After a brief spike to $62,700 at 22:00 last night, Bitcoin rebounded again and reached a high of $64,698 at around 7:00 this morning (25), and it seems that it will soon challenge the $65,000 mark. But then the price of Bitcoin fell back slightly, and the current price fell back to around $64,000, an increase of 0.38% in 24 hours.

How will the market trend develop in the future?

Let me first state the conclusion. I believe that there is still a risk of the last downward exploration in this round. If there is only one downward exploration (buy decisively when it is downward exploration), it will be a slow bull trend from now to the middle of next year! As for the future trend of Bitcoin, the current rebound cannot confirm the end of the long-term downward trend. We need to continue to observe whether Bitcoin can break through the relative high of $65,000 on August 25. Bitcoin needs to break through the high point of $65,000 in August to confirm the end of the long-term downward trend. There are still many good news in the market in the past two days. The news about another 50 basis point interest rate cut in November has been called for by the market again. The probability of a 50 basis point interest rate cut is close to 51.5%. From the logic of this month's interest rate cut, if the inflation data can be kept within a reasonable range, the unemployment rate rises slightly, and the principle of high-intensity defensive interest rate cuts is adhered to, the market may really fall beyond expectations. If this is true, the liquidity of the market will be injected in advance after the short-term economic panic, and the early arrival of the big bull market will no longer be hindered.

The weekly pressure of BTC current rise is 65,000. It rushed to around 64,700 yesterday and began to fall back quickly, which shows that the pressure here is still very large. After all, this position was the high point of the previous market crash. Currently, BTC is still moving in tandem with the U.S. stock market. The U.S. stock market did not rise much last night, so BTC naturally could not go up. The recent rise of the market was basically pulled up during the day, so there may be more funds entering the market in the Asian session. In the past, the market usually rose in the middle of the night, and in the middle of the night and early in the morning, there are usually more foreign funds entering the market.

In terms of operation: for those who buy the dips in the 56000-53000 range before, if it is a short-term trade, I personally suggest that you don’t pay attention to the short-term market anymore, and pocket the short-term profits, and then wait for the opportunity to enter the market again. You can also make a few thousand BTC by selling here, which is not bad. If it is a long-term trade, the cost-effectiveness of buy the dips at this position is still very high. Don’t be affected by the short-term market, just hold firmly. If you have buy the dips in the 2200-2300 range of Ethereum before, you can continue to hold it now, and sell it when it reaches around 2800 in the short term. Don’t pay attention to the short-term market for long-term holdings.

The current market panic has finally broken free and returned to a normal neutral level. The market continues to rebound. In addition to Bitcoin and Ethereum, which sectors have performed well?

Sui

Sui has performed extremely strongly recently. After falling below $0.5 in early August this year, it quickly rebounded to around $1. After fluctuating for several weeks, it continued to soar from around $0.8, reaching a high of nearly $1.8, an increase of more than 100%. Since this month, Sui has received a lot of good news. Mysten Labs launched a game handheld reservation in early September, priced at $600 each, which was quickly sold out, bringing it a lot of heat. A week later, Grayscale Trust announced that it had opened to qualified investors seeking to invest in SUI, opening a large capital entrance. On the same day, Binance launched the SUI coin-based perpetual contract with a maximum leverage of 20 times, which continued the rise in its coin price. On September 17, Sui Lianchuang announced that USDC would soon be expanded to the Sui network. The next day, the TVL of the Sui network exceeded $1 billion, setting a record high. Its ecological sectors also saw significant growth subsequently, including SUIP, CETUS, NAVX, etc. Even the Meme coin BLUB continued to rise during this period, with its market value rising to 45 million US dollars.

AI Section

AI-related projects such as ARKM, AR, NEAR, LPT, and FET are on the rise and have broad prospects. FET: Fetch.ai's original token FET is gradually gaining momentum with the help of Bitcoin's rebound. As the market recovers, FET's hype potential still exists, especially before the launch of the second phase of the three-coin integration plan, investors should keep an eye on it.

CZ Concept

On September 17, He Yi published a long article specifically responding to rumors that the crypto was anxious about listing coins, which shows that the market was extremely dull. However, a week later, when the market picked up again, CZ's release from prison became a major event in the crypto has been discussing CZ's actions after his release and the tokens of Binance's new projects. Binance's territory and its new projects have ushered in a wave of gains.

Leading projects in the blockchain gaming sector: YGG, GALA, IMX

As one of the important application areas of blockchain technology, projects such as YGG, GALA, and IMX are gradually becoming leaders in the field of blockchain games with their unique game mechanisms and strong community support, and have great potential in the future.

Memecoin Carnival:

Meme coins such as BONK, WIF, PEPE, FLOKI, BOME & FOUR, and Binancedog have attracted a lot of attention with their unique cultural background and social attributes. Although they are volatile, they also have great potential for growth. For investors who seek excitement and short-term returns, they are choices that cannot be missed. FOUR and Binancedog stand out in the Meme coin market with their unique creativity and strong community support.

Outlook

At present, the questioned tracks such as games and social networking are generally confused and have not seen much improvement. The new meme has not set off a large hype atmosphere. A considerable amount of funds have been pouring into the aforementioned fields in the article. At the macro level, after the Fed cut interest rates this month, the market generally predicts that interest rates will continue to be cut in November and December, and it is expected that there will be another 70 basis points of interest rate cuts this year. The published dot plot suggests that there will be another 50 basis points of interest rate cuts this year. The Fed's continuous interest rate cuts will inject liquidity into the crypto market and provide continuous benefits for the rise of the crypto market. In addition, after the results of the US presidential election in early November are announced, some hesitant funds will also choose to be injected into the crypto market. In terms of the crypto market, October is historically an extremely bullish month. The market conditions often improve significantly at the end of the year and the beginning of the year, and generally perform poorly in the summer.

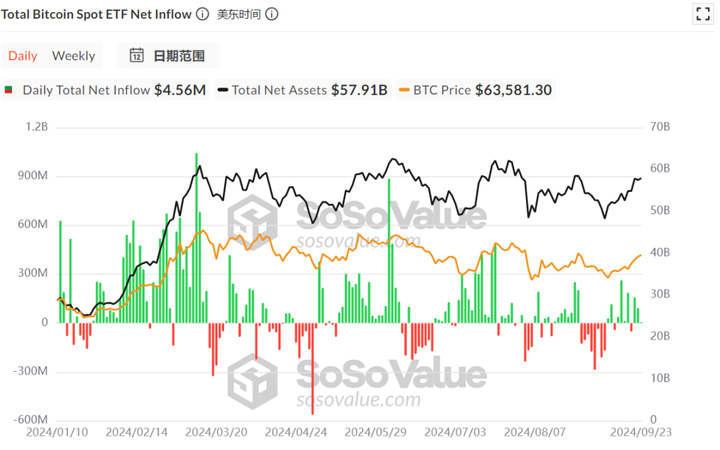

As for Bitcoin spot ETF, the total net inflow has reached 17.7 billion US dollars since its launch. In addition, since September 9, there have been only two days with small outflows, and the rest have been positive inflows, with the largest one-day net inflow reaching 263 million US dollars. The data performance is relatively optimistic, and the confidence of OTC buying funds is firm.

TOKEN 2049 in 2023 is the dawn of the bull market before the end of 2023. It is worth waiting to see whether the just-passed TOEKEN 2049 will once again become the bottom of a new round of bull market cycle.