Bitcoin surpassed $63,000, continuing to set a new high in September and recording its third consecutive day of gains.

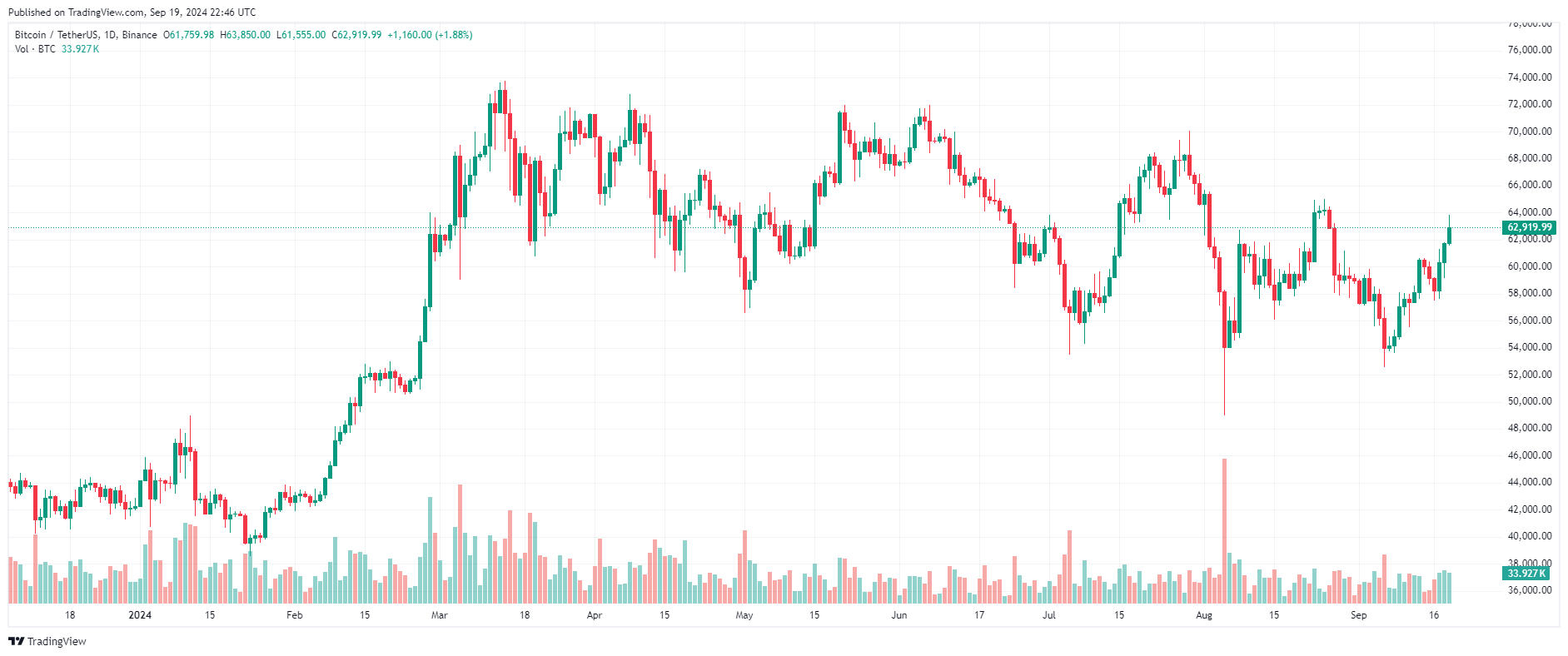

BTC Price Chart – 1 Day | Source: TradingView

Stock futures were little changed on Thursday night after the S&P 500 and Dow Jones closed at fresh records, fueled by excitement over a rate cut by the US Federal Reserve.

Futures linked to the S&P 500 edged down 0.03%. Dow futures rose 22 points, or 0.05%, while Nasdaq 100 futures lost 0.1%.

Shares of shipping giant FedEx fell 10% in after-hours trading after the company cut its full-year earnings outlook and lowered its revenue guidance. Nike, on the other hand, jumped more than 9% after announcing that CEO John Donahoe would step down on Oct. 13.

Markets rallied in Thursday's regular session, with the S&P 500 rising 1.7% to close above 5,700 for the first time. The 30-stock Dow Jones Industrial Average ended the day up more than 500 points, closing above 42,000 for the first time. Both indexes also posted intraday all-time highs. The Nasdaq Composite jumped 2.5%.

The unemployment data, along with the Fed’s half-point rate cut on Wednesday, appeared to bolster investor sentiment. Initial jobless claims, which came in at 219,000 for the week of September 14, were lower than expected, indicating a decline from the previous week.

