In recent days, the Binance Coin (BNB) market has been in a state of sideways movement without any decisive direction, with both buyers and sellers lacking sufficient momentum.

However, the uptrend in the key technical indicators suggests that a bullish divergence is forming. Some in the BNB market have begun accumulating altcoins in anticipation of a bullish breakout.

'Smart Money', On-Chain Traces of BNB Accumulation on the Downturn

From September 6 to 12 , the price of BNB was in an upward trend, attempting to break through the long-term support line formed at the $560 price level. However, this attempt failed, and the coin’s price is now moving sideways without a strong uptrend or downtrend.

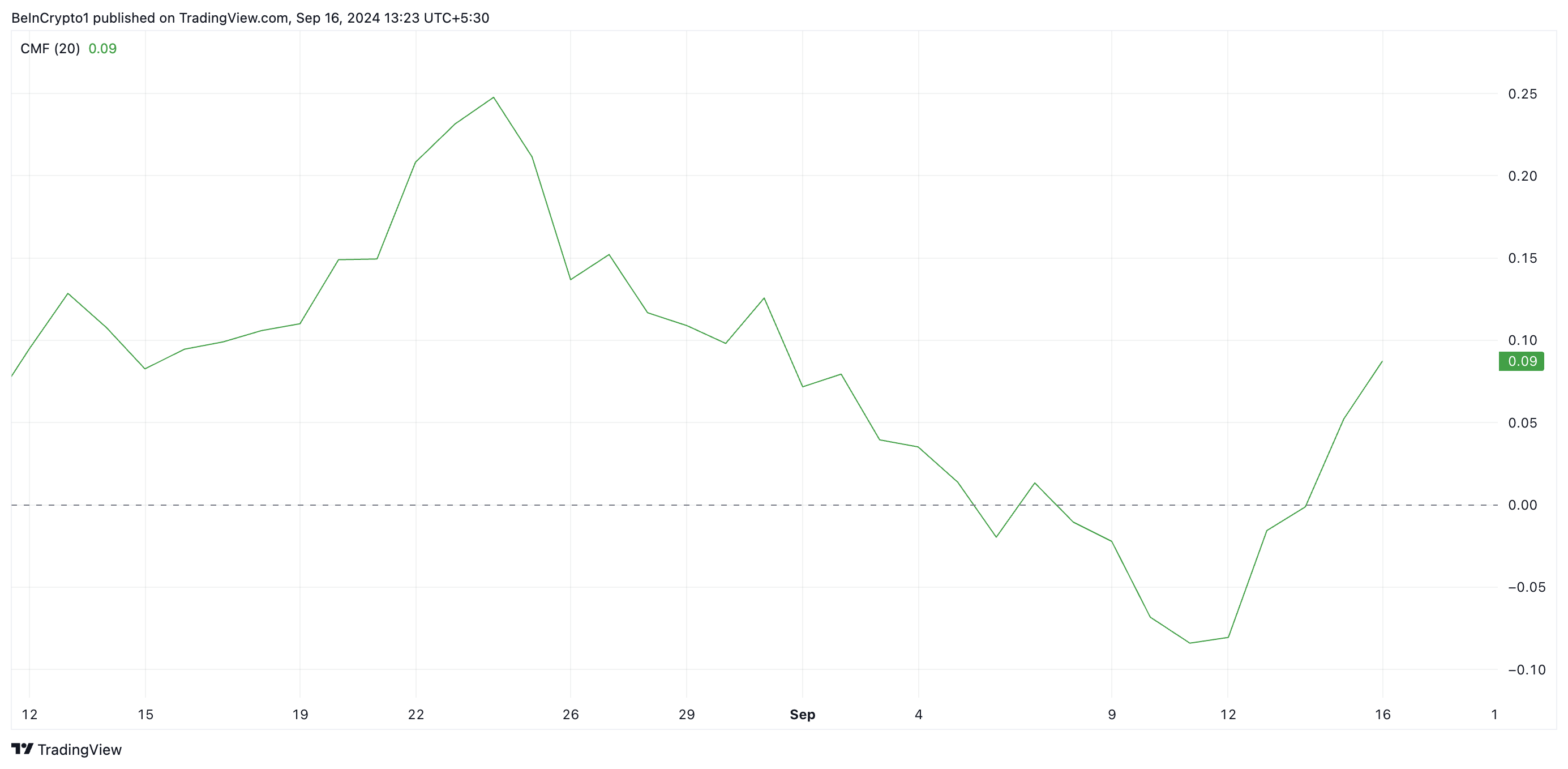

Interestingly, while BNB is consolidating within the range, Chaikin Money Flow (CMF), which measures the inflows and outflows of funds, is rising, forming a bullish divergence.

This divergence is formed when the CMF is rising while the price of the asset is moving sideways. This suggests that buying pressure on the asset is increasing, although this is not yet clearly evident in the price.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

