Bitcoin’s dominance hit a five-year high, sparking speculation of a potential surge ahead.

Bitcoin [BTC] has made a major breakout, closing at a 57.68% dominance level for the first time since April 2019. Historically, when Bitcoin’s dominance reaches such levels, it kicks off a long-term uptrend that pushes dominance as high as 71%. With the recent breakout, Bitcoin is currently trading at $60,144 at press time, up 3.8% in the past 24 hours, with many speculating whether it is about to see another massive rally.

RSI and Bollinger Bands show potential upside

Bitcoin’s RSI is currently at 51, reflecting a neutral market with no signs of extreme buying or selling pressure. Meanwhile, the Bollinger Bands show that BTC is approaching its upper boundary, which typically signals a potential upside price swing.

If BTC can break through the $62,000 threshold on strong volume, it could signal further price gains, helping to maintain or expand its market dominance.

Foreign exchange reserves point to long-term holders

Bitcoin exchange reserves are at 2.585 million BTC, up only slightly by 0.04% over the past 24 hours. While this indicates short-term selling pressure, the overall trend shows a decline in reserves this week.

This suggests that investors may be moving Bitcoin from exchanges to cold storage, a strong sign of long-term confidence.

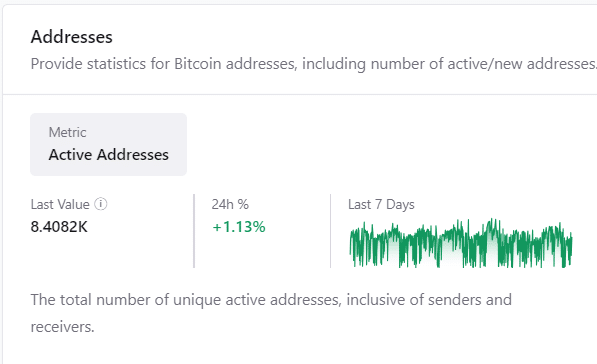

Active addresses and transactions indicate strong network activity

The Bitcoin network continues to show strong activity, with over 8.4 million active addresses, up 1.13% from the previous day. The number of transactions also rose to 515,260 in the past 24 hours, up 0.83%, according to CryptoQuant.

The steady growth in on-chain activity supports Bitcoin’s dominance, highlighting strong network fundamentals.

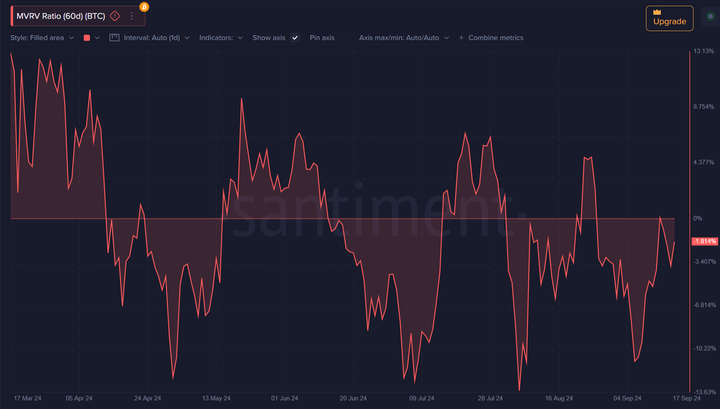

MVRV ratio suggests buying opportunities

The 60-day MVRV ratio is currently -1.81%, indicating that, on average, investors are losing less by holding Bitcoin.

Historically, negative MVRV values have indicated undervaluation, which suggests that Bitcoin could be about to undergo an upside correction, which is a potential buying opportunity.

Can Bitcoin lead the market into another bull run?

With a dominance of over 57.68%, strong on-chain fundamentals and technical indicators aligned, Bitcoin could be gearing up for another major upswing. However, key levels such as $62,000 and sustained network activity will be crucial in confirming whether Bitcoin can expand its dominance and reignite a broader bull run.

In simple terms

Currently, Bitcoin's dominance has soared to over 57.68%, with indicators indicating potential bullish volatility. On-chain activity has increased, while the MVRV ratio indicates that investors may have buying opportunities. Technical indicators and other indicators support the bullish outlook in the short term. However, it is worth noting that the upcoming interest rate cut will make the market more intense from a historical perspective, but as market liquidity increases, this will provide support for further market gains.