“The first economic data since the rate cut will please the Fed,” said Chris Larkin, managing director of trading and investing at Morgan Stanley’s E-Trade. “Lower-than-expected jobless claims should not raise any immediate concerns about the labor market slowing too much.”

The Fed's decision on Wednesday marked the first rate cut since 2020.

The three major indexes are on track for the week, with the S&P 500 up nearly 1.6% through Thursday's close. The Dow Jones Industrial Average is up 1.5% for the week, while the Nasdaq is outperforming with a gain of 1.9%.

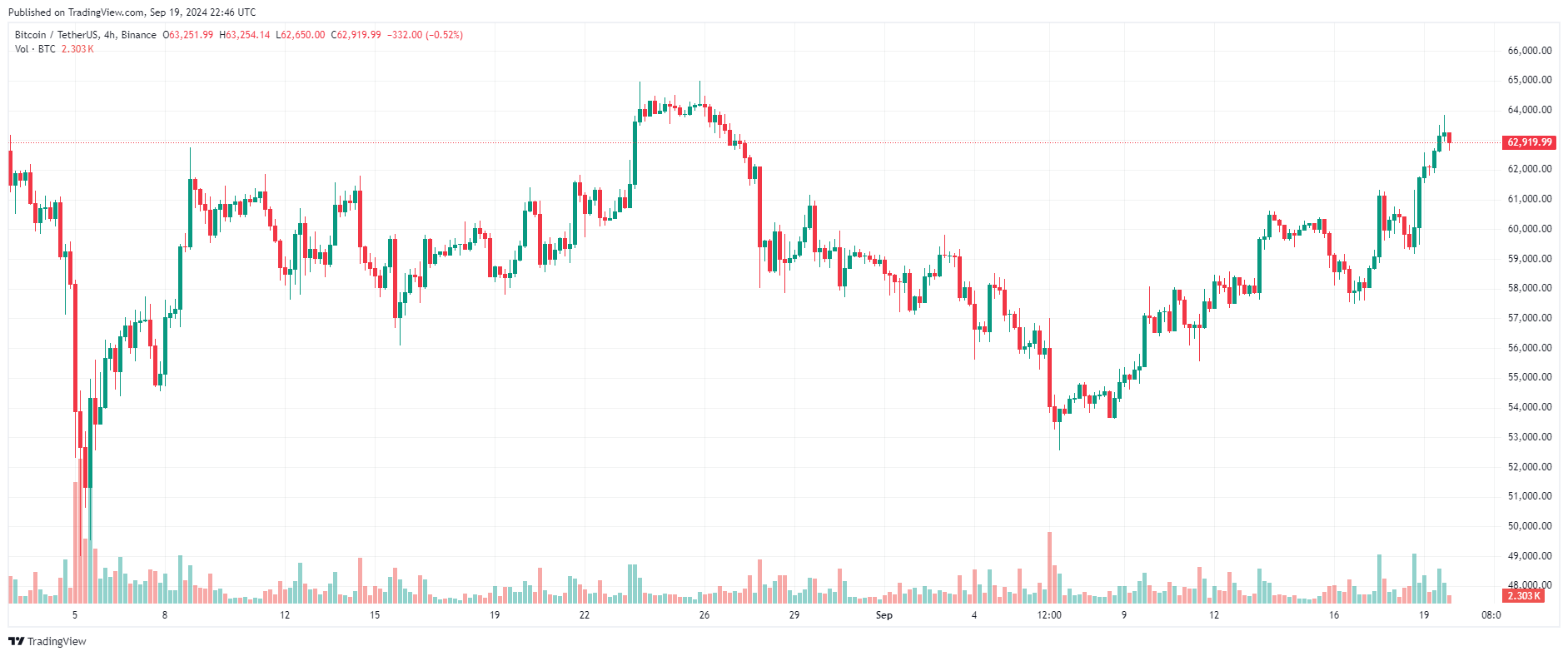

Bitcoin continued to gain ground for the third consecutive day as market sentiment turned positive after the Fed decided to cut interest rates by 0.5 percentage points.

The top asset has surged nearly 4% in the past 24 hours, setting a local top at $63,850, its highest level in September, before retreating slightly to around $63,000 at press time.

The rally was further fueled after the world’s largest asset manager, BlackRock, released a whitepaper highlighting BTC ’s potential as a hedge against currency and geopolitical risks.

Accordingly, BlackRock has released a Bitcoin whitepaper to investors, calling it a “unique diversification tool” separate from traditional financial and geopolitical risks.

Since the beginning of the week, BTC has climbed nearly 7%.

BTC Price Chart – 4 Hours | Source: TradingView

Altcoins continue to recover strongly as overall market sentiment improves.

