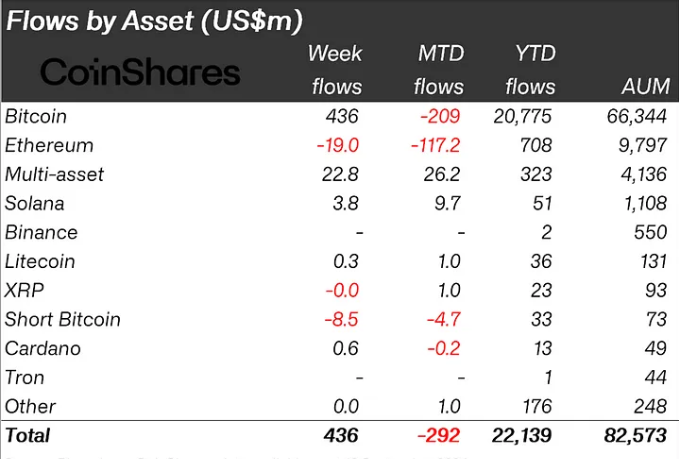

Last week, digital asset investment products recorded inflows of $43.6 million, representing a paradigm shift after consecutive outflows of $1.2 billion.

Cryptocurrency markets are anticipating a pivotal moment this week: On Wednesday, the Federal Open Market Committee (FOMC) will decide how much to cut interest rates in September.

Cryptocurrency investment inflow reaches $43.6 million

Bitcoin (BTC) led the crypto inflows last week, attracting up to $43.6 million. This is a reversal of the negative market sentiment, considering that it had net outflows in the first week of September. Ethereum (ETH), on the other hand, continued to experience negative outflows, with $19 million outflows following last week’s $98 million outflows.

The CoinShares report analyzed that this positive inflow of Bitcoin is due to the expectation of a 0.50% interest rate cut in the United States. Looking at the inflow amount by region, this hypothesis is very convincing. The country with the largest net inflow last week was the United States, recording $41.6 million.

In particular, comments from Bill Dudley have stirred optimism. The former New York Fed president said Thursday that there is a strong case for a 50bp rate cut.

“I think there is a strong case for a 50 basis point cut, I don’t know if they will do it,” Dudley said at the Bretton Woods Commission’s annual Financial Futures Forum in Singapore.

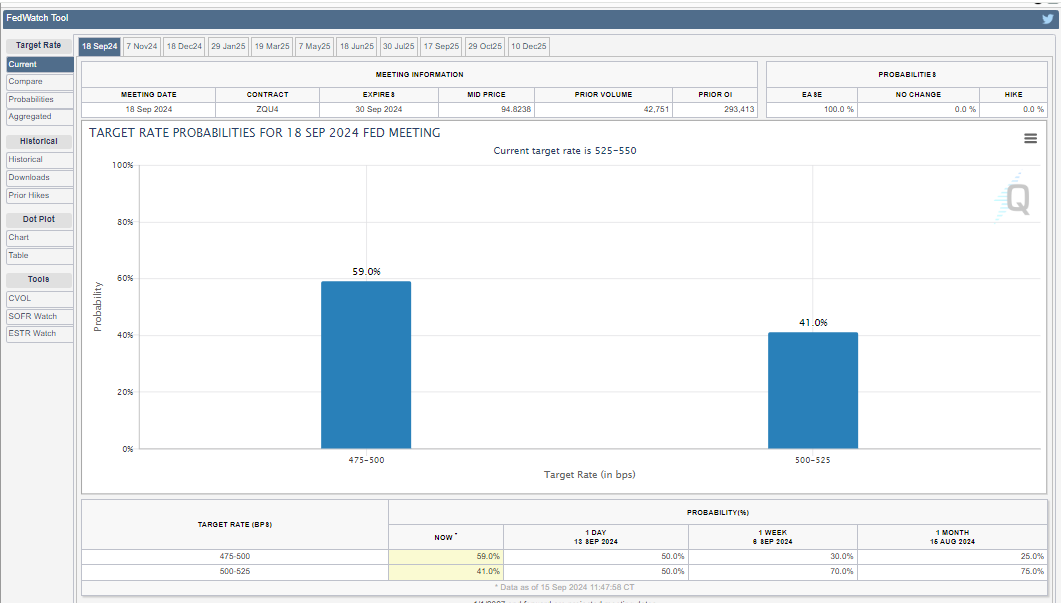

The FOMC’s decision to cut rates on Wednesday is the main event to watch for in the crypto markets this week . Traders and investors are bracing for the impact on their portfolios depending on which rate cut policymakers choose. Data from the CME FedWatch tool shows a 59% chance of a 50 bps cut, while the odds of a 25 bps cut are 41%.

Read more: How to Protect Yourself Against Inflation Using Cryptocurrencies

American investment bank JPMorgan also supports a 50bp rate cut, but whether the cut is 50 or 25, it will continue to be an uncertain time for Bitcoin. A 25bps cut is already priced in, and analysts warn that a larger 50bp cut could have a negative impact on Bitcoin .

Regardless of the outcome, markets are awaiting Wednesday's FOMC decision, which could be the first rate cut since early 2020.

ETF rotation is increasing

Meanwhile, CoinShares reports that volumes remained flat last week at $8 billion. However, Bloomberg ETF analyst Eric Balchunas points out that data shows $11.4 billion in inflows into value ETFs over the past 30 days, a significant shift that reflects capital movement into this financial instrument.

“There has been $11.4 billion in inflows into value ETFs over the past 30 days, which is huge. A lot of value ETFs have attracted cash, but a lot of that is BlackRock’s model portfolio rotating into EFV,” Balchunas added .

The ETF expert says several value ETFs have benefited from recent cash inflows, much of which is attributed to BlackRock’s model portfolios . Balchunas highlights the increased rotation into value ETFs, noting that there were $5.6 billion inflows in the first two weeks of September.

He compares this influx to “the great delusion of late 2020,” during which the market experienced an unexpected trend shift, when growth stocks, especially in the technology sector, outperformed value stocks and surprised many investors.

It is unclear whether this value rotation will be reinforced or whether it will face obstacles, particularly given the dominance of technology-focused ETFs. Balchunas questions the sustainability of this shift, given the continued appeal of technology-focused investments.

The current rotation, which has prompted a reevaluation of traditional strategies and debates about their sustainability as we look back on the “big mistake,” raises similar questions. Whether this rotation will continue or be challenged by competing investment themes remains to be seen, but it is an intriguing development that investors should watch closely.