Alex Thorn, chief research analyst at cryptocurrency management firm Galaxy, believes that altcoins will benefit more than Bitcoin from a Donald Trump election victory due to potential changes in the regulatory environment. Thorn Chia this view in a post on X in response to comments about the weakness in the ETH/ BTC ratio.

The ETH/ BTC ratio depicts the value of ETH relative to BTC and fell to 0.039 on September 15, its lowest level since April 2021.

With that drop, the ETH/ BTC ratio has dropped 53% and looks set to continue falling, but some believe a Trump victory could boost ETH. Thorn seems to have a similar view. He said :

“In my opinion, a Trump victory is better for altcoins than BTC on a relative basis, mainly because the regulatory easing helps altcoins more than BTC.”

His views are in line with the general consensus that a Trump victory would boost cryptocurrency prices as it eases regulatory pressure on the crypto industry. While his focus on altcoins differs from many analysts, it may be because he believes Bitcoin has received significant regulatory clarity as an asset.

Compared to BTC, the status of most altcoins remains uncertain, as the U.S. Securities and Exchange Commission (SEC) still classifies most of them as securities. Trump’s victory would see him fulfill his promise to replace SEC Chairman Gary Gensler, which could provide more regulatory clarity for altcoins, ultimately boosting their value.

Thorn’s comments on the potential impact of a Trump victory on altcoins are not surprising, given their struggles over the past few months. Large Capital altcoins, including Solana (SOL), Ethereum (ETH), Ripple (XRP), Dogecoin (Doge), and Cardano (ADA), are set to underperform Bitcoin by 2024.

These difficulties are due to regulatory pressure, reduced activity on some blockchain networks, and prevailing bearish market sentiment. However, analysts believe things could have been worse without the price rally.

Will Clemente, founder of Reflexity Research, believes that altcoins could attract less money from institutional investors without the bull run.

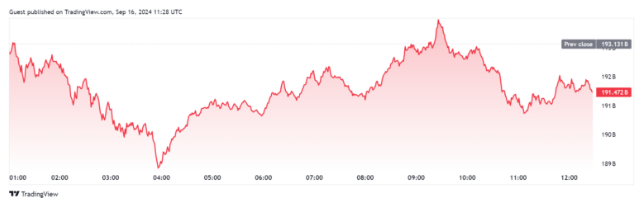

Altcoin market Capital excluding top 10 assets | Source: Tradingview

Analyst Benjamin Cowen also Chia a similar view, saying on his YouTube channel that altcoins will fall further this year and capitulate to Bitcoin due to low net global liquidation .

“What I said could be the end result: altcoin/Bitcoin pairs capitulate before the end of the year. So I think there is a case to be made that altcoin/Bitcoin pairs will simply reject at 0.4, they may still rally a bit above that, but will eventually reject and return to the lows of the range before the end of the year.”

Source: Tradingview

However, MN Trading CIO Michael van de Poppe believes that the Dip has been reached for altcoins and expects the assets to trend higher. Bitfinex analysts also said that altcoins remain relatively strong against BTC and show resilience, which could make them attractive to investors.

Most institutional analysts are focused on the potential impact of Bitcoin with varying predictions on how high the flagship asset could reach depending on who wins the US Presidential election.

Standard Chartered has an optimistic forecast for Bitcoin, as the bank predicts Bitcoin will hit a new record high by the end of 2024, regardless of who wins the 2024 election.

Analysts at the bank predict that Bitcoin could hit $125,000 if Trump wins or $75,000 if Kamala Harris wins. They attribute the price difference to the loosening of regulations under Trump. However, the bank expects regulatory progress for the crypto industry regardless of who wins, but it may be slower under Harris.

Analysts at brokerage firm Bernstein are less optimistic about the impact of a Trump victory, saying BTC could hit $90,000 by 2024 if the former president wins. As for Harris, analysts are pessimistic, noting that BTC risks falling below $50,000 and even to $30,000 if she wins.

However, many believe the potential impact of a Trump victory on cryptocurrency prices may be overstated, noting the former president has a record of breaking his political promises. Polymarket data shows Harris has a 50% chance of winning the election, 1% higher than Trump.

You can XEM BTC price and ETH price here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Dinh Dinh

According to Cryptopolitan