The world’s fourth-largest cryptocurrency, Binance Coin [BNB], successfully retested its breakout level of $530 on September 17 and is currently expected to rise.

While major cryptocurrencies struggled to gain momentum, BNB’s price rose by more than 3.5%. This suggests the potential for an upcoming rally.

Welcome to join the exchange group →→ VX: ZLH1156

BNB Price Momentum

At press time, BNB is trading near $545, with prices up more than 3.5% in the past 24 hours, according to Tradingview.

During the same period, its trading volume fell by 9%, suggesting that traders and investors may be less engaged due to current market sentiment.

BNB Technical Analysis and Key Levels

BNB is showing bullish momentum as its daily trading price is above the 200 exponential moving average (EMA).

The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or a downtrend.

On September 12, BNB broke above a critical resistance level. Its current momentum suggests that BNB has successfully retested this level.

Based on historical price momentum, if this bullish momentum continues, there is a high chance that BNB will rise by 10% to the $600 level in the coming days.

On the other hand, if BNB fails to sustain this bullish sentiment and its price drops below $527, a drop of 8% to $475 levels is possible.

Trader Sentiment and Ideal Risk-Reward Ratio

Currently, traders can expect an ideal risk-reward ratio of 1:3. A perfect buy price should be above $545 with a target of $600 and a stop loss of $525.

However, the trade will only be activated if BNB closes above $545 on a daily basis.

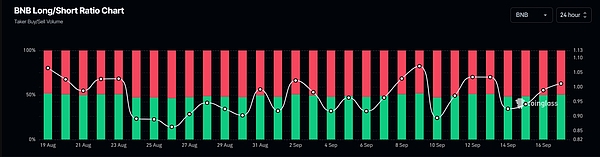

Furthermore, on-chain metrics further support this bullish outlook. Coinglass’s BNB long/short ratio currently stands at 1.031 (values above 1 indicate bullish market sentiment among traders).

Main clearing level

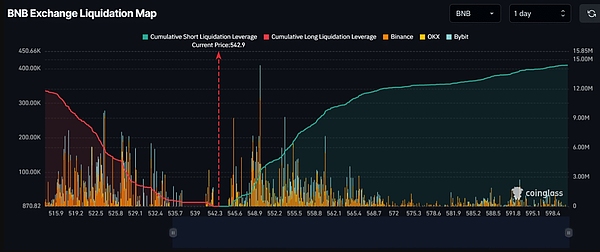

At press time, major liquidation levels are near $524 on the downside and $550 on the upside, as traders are overleveraged at these levels, according to data from Coinglass.

If the market sentiment towards BNB remains bullish and the price rises to the $550 level, short positions worth nearly $3 million will be liquidated.

Conversely, if sentiment changes and BNB drops to $524 levels, around $5.4 million worth of long positions would be liquidated.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156