Driven by bullish indicators and liquidity dynamics, DOT shows potential to rise.

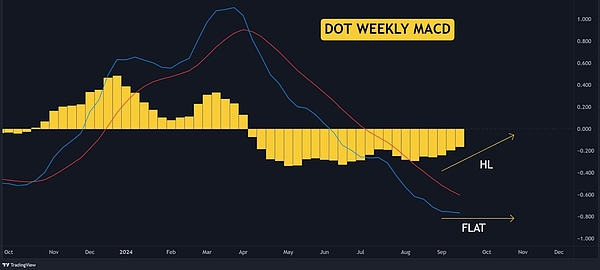

- As Polkadot’s moving averages flatten out, the MACD shows higher lows.

- The long percentage increases amid favorable liquidity changes.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

Polkadot [DOT] appears to be gaining momentum in the Web3 space, with its recent upgrades attracting a lot of attention from developers.

Like other cryptocurrencies, DOT has seen a decline in recent months. However, there are signs that a bottom may be forming, sparking optimism for the last quarter of 2024.

The weekly MACD shows higher lows and a flattening moving average, suggesting that DOT could be preparing for a bull run as the market stabilizes and recovers.

Polkadot’s price action further supports this outlook. DOT/USDT has shown resilience, failing to break below the October 2023 lows, which preceded the bull run peak in March.

Since then, prices have been trending down. The August 5 market crash low has not yet been breached, suggesting accumulation.

A potential Double Botto at $3.56 could indicate that a reversal is imminent. When analyzing the Chaikin Money Flow (CMF) indicator and the price of DOT, a divergence emerges: CMF is rising, while the price of DOT is falling.

This divergence hints at accumulation and suggests that buying pressure could soon push prices higher. DOT may need to test the $3.56 level before moving decisively upwards.

DOT long positions increase

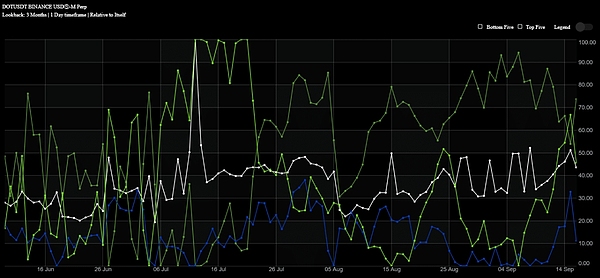

Additionally, the percentage of long positions in Polkadot tokens is surging and currently stands at 73%.

This high ratio indicates growing bullish sentiment among whales, retail investors, and institutions, who may be accumulating DOT in anticipation of higher prices.

The difference between whales and retail investors, currently at 46%, also shows a bullish trend, with only a slight drop today, which reinforces the positive outlook for DOT.

Good liquidity dynamics

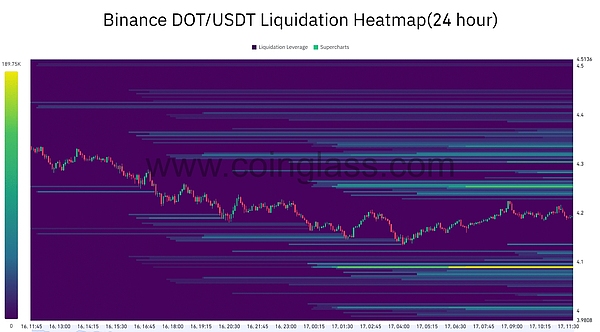

Polkadot’s price action is largely influenced by liquidity zones. DOT tends to move from areas with lower liquidity to areas with higher liquidity.

Currently, the liquidity area that indicates a price increase is closer to DOT’s current price action. This suggests that DOT is more likely to rise, with the next important target being the $4.25 level, which holds the $117,000 liquidation.

In comparison, the less liquid area at $4.08 saw liquidations at $189,700, making an upside move more likely.

DOT has already gained liquidity below its current price, so it is ready to target higher liquidity areas above, potentially pushing its price higher.

Investors should keep a close eye on whether Polkadot is poised to surge higher in the near future.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!