Explore why Ethereum’s price is struggling, including the impact of Metalpha’s ETH sale, lackluster on-chain metrics, competition, L2 issues, and macroeconomic factors.

While most of the cryptocurrency market is losing money, the price of Ethereum has been struggling. Despite the launch of a spot Ethereum ETF in June, the price of ETH fell 40% between May and August. In addition to this challenge, Metalpha’s $90 million sale of ETH further pressured the price. This continued weakness suggests that there may be deeper underlying problems with Ethereum. Should investors be concerned about the future of the Ethereum network and its underlying asset?

Reasons for Ethereum Price Lagging

Ethereum is the most extensive blockchain network in terms of total locked value (TVL) and ecosystem protocols — yet, despite its huge success, its price has struggled to rise. Ethereum’s market cap has shrunk to $281 billion, while USD Tether (USDT) has swelled to $118 billion. It’s only a matter of time before USDT replaces ETH as the second-largest crypto asset. But why is Ethereum lagging behind? Here are some reasons:

- On-chain indicators are sluggish

- Layer 2 solutions are economically extractive and hinder Ethereum’s growth.

- Competition from other blockchains.

- Spot Ethereum ETF funds outflow.

- Macroeconomic factors

- On-chain indicators are sluggish

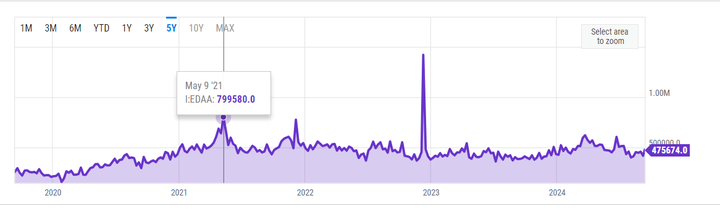

ETH price has been losing attention as on-chain metrics show a poor outlook for the network and token prices. According to YCharts, the current 30-day average ETH daily active addresses is 430,250, down 7% from 90 days ago. In comparison, at the peak of the 2021 bull run, Ethereum reached 799,580 DAA in May 2021.

These data suggest that fewer users are interacting with the Ethereum blockchain, resulting in a decrease in ETH transaction volume.

Layer 2 Solutions on Ethereum

Unfortunately, most Ethereum layer 2 (L2) solutions perform well but at the expense of the parent chain. Justin Bons, founder and CIO of Cyber Capital, said that L2 is a centralized network funded by venture capital that siphons off fees from Ethereum L1.

In addition, Ethereum co-founder Vitalik Buterin increased the pressure on L2 to be further decentralized and said that he would no longer mention L2 as not decentralized enough.

Competition from other blockchains

Among other issues, the race for the top spot as the leading DeFi chain is fierce, with Solana gaining momentum. Based on volume alone, Solana and Near Blockchain beat Ethereum on certain metrics. For example, data from The Block shows that Solana DAAs have surged to 5.9 million, while Near Blockchain has 2.9 million DAAs. In comparison, Ethereum has only 475,000 DAAs.

Ethereum ETF Spot Outflow

U.S. spot Ethereum trading needs to proceed as expected. Data from Soso Value showed that the ETF had a net inflow of $20.14 million on September 12, with a total cumulative net inflow of negative $582.74 million.

In contrast, the US spot Bitcoin ETF has performed more successfully since its approval on January 10, which has been reflected in the Bitcoin price. Similarly, the replication of net negative flows can be seen in the downward trajectory of Ethereum prices.

Macroeconomic factors

Broader macroeconomic factors, such as the Federal Reserve's potential rate cut on September 18 and concerns about a tech bubble sparked by the recent plunge in NVIDIA's stock price, could have a negative impact on investor sentiment and, in turn, Ethereum prices. These factors determine a favorable environment for crypto asset prices to thrive.

Can Ethereum Price Catch Up?

If development and internal issues remain unresolved, Ethereum’s price could shrink to $1,500. US spot Bitcoin ETFs have been more successful than Ethereum ETFs, and Solana and Near beat Ethereum in terms of daily active users. Together, these issues paint a grim picture for Ethereum’s price, affecting its adoption and growth in a competitive young market. Ethereum must resolve the development and internal issues of its L2 chain before things can change. Additionally, a full-blown bull run could change Ethereum’s fortunes, leading to higher prices.