A possible explanation is that the asset is being bought by “smart money” who expect a bullish breakout after sufficient consolidation.

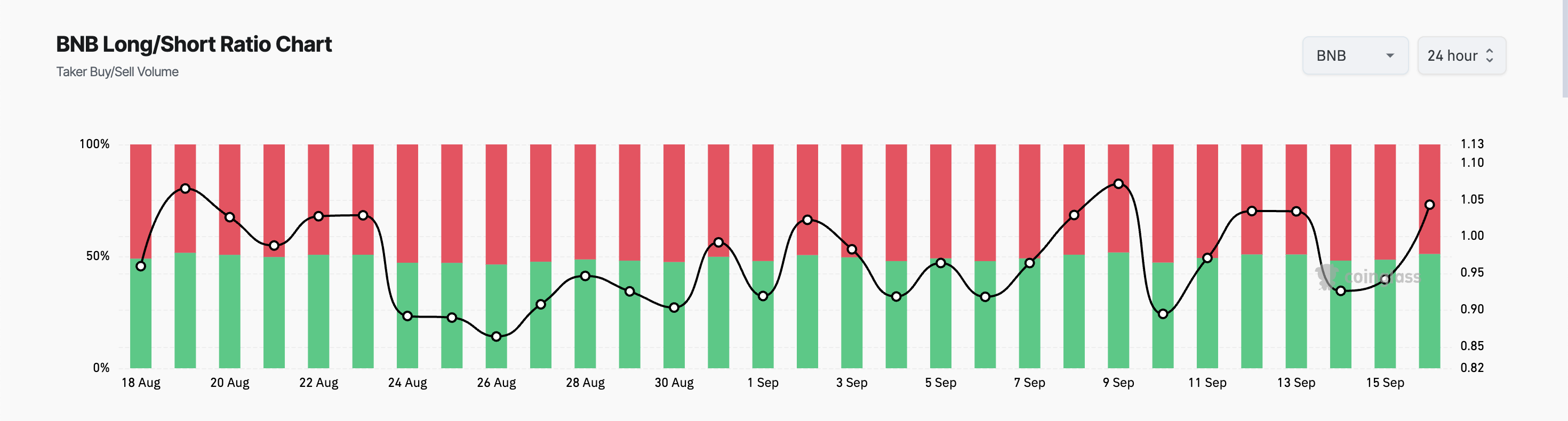

BNB’s positive long/short ratio confirms its bullish sentiment on altcoins. At the time of writing, this ratio stands at 1.04.

This suggests that more traders are taking long positions and expecting prices to rise.

BNB Price Prediction: Why Breaking $598 Is Important

If these longs are successful and BNB breaks out of the sideways pattern and enters an uptrend, the price could move above $560 and target the major resistance level of $598 that has been in place since July. BNB has tested this resistance three times since then, but has failed to break through each time.

If this retest is successful, the coin could rally to its three-month high of $645.90.

Read more: 9 Best Cryptocurrency Desktop Wallets in 2024

However, if the BNB price breaks out of the consolidation into a downtrend , the price will plunge towards the support level of $468.90, invalidating the bullish outlook above.