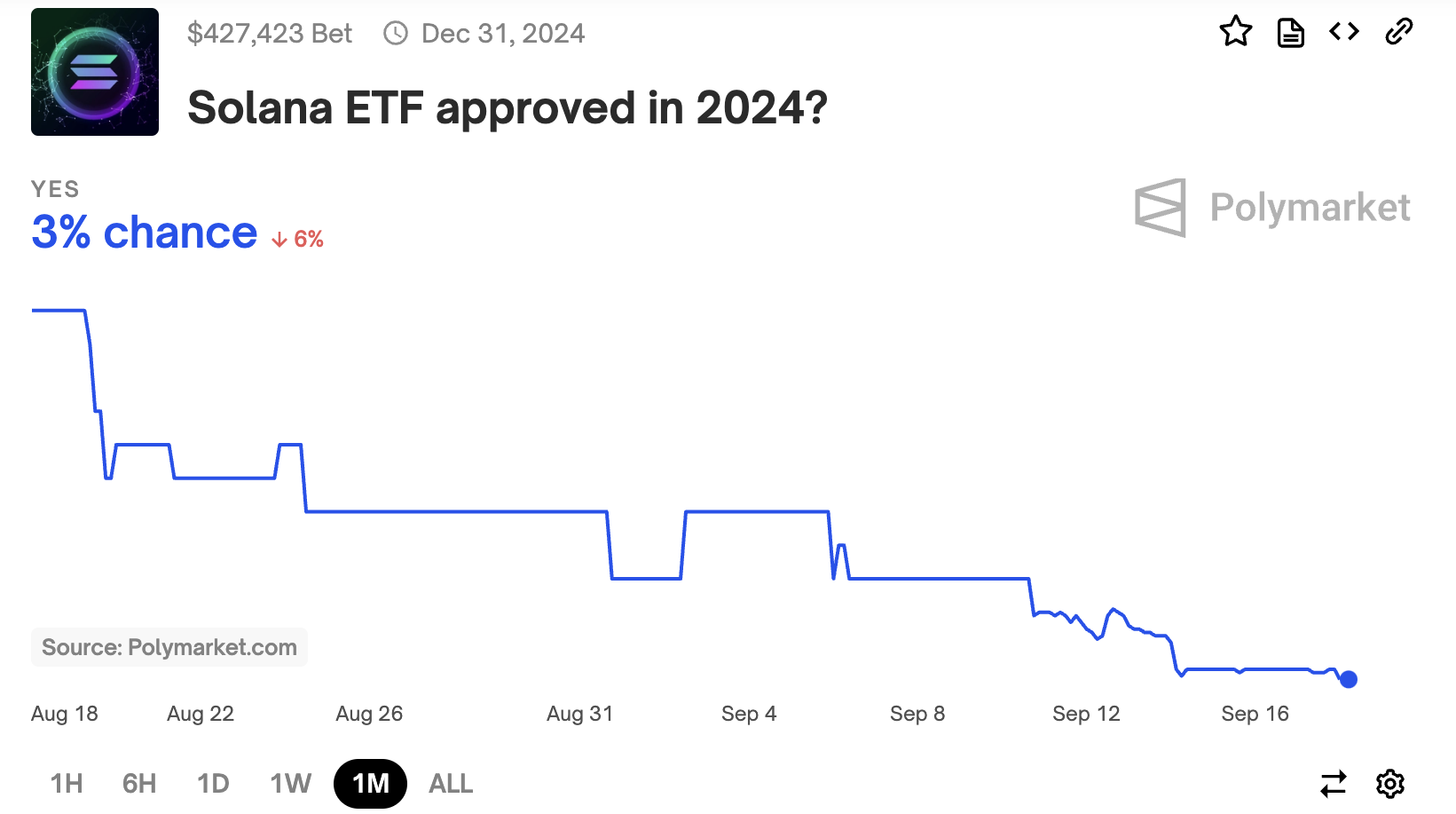

The Polymarkets forecast for the Solana ETF has fallen to a record low of 3%. Still, some experts are bullish on the long-term outlook.

While there is agreement on the importance of regulatory change, there is disagreement about the ideal form such change should take.

The probability of ETF approval, which was already low, has decreased from 15% to 3%.

Polymarkets, a decentralized prediction market platform, has once again lowered the odds of a Solana ETF . Since the site began taking bets on a Solana ETF, the odds have never been higher than 15%. However, over the past month, those already low odds have plummeted to a pitiful 3%.

Read more: Solana ETF Explained: What It Is and How It Works

In other words, the Solana ETF has always been considered shaky. Nevertheless, it is better off than most cryptocurrencies.

After a long struggle, the SEC approved Bitcoin and Ethereum ETFs in the same year, and many experts believe Solana is a good candidate for the third. Brazil has already announced its approval , and there is hope that this ETF will be a significant test case.

What's the silver lining?

Nate Geraci, president of the ETF Store , was clearly negative on social media.

“It is unlikely that additional spot cryptocurrency ETFs will come to market under the current administration. There is no indication at this point that a Solana or XRP ETF will be available in the next year or two,” Geraci said.

According to Geraci, the only hope for the Solana ETF could come from the U.S. presidential election, although he did not explicitly endorse any particular candidate.

Matt Hogan, chief investment officer at Bitwise, was more optimistic. In a recent interview, he claimed that after 10 years of rejection, the SEC finally approved Bitcoin and Ethereum ETFs in 2024.

The first approval can open the door, and subsequent wins will be easier.

“From my perspective, the most important thing is to resolve uncertainty. We think that change will happen. We need regulatory changes,” Hogan said.

Read more: XRP ETF Explained: What It Is and How It Works

Hogan seemed less interested in linking ETF performance to the upcoming election itself. Instead, he argued that regulatory uncertainty would be resolved during the election period, and that new ETF efforts would ultimately perform better. Bitwise plans to lead this effort with data.

“Bitwise has always put data first in our SEC filings. We’re very excited about the Solana ecosystem. We think it’s solid. We’re working on it,” Hogan said.