After four years of waiting, the U.S. Federal Reserve announced its first interest rate cut of 50 basis points at its morning meeting today. The announcement of this decision has injected new vitality into the long-sluggish cryptocurrency market.

According to Binance data, Bitcoin surged from $58,000 to over $62,000, with the premium of the Bitcoin delivery contract at the end of the year being nearly $1,600, fully demonstrating a strong bullish signal!

The public chain sector generally rose:

SEI is currently quoted at $0.3305, up 20.5% in 24 hours

SUI is currently priced at $1.39, up 17.2% in 24 hours

TAIKO is currently priced at $1.89, up 31.9% in 24 hours

ZETA is currently priced at $0.7186, with a 24-hour increase of 38.1%

SAGA is currently priced at $2.46, with a 24-hour increase of 25.1%

MEME Section:

NEIRO hits a new high, with a 24-hour increase of 30.1% and the current price is 0.00098 USD

POPCAT is currently priced at $0.87, a 24-hour increase of 25%.

RATS is currently quoted at $0.000118, a 24-hour increase of 20%

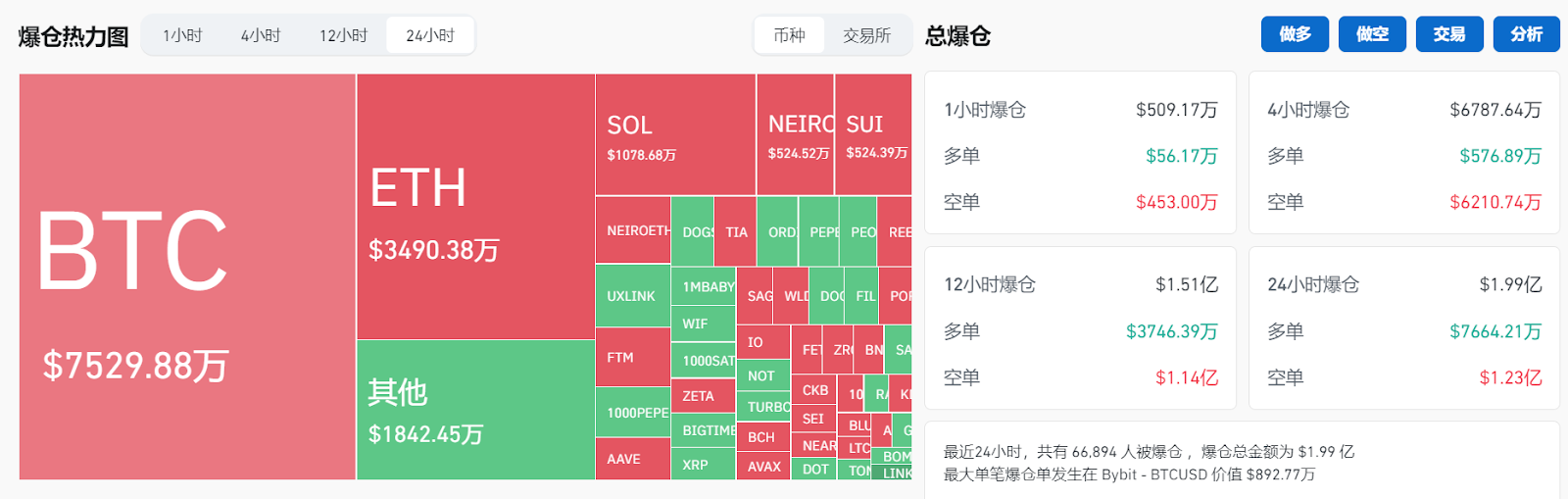

According to coingrass data, in the last 24 hours, a total of 66,865 people were liquidated, with a total liquidation amount of $199 million. The largest single liquidation occurred on Bybit - BTCUSD worth $8.9277 million

According to statistics, the last time the Fed cut interest rates by 50 basis points was in March 2020, when it cut interest rates by 1 percentage point to 0-0.25% in response to the COVID-19 pandemic. Since March 2022, the Fed has launched an almost unprecedented round of aggressive interest rate hikes, and has maintained the policy interest rate at a high level of 5.25%-5.5% since July 2023.

