Cryptocurrency market activity increased slightly this week, with the global market capitalization up more than 3% in 24 hours. The following coins performed well in a bearish week for the cryptocurrency market. Most Altcoin are falling during the consolidation phase of the leading cryptocurrencies. However, the coins with the biggest gains are facing buying pressure. Let’s analyze why.

This growing optimism has prompted whales to accumulate assets such as Telegram-pegged Toncoin (TON), leading Altcoin Ethereum (ETH), and AI-driven The League of Superintelligence (FET).

TON

This week, crypto giants are paying attention to Toncoin (TON) as its price continues to rise. Earlier this week, Telegram CEO Pavel Durov broke his silence on his arrest in France. At press time, the Altcoin is trading at $5.76, with many holders taking profits after a massive price surge of more than 24% in the past seven days.

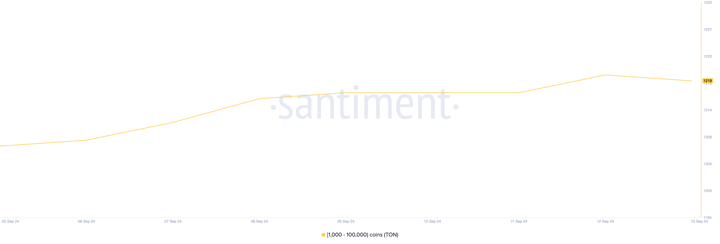

This has led to an increase in the number of whales trading the Altcoin. According to Santiment, the number of whale addresses holding between 1,000 and 100,000 TON currently stands at 1,219, the highest level in 30 days.

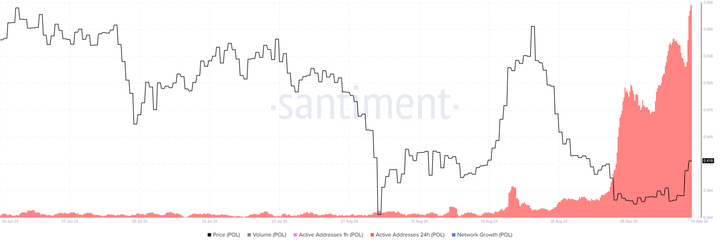

POL

Polygon’s native token, POL, surged nearly 15% today after Binance announced plans to integrate it into several key products, including earning, buying crypto, conversions, margin, and futures. At press time, POL is trading at $0.418 and its market cap remains at $2.98 billion. Further adding to the bullish momentum, 24-hour active addresses suddenly surged to 1,400, according to data from Santiment. This suggests a surge in user engagement and activity on the network following the recent migration from MATIC to POL.

ETH

This week, Ethereum’s net flows surged 109%. Hedge holders are whale addresses that hold more than 0.1% of the asset’s circulating supply. Their net flows measure the difference between the tokens they bought and sold in a specific period. This accumulation occurred despite Ethereum facing resistance at the $2,386 price level, indicating that whales remain indifferent to price challenges.

As the sentiment turns from negative to positive, whales may anticipate a price increase. If ETH succeeds in breaking out of the $2,386 resistance, it is likely to continue the uptrend and reach $2,783.

FET

The value of the artificial intelligence asset, the Alliance for Superintelligence (FET), has increased by 25% this week as market participants are paying more attention to FET as OpenAI reportedly seeks to raise $6.5 billion in new equity funding.

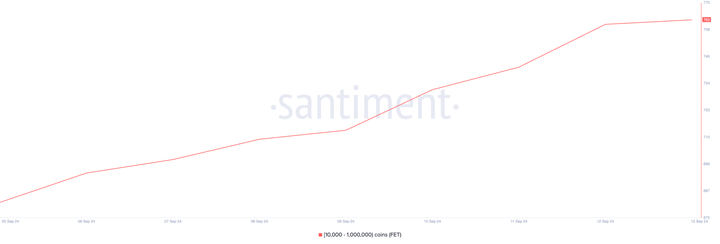

Santiment data shows that the number of cryptocurrency whale addresses holding between 10,000 and 1,000,000 FET has increased by 11%. As of press time, this group now includes 763 addresses, a new all-time high.

The technical chart shows that FET price has been declining in a descending channel. It has broken out of the channel and retested the downtrend line. After the retest, the price has risen by 30% and stretched to the 200-day EMA. Assuming the price is above the 200-day EMA, FET buyers may show interest in the breakout and retest. FET price has formed an inverted head and shoulders pattern at the bottom of the daily chart. At the time of writing, the price has touched the neckline. Exceeding this level may trigger strong buying pressure. On the other hand, the bearish momentum near the 200-day EMA will trigger bearish momentum. Most investors may prefer to take profits if the price falls below the psychological barrier of $1, which is also a demand zone. Profit-taking may lead to selling pressure.

AAVE

Aave has recently gained attention for its potential as a major decentralized finance (DeFi) protocol. It is recognized as the world's largest liquidity protocol, providing a range of services including lending, exchanging, and staking. Currently priced at $141.17, Aave is gradually recovering from a period of stagnation. With its strong fundamentals and huge market accessibility (available on major platforms such as Binance and Coinbase), Aave is seen as having strong growth potential. The token is showing upward momentum and is close to setting a new high in 2024. Historically, whenever $AAVE touches the $50 level, it represents a strong buying opportunity.

Currently, the token is approaching the $150 resistance level and could break through $170 or even $200. In the upcoming bull run, AAVE is expected to reach between $400 and $700. While this may not represent a 10x return in the short term, it is considered a strong candidate for significant gains in the next decade. Overall, Aave's strong market position and bright prospects make it an attractive option for those looking to invest in the DeFi space.