For the current market, the bear market will not go into a bear market unless it effectively falls below 50,000. Under such a macro environment, the probability of another fall is already very low. If the high point breaks through 70,000 again, it is very likely that the real main uptrend will start. It has been fluctuating for more than half a year, and everything is possible. The engine of the bull market cannot only look at Bitcoin. Only when Ethereum leads a group of small coins to make money can a spark start a prairie fire. Otherwise, it is just a bull market for Bitcoin, and this bullish taste carries a hint of sadness. What is certain is that Bitcoin will definitely be bullish, and small coins need to wait for real liquidity spillover.

Judging from the recent trend of small coins, in fact, many coins have come out of the bottom, and it can be basically confirmed that the big bottom has been reached. After the first wave of this bottom is pulled up, there will often be a retracement confirmation. The depth of the retracement should be calculated according to different tokens. At that time, whether you dare to go up will greatly affect the yield in the next six months to a year. After so long, I hope that everyone has not fallen before dawn. Reach out and grab the light that is right in front of you. Without despair, how can there be hope?

The impact of the Fed’s rate cut on the crypto market

1. Bitcoin halving cycle plus interest rate cuts, double positive drivers

The Fed’s rate cut coincides with the Bitcoin halving cycle. Bitcoin’s halving event, which occurs every four years, is seen as one of the important driving forces behind its supply reduction and price increase. After each halving, Bitcoin’s price usually enters a bull market cycle, and this halving coincides with a global liquidity easing monetary policy cycle, which is very likely to become another opportunity for a big rise in Bitcoin’s history.

2. A weaker dollar and inflation concerns boost Bitcoin’s safe-haven properties

Interest rate cuts usually trigger expectations of a depreciation of the U.S. dollar, as the return on holding the dollar decreases. The Fed's drastic interest rate cuts will put pressure on the dollar and weaken its position as the world's reserve currency. In this case, Bitcoin's safe-haven properties as "digital gold" will be further highlighted.

3. Loose liquidity environment boosts Bitcoin's rise

The Fed's interest rate cut means that the cost of funds in the entire market has dropped, and borrowing has become cheaper. This has given more capital the opportunity to flow into high-risk, high-return assets, and cryptocurrencies, especially Bitcoin, are the representatives of such assets. The expansion of liquidity brought about by the interest rate cut provides investors with more funds to allocate assets, and the downward trend of traditional market interest rates has also reduced the attractiveness of low-risk assets such as bonds and deposits, driving investors to turn to more promising crypto assets.

4. Further layout of institutional funds

The Fed’s drastic interest rate cuts have also provided an opportunity for institutional funds to enter the crypto market. In recent years, more and more traditional financial institutions have begun to get involved in the Bitcoin and crypto asset markets, and this trend may accelerate further in the context of loose liquidity. In a low-interest environment, institutional investors will pay more attention to asset allocations with higher returns, and Bitcoin, as a high-volatility, high-return asset, will become one of the important choices.

The Fed's 50 basis point rate cut, coupled with the Bitcoin halving cycle, has provided strong upward momentum for the cryptocurrency market. With multiple positive factors such as loose liquidity, a weaker dollar, and the entry of institutional funds, the possibility of Bitcoin prices hitting new highs in the coming months has greatly increased. However, while enjoying this wave of dividends, investors must also remain rational and pay close attention to possible risks in the market.

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

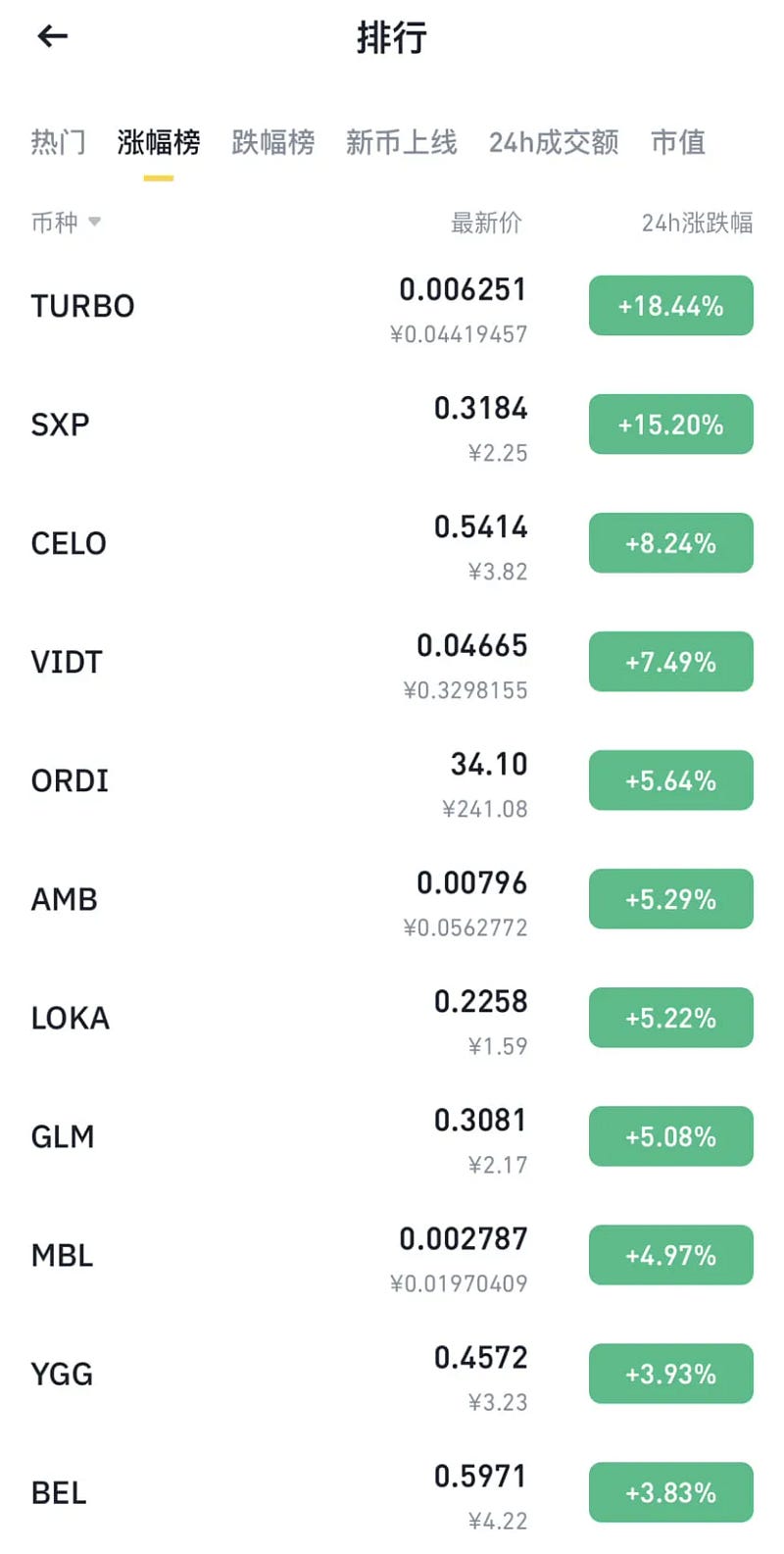

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background