The recent upgrade focuses on improving transaction efficiency, and TFL plans to destroy all tokens. This may have a positive impact on the supply and price of Terra Luna Classic.

The price of Terra Luna Classic has been gradually rising over the past month and a half, indicating that the project has the potential to return to the highs of the previous year. Today is a critical day for the Terra Luna Classic community as it awaits its Chapter 11 bankruptcy hearing. In addition, the Federal Reserve’s recent decision to cut interest rates by 0.50% has sparked speculation about a possible rebound in the cryptocurrency. Will the LUNC price make a comeback?

Bankruptcy hearing could push up Terra Luna Classic price

Terraform Labs (TFL), the company behind the Terra ecosystem, has announced that its Chapter 11 bankruptcy hearing will begin on September 19 following a confirmation date. This hearing is critical to the liquidation of Terraform Labs Ptw Ltd and Terraform Labs Limited and will allow the company to reorganize.

According to the agreement signed by TFL and the SEC, TFL agreed to pay $4.5 billion in compensation and initiate liquidation procedures. TFL is now defunct and they will destroy all of their tokens, including LUNC and USTC, by October 30, 2024. In addition to the upcoming hearing, the Terra Luna Classic chain recently completed the v.3.1.5 upgrade, which is expected to improve transaction efficiency and pave the way for Tax2Gas implementation.

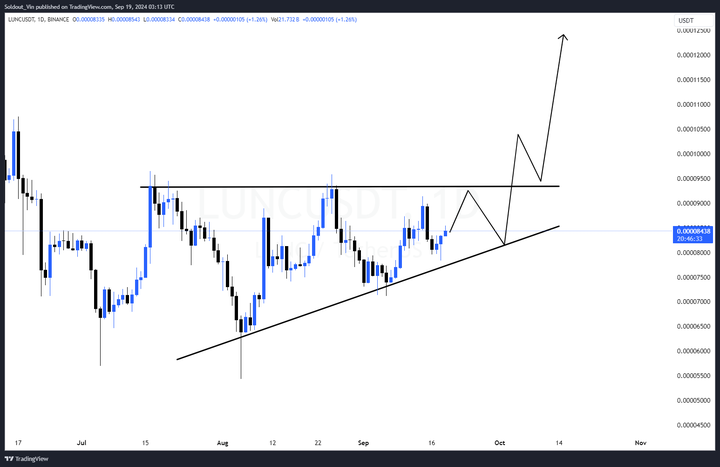

These technical improvements have boosted confidence in the project and could attract more investors ahead of the hearing. The price of LUNC has risen 2.2% in the past 24 hours and is currently trading at $0.00008452. A bullish pattern is forming on the daily timeframe chart ahead of the hearing and could drive the price of Terra Luna Classic up 50%.

Factors behind the bull market rebound

One of the main factors driving LUNC's upward momentum is TFL's plan to destroy all held tokens. Reducing the supply could create a scarcity effect, and as demand remains stable or grows, the price of LUNC will rise. This is in line with the overall market recovery, with the Federal Reserve's recent decision to cut interest rates by 0.50%, driving optimism that the cryptocurrency market as a whole could rebound.

If this resistance is broken, the next move will be to $0.000013

The price action of Terra Luna Classic shows an uptrend that started in early August. The upward sloping support indicates a bullish trend in the short term. The ascending trendline is an important dynamic support currently around $0.000080, with a stronger support at $0.000075. On the other hand, the horizontal resistance at $0.000095 has been tested several times but has not yet been breached.

It remains a major hurdle for bullish continuation. Above this, $0.000120-0.000135 is a potential long-term target if $0.000095 is crossed. Terra Luna Classic price seems to be forming a bullish continuation pattern (ascending triangle). The lower prices are higher compared to the horizontal resistance, which suggests a possible upside breakout if the price closes above $0.000095 with increasing volume.

Any pullbacks close to the uptrend line are good accumulation points as they serve as low-risk entry points for long-term holdings. If the LUNC price drops below the $0.000080 level, the current bullish setup will be invalidated and set new lower targets of around $0.000075, $0.000065, and $0.000054.

In simple terms

LUNC prices are expected to soar amid the overall market recovery. Meanwhile, the Chapter 11 bankruptcy hearing of Terraform Labs (TFL) begins today, and TFL will destroy all of its tokens, including LUNC and USTC, by October 30, 2024. This will also push up the price of Terra Luna Classic.