After the interest rate cut in 2020, Bitcoin started to rise from the price range of US$4,000-6,000 after "3.12", and reached the high of the last bull market at US$69,040 in November 2021, with a maximum increase of more than 10 times. During the same period, the price of gold started to rise in the range of US$1,450 to US$1,700 in March, peaking ahead of Bitcoin, and fell after reaching a high of US$2,075 in August 2020. It bottomed out at US$1,616 in November 2022 and started a new round of increases until now.

After this rate cut, will the crypto market repeat history?

Rate cuts are likely to continue in the coming months

The interest rate cut exceeded the market's expectation of 25 basis points and reached 50 basis points. At the press conference, Powell made it clear that the substantial interest rate cut does not mean that the US economy is about to fall into recession, nor does it indicate that the job market is about to collapse. On the contrary, the interest rate cut is a preventive measure aimed at maintaining the stability of the economy and the labor market.

The market generally expects that interest rates will continue to fall in the coming November and December. It is expected that there will be another 70 basis points of interest rate cuts this year. The published dot plot shows that there may be another 50 basis points of interest rate cuts this year.

Related reading: An article to understand the key points of Powell's hawkish press conference (Chinese and English)

The interest rate cut is a long-term positive for the risk asset market. Although the effect may not be immediately apparent in the short term, as time goes by and the interest rate cut policy continues to be implemented, market liquidity will gradually shift from traditional channels such as bonds and banks to emerging markets such as stocks and cryptocurrencies.

In addition, the upcoming U.S. presidential election in early November may also cause short-term volatility in the cryptocurrency market. After the election results are announced, funds that were originally on the sidelines may begin to flow into the cryptocurrency market.

BTC Spot ETF

As of September 18, the Bitcoin spot ETF has accumulated a total net inflow of 300,000 BTC.

When Bitcoin spot exchange-traded funds (ETFs) continue to receive inflows, the price of Bitcoin usually remains stable and shows an upward trend. On the contrary, if there is a large outflow of funds, the price of Bitcoin tends to continue to fall.

Currently, after a period of price fluctuations and declines, market confidence is gradually recovering and investors continue to actively buy Bitcoin.