Many major projects in the top 100 such as Popcat (POPCAT), Core (CORE), Celestia (TIA), Dogwifhat (WIF), Aptos (APT), Bittensor (TAO), Sei (Sei), DYDX (DYDX), Brett (BRETT), ORDI (ORDI), Avalanche (AVAX) , Stacks (STX), Immutable (IMX)... simultaneously increased by more than 10% in just the past 24 hours.

Other altcoins include: Sui (Sui), Optimism (OP) , Jupiter (JUP), AAVE (AAVE), Solana (SOL), PEPE (PEPE), Bitcoin Cash (BCH), Arbitrum (ARB), The Graph (GRT), Pyth Network (PYTH), Ondo (ONDO), Beam (BEAM)... climbing 7-9%.

Source: Coin360

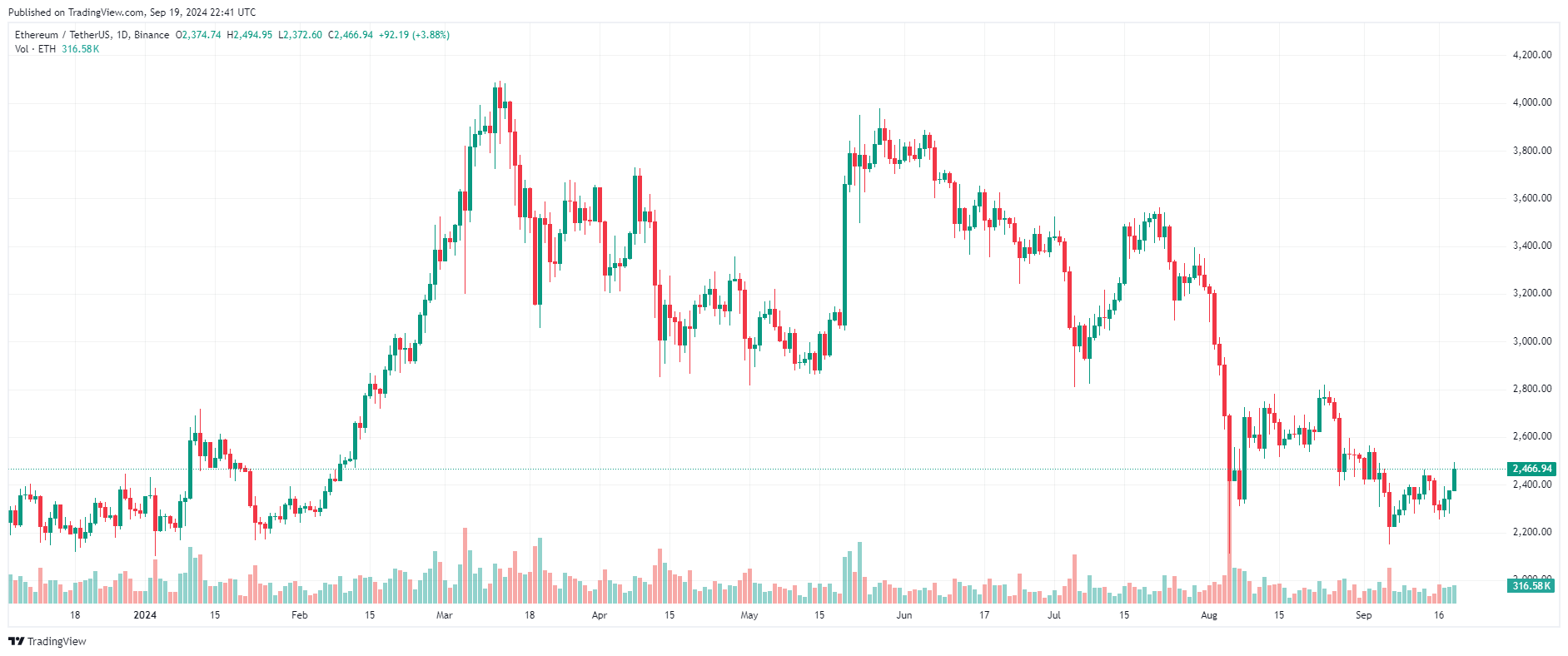

Ethereum (ETH) continued to rally for the third consecutive day, recovering almost all of its losses in the correction since early September.

The second-largest asset by market Capital jumped nearly 4%, hitting a local high around $2,494.

The bulls are currently trying to keep the price above the $2,450 mark with an eye on a move above the important psychological level of $2,500.

ETH Price Chart – 1 Day | Source: TradingView

You can XEM coin prices here.

The "Coin Price Today" section will be updated at 9:30 every day with general news about the market, we invite you to follow.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine