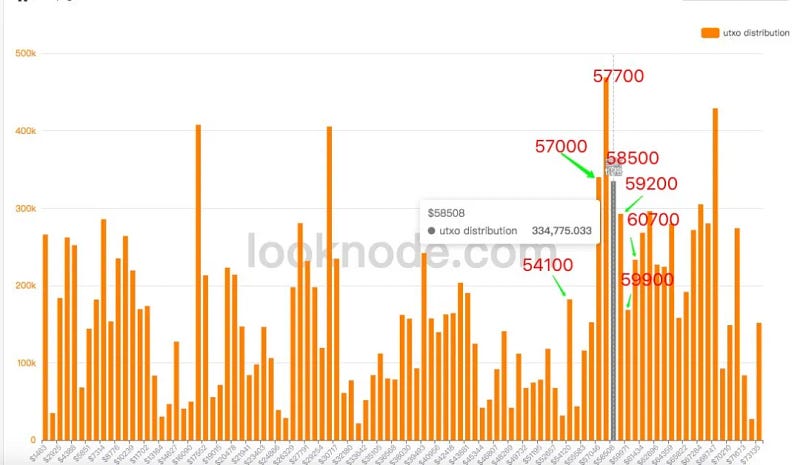

Before the new hype emerges, it is still in a narrow range. As shown in the figure, in the range of 53,600-58,500

After the September rate cut, it will depend on what kind of sentiment will break this narrow range of fluctuations. Will it be another hype of recession expectations, or Japan's rate hike, or both? Will it welcome the boost in sentiment brought by the US election that we mentioned earlier? Let's wait and see.

Slowly and patiently. Of course, there will be short-term swing trading opportunities before the election (11.6), but it is difficult to capture. It is really difficult. Of course, I will announce the latest strategic trading points in my community. If you are interested, you can pay attention!

If you have been chasing ups and downs, often being trapped, and have no latest news in the crypto and no direction, please scan the QR code below. I will try my best to answer any questions you have recently. If you are confused about the future, I will share the strategy layout with the small circle! You are welcome to join us to grasp the next hot spot and maximize the return on investment together!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!