Market Analysis

All asset classes rose across the board, with U.S. stocks, cryptocurrencies and gold rebounding, with less than six days left before the Federal Reserve's historic policy shift.

Much of the market's gains are attributed to investor expectations that the Federal Reserve may announce a 50 basis point rate cut after the Federal Open Market Committee meeting next Wednesday. Bill Dudley, former president of the New York Fed, said there is a "strong case" for further rate cuts.

The CME FedWatch tool currently shows a 50% chance of a 50 basis point rate cut, up from 28% on Thursday.

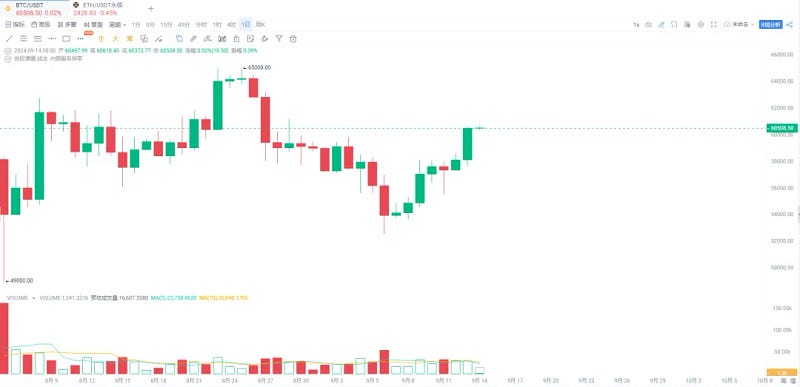

In the market, BTC surged by more than $1,500 in the short term, jumping from $58,000 to $59,700, and broke through the $60,000 mark after the U.S. stock market closed. As of press time, BTC is trading at $60,280, up 4.34% in 24 hours.

Similar to the broader market, Altcoin performed strongly this week, with more than 90% of the top 200 tokens rising. Nervous Network (CKB) led the gains, up 45.3%.

The current overall market value of cryptocurrencies is $2.1 trillion, with Bitcoin accounting for 56.4%.

Volatility is expected to increase further

Bitcoin finally ended the week in an uptrend.

This price action is consistent with the recent pattern of increased volatility on the low timeframe, moving within a six-month descending channel. If this trend continues, we could easily see BTC testing the $62,000 to $64,000 range next week.

Ethereum (ETH) continues to underperform, as highlighted on the ETH/BTC chart. The daily chart shows that the bearish momentum in the ETH/BTC pair shows no signs of slowing down, suggesting that it may struggle to keep up with Bitcoin in the short term.

Will BTC rise or fall if the interest rate is cut by 25 or 50 in September?

Let me first state the conclusion. If we follow the current trend, Nick did not release the reason for the 50 basis point rate cut before the interest rate meeting, but announced a 50 basis point rate cut. Then it is highly likely that the risk market will fall more in the 40 minutes from the announcement of the rate cut to Powell's speech (30 minutes of waiting + 10 minutes of opening remarks).

If the Fed cuts interest rates by 25 basis points in September, the market transition will be very stable, and the probability of a small increase will be relatively high. As for the reason, we have discussed before that if a 25 basis point interest rate cut is in line with the Fed's most basic logic, the economy is not in recession, unemployment is not out of control, and inflation is under control, then 25 basis points is very appropriate as the first cut, which is also the current market expectation. Therefore, 25 is the most stable option at present. Choosing 25 will not cause sharp fluctuations. The market already has enough expectations, and the risk market will give a positive response.

Has the bull market started? How can we escape the peak?

Started 163 days after the 2016 halving

The breakthrough started 163 days after the 2020 halving

It has been 145 days since the halving, and there are still 18 days to go until the 163rd day. Generally speaking, the peak of a bull market is often 500 days after the Bitcoin halving.

This was the case with the last two bull markets. Will this one be the same?

At least let it be one of the references. The 500 days after this round of Bitcoin halving should be September to October of 25 years.

If you have been chasing ups and downs, often being trapped, and have no latest news in the crypto and no direction, please scan the QR code below. I will try my best to answer any questions you have recently. If you are confused about the future, I will share the strategy layout with the small circle! You are welcome to join us to grasp the next hot spot and maximize the return on investment together!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!