Author: Lucas Outumuro, Head of Research at IntoTheBlock; Translation: Jinse Finance xiaozou

In this article, we will introduce the landscape of the Bitcoin staking space, focusing on the core players and the architecture used to provide returns to Bitcoin holders, some of the limitations of the current state of Bitcoin staking, and some of the long-term potential and high returns that Bitcoin staking can provide.

Bitcoin staking has arrived

For the first time ever, it is possible to earn native returns on the Bitcoin network. While it is not “staking” as it is commonly described in proof-of-stake networks, multiple projects have recently launched that offer BTC returns.

The concept of restaking pioneered by EigenLayer is expanding to the Bitcoin blockchain and tokens pegged to BTC. In this regard, Babylon has become a major platform, building an architecture that allows applications to launch and utilize Bitcoin's cryptoeconomic security. In the Ethereum ecosystem, Symbiotic is another restaking protocol that accepts tokens such as WBTC as collateral and will eventually support applications that want to use these assets as collateral.

Now let’s take a closer look at the major players in the Bitcoin staking space.

The pledge amount exceeds US$500 million

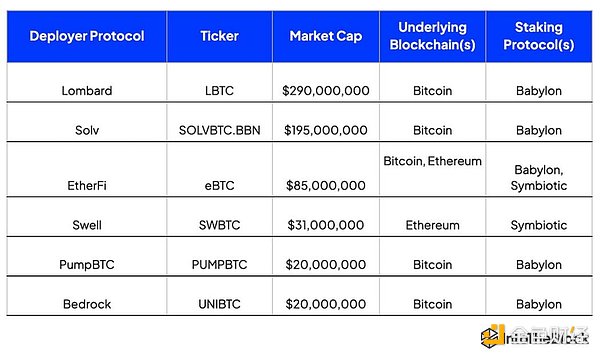

In just a few weeks after the launch of Bitcoin restaking, more than $500 million in assets were deployed into the Bitcoin staking protocol.

● Lombard is a leader in Bitcoin staking, with nearly $300 million of their LBTC product staked on Babylon.

● Babylon recently raised $70 million led by Paradigm, which greatly enhances the credibility that this technology will eventually build something similar to EigenLayer, but only for applications seeking to leverage Bitcoin’s security rather than Ethereum’s.

● On the other hand, Symbiotic focuses on using existing assets on Ethereum, such as WBTC and tBTC, and ultimately entrusts these assets to operators as collateral, who may lose a portion of their assets if they behave maliciously.

● EigenLayer also announced that it will expand to support more assets, indicating that BTC tokens will soon be included in their re-staking services.

How does Bitcoin staking work?

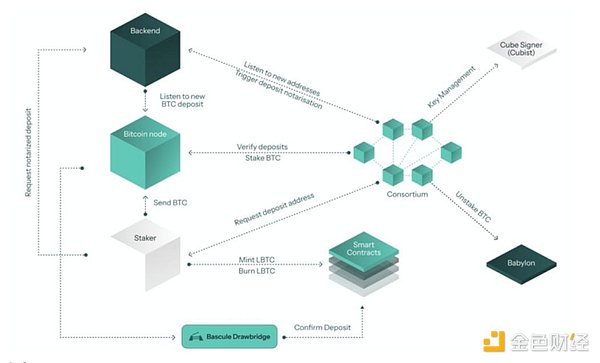

It combines Bitcoin’s security layer with Ethereum’s DeFi ecosystem.

● The way to mint LBTC is to send BTC to a consortium address stored in the Babylon protocol, and then mint LBTC on Ethereum.

● Currently, funds are simply held in the Babylon contract, no applications have been verified, and withdrawals are not enabled.

● Depositors are rewarded with points from Babylon and Lombard for helping to launch their supply side.

● Ultimately, the BTC held by these contracts will enable an ecosystem of applications to leverage these assets to secure their own applications or chains running on Bitcoin.

The data is up ?

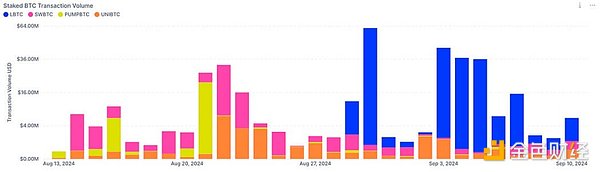

With the rise of the Pendle market, trading volume of Bitcoin-collateralized tokens has been climbing.

● The Pendle protocol allows traders to buy or sell future earnings on tokens such as LBTC and eBTC.

● Currently, the Pendle market’s expected yield on these Bitcoin-collateralized tokens is 7%-9%.

● In less than two weeks, the eBTC and LBTC markets on Pendle have attracted over $40 million in liquidity.

● These tokens are likely to continue to grow as Bitcoin holders rarely receive such gains.

Bitcoin staking is just the beginning

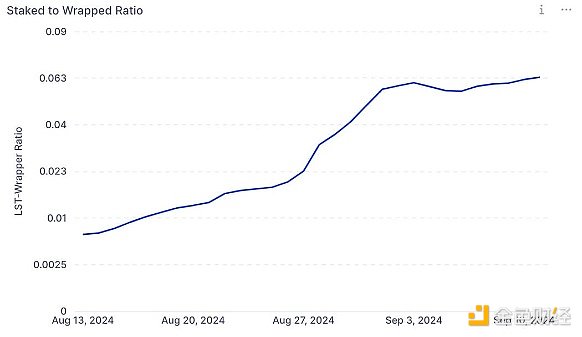

The total market value of different versions of staked BTC is less than 1% of the market value of wrapped tokens.

● WBTC’s market cap has dropped by nearly 2,000 BTC (about $120 million) since news of Tron’s connection to potential token acquirers surfaced.

● Meanwhile, Coinbase recently launched their wrapped token cbBTC, a strong contender to WBTC for dominance.

● Despite no revenue, cbBTC’s market cap surpassed $100 million in 24 hours

● In the coming weeks we may see people pledge Bitcoin collateral tokens to borrow wrapped tokens like WBTC and cbBTC to get leveraged exposure to Babylon and Symbiotic.

This drama has played out before with the Ethereum LRT protocol and should greatly accelerate the development of the ecosystem in the foreseeable future. While all of this infrastructure is still in its infancy and the risks are high, enthusiasm for Bitcoin staking is growing and is likely to continue.