Currently, Ripple [XRP] is trading at $0.5814, down 0.02% and continuing its steady recovery over the past few weeks. In the past seven days alone, XRP has gained 7.74%, sparking optimism among many investors.

The recovery comes during a period of overall market volatility, with XRP’s performance relatively lackluster compared to some other major cryptocurrencies.

Optimistic about XRP

The bullish pattern that formed on the XRP chart is the “mother of all bullish flags” because of its long duration. This bullish price action pattern is very rare and unique in the cryptocurrency space as cryptocurrencies have not been around long enough to form similar patterns.

Once whales and investors notice this pattern, there is a high chance that they will rush to buy XRP, causing a massive increase in price.

XRP On-Chain and Market Data: Evaluating Bullish Signs

To determine if XRP is truly ready for a bull run, consider looking at its on-chain metrics. Despite the bullish technical outlook, on-chain data presents a more nuanced picture. The number of active XRP addresses has dropped significantly in recent months. The number has dropped from a peak of 382,000 in April to around 196,000 currently. A decrease in active addresses typically indicates a decline in user engagement and less transaction activity on the network.

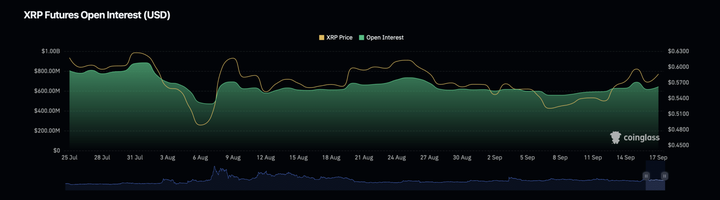

This decline could signal caution in the near term, as lower active addresses could limit upward momentum and suggest that the rally could be short-lived without an influx of new participants. Further data from Coinglass shows that XRP's open interest rose by 4.32% and is now valued at $650.26 million. Open interest refers to the total number of open derivative contracts (such as futures and options) that have not yet been settled. An increase in open interest indicates increased trading activity, reflecting growing speculation about the direction of XRP's price. In addition, the asset's trading volume rose slightly by 0.15% to $1.32 billion.

A simultaneous increase in open interest and volume could indicate a strengthening trend, with traders taking positions in anticipation of potential price movements. However, it also brings the possibility of increased volatility, as higher open interest could cause the market to react violently to news or price swings. Meanwhile, XRP is showing bullish momentum and has been consolidating in a tight range between $0.57 and $0.595 for the past four sessions. Moreover, it is trading above its 200 exponential moving average (EMA), suggesting an uptrend.

Based on historical price momentum, if XRP price closes above $0.60, there is a high chance that it will surge 20% to $0.75 while breaking through $0.65. This bullish outlook will only hold if XRP closes above $0.65, otherwise, it may stagnate at the $0.65 level.

In simple terms

XRP shows signs of a possible breakout, and the technical outlook is positive. It is currently consolidating in a narrow range between $0.57 and $0.595. It is expected to rise sharply, but it is worth noting that on-chain data shows that active addresses are declining, which raises questions about the strength of the bullish trend. Technical indicators and other indicators support the bullish outlook in the short term, but with the decline in active addresses, it has some impact on its bullish strength. However, if the XRP price closes above $0.60, it is very likely to surge further.