BNB trading volume surged 14.42%, with strong on-chain indicators driving bullish momentum.

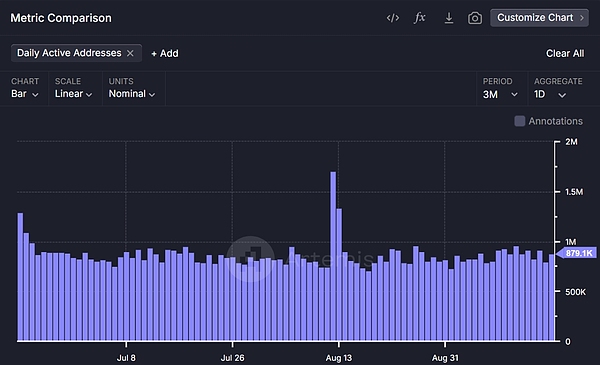

- BNB’s daily active addresses surged from 797.3K to 879.1K, indicating rising network usage.

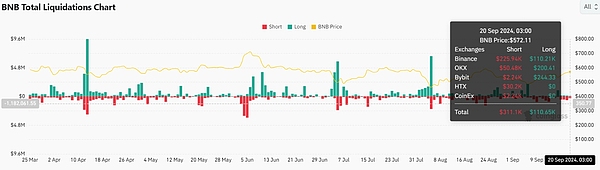

- $3.111 million of short liquidations added to the bullish momentum as BNB eyes further price gains.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

Binance Coin [BNB] has captured the attention of traders with a massive surge in trading volume, rising 14.42% in 24 hours to $758.83 million at press time. The surge coincided with a breakout above a notable falling wedge pattern.

However, with BNB trading at $571.25 at press time, up 2.67% over the past 24 hours, the focus turns to on-chain metrics to determine if this momentum will continue. Could this be the start of a breakout rally?

Has BNB reached new heights in network activity?

One of the most important on-chain metrics for BNB is the number of active addresses. The number of daily active addresses rose from 797.3K to 879.1K, indicating a significant increase in network activity.

More active addresses means more participation in the entire Binance Smart Chain. This generally indicates growing demand for the token. An increase in active users indicates that both institutional and retail investors are interested in BNB.

As more addresses interact with BNB, its utility and growth potential will increase.

How strong is BNB’s trading volume?

Trading volume is another important indicator of market sentiment. BNB's trading volume surged 14.42% to $758.83 million. A sharp rise in trading volume can signal a major price move. An increase in trading volume usually reflects increased investor confidence.

More and more people are actively trading BNB, which could further drive the price higher. If the volume trend continues, this could signal a continued rise in BNB as more participants enter the market.

What do liquidations reveal about market sentiment?

Liquidation data provides an interesting perspective on market sentiment. Across major exchanges such as Binance, OKX, and Bybit, BNB saw a total of $311,100 in short position liquidations and $110,650 in long position liquidations.

Rising short liquidations suggest that bearish traders are being forced to close their positions, potentially exacerbating the recent price surge as more short positions are eliminated.

Therefore, with BNB priced at around $571 at the time of writing, short liquidations could trigger a chain reaction of price movements, sparking more bullish sentiment in the market.

Is BNB ready for a bull run?

On-chain metrics show that BNB is gathering strength, with rising active addresses, healthy trading volumes, and declining exchange reserves, all of which point to a positive outlook. Short liquidations further strengthen the momentum behind the current price rally.

If these trends continue, BNB will likely see further gains, setting the stage for a sustained bull run in the coming weeks. However, as BNB continues to gain traction, traders and investors alike should keep a close eye on these key indicators.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!