Bitcoin prices surged to $61,000 after the Federal Reserve slashed interest rates by 50 basis points, its first rate cut in four years and a positive start to the Fed’s first easing policy.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

On Wednesday afternoon local time, Federal Reserve Chairman Jerome Powell announced that the benchmark interest rate would be cut by 50 basis points to a range of 4.75% – 5.0%, marking the start of a loose monetary policy cycle in the United States.

Fed plans to cut rates again by December

The Federal Reserve cut the federal funds rate by 50 basis points to 4.75%-5.00%, the first rate cut since March 2020. This is also the first rate cut by the Federal Reserve in four years after its most aggressive rate hike cycle.

According to the Fed's quarterly economic projections, the median benchmark interest rate is expected to fall to 4.4% by the end of the year, which means that the Fed will cut interest rates by another 50 basis points at the next two Federal Open Market Committee (FOMC) meetings. This is an increase from the single rate cut predicted in June.

After the resolution, Bitcoin rose rapidly to break through $62,000, and then fell back slightly.

The Federal Reserve cut interest rates by 50 basis points

It was both unexpected and reasonable. After all, judging from the market survey, the probability of a 50 basis point rate cut has risen to 60%. This is always the way the Fed controls market expectations. A 25 basis point rate cut would be dovish. Fortunately for the market, Bitcoin did not immediately surge by 10%+. I am happy to see this pace of growth.

It is said that a 50 basis point rate cut indicates that the fundamentals are not very good. In fact, the trading recession is a bit too large. It may not be possible to achieve a market trend like 312 even after half a year. And through the monetary policy of the Federal Reserve and market expectations, it may not come even after the bull market of Bitcoin is over... Let the violent bull fly for a while~

A large group is the key to the top

When BTC encounters a critical resistance level, short-term holders adjust their positions, while long-term holders actively divest to maintain the $60,000 level as the next support area.

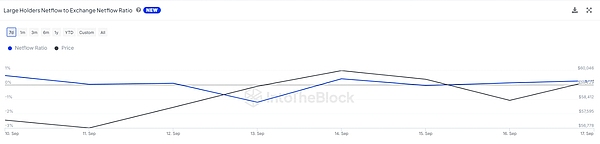

The Net Flow Ratio currently stands at 0.30%, having doubled from the day before, indicating growing support from large holders, as evidenced by this post.

$60,000 represents a key battle zone, with short-term holders viewing it as a potential market bottom, a view reinforced by growing panic.

Whether $60,000 can reverse to solid support depends on long-term holders, whose actions could challenge the price bottom thesis.

End

As demand for the leading cryptocurrency by market cap grows, the return of momentum behind the Bitcoin ETF could push Bitcoin higher. However, there is still a long way to go to make up for the high interest rates of the past few years. As interest rates continue to fall, it will be important to track the behavior of Bitcoin. Now that the rate cut cycle has begun, the next market trend has been clear, but it will take time to brew. Don't miss the opportunity.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!