October usually sees an increase

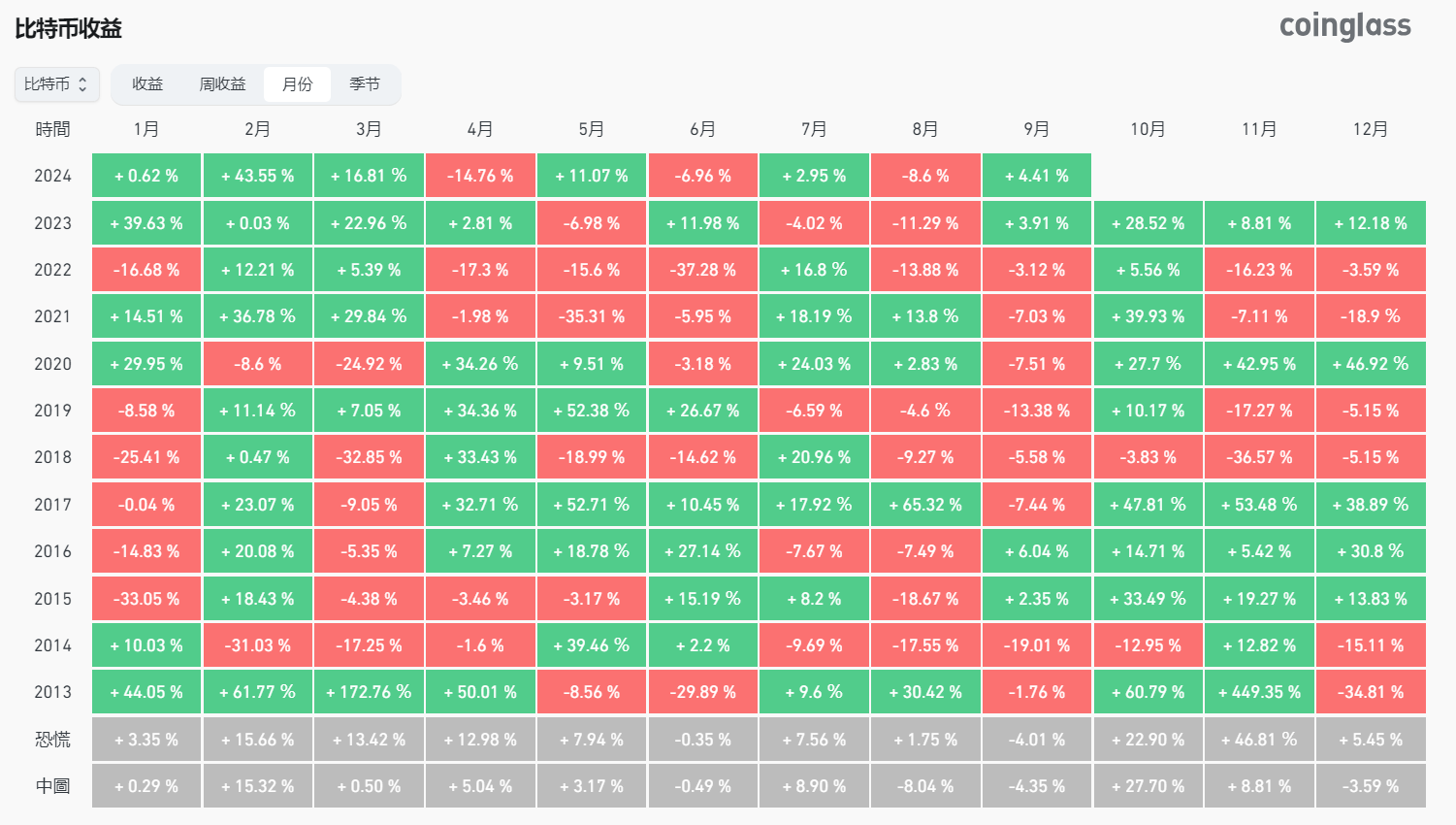

According to Coinglass data, the cryptocurrency market exhibits obvious seasonal fluctuations. For example, summer often witnesses a downturn in market performance, while the end and beginning of the year usually usher in market recovery and growth. Historical data shows that Bitcoin has achieved significant positive returns in the past nine years, except for the decline in October 2018 due to the bear market, from 2015 to 2023.

In the second half of 2023, the price of Bitcoin has been rising steadily since October. This trend, combined with the expectation of approval of the Bitcoin spot exchange-traded fund (ETF), may herald the start of a new bull market.

Market View

HashKey Jeffrey: The darkness before dawn has passed, and the starting point of a new round of tidal market has arrived.

Jeffrey Ding, chief analyst at HashKey Group, said: The Fed's 50 basis point rate cut this time indicates that it has obvious concerns about the current economic environment and needs to start a rate cut cycle with a larger scale. The global economy has recently faced liquidity challenges, and this rate cut decision has released new vitality for the global financial market. Bitcoin, as the "digital gold" of the new era, has performed strongly against this backdrop, breaking through $62,000 in the short term. However, it is not just Bitcoin that benefits this time, and the entire crypto market is expected to usher in a new round of market conditions in the loose monetary policy. It should be noted here that, unlike traditional markets, Bitcoin's performance is more affected by US dollar liquidity rather than changes in the US economic outlook. This means that in the future loose monetary environment, Bitcoin may continue to be the preferred asset for investors to fight inflation and seek safe havens. As the rate cut cycle continues, the crypto market may enter a longer rising channel. Market volatility still exists, but this round of cryptocurrency market conditions may drive more funds and innovation into the field, pushing the entire crypto ecosystem into a new stage of development.

Hyblock Capital: Bitcoin market deep exhaustion may indicate bullish Bitcoin price

Shubh Verma, co-founder and CEO of Hyblock Capital, told CoinDesk earlier: “By analyzing the aggregate spot order book, especially the order book with a spot order book depth of 0%-1% and 1%-5%, we found that low order book liquidity usually coincides with market bottoms. These low order book levels can be an early indicator of price reversals, which usually precede bullish trends.

Glassnode: The Bitcoin market is in a period of stagnation, with both supply and demand showing signs of inactivity

Glassnode, a crypto market data research organization, said in a statement that the Bitcoin market is currently experiencing a period of stagnation, with both supply and demand showing signs of inactivity. In the past two months, the actual market value of Bitcoin has peaked and stabilized at $622 billion. This shows that most of the tokens being traded are close to their original acquisition price. Since the all-time high in March, the absolute realized gains and losses have dropped significantly, which means that the overall buyer pressure has eased in the